Nowadays, mastering money management skills are more vital than ever. No matter your age, background, or experience, managing your finances effectively is crucial to your financial success. Managing money goes beyond balancing a checkbook or paying bills on time. It involves making sound financial decisions, understanding money, and establishing a foundation for the future.

Financial management knowledge can reduce financial stress and setbacks, especially in an uncertain economy. It gives you control over your financial destiny, allows you to live within your means, and enables you to accumulate wealth over time.

The consequences of poor money management

Inadequate handling of finances can result in severe ramifications that can significantly affect various aspects of your daily existence. One prevalent outcome is the struggle of living paycheck to paycheck, consistently grappling to meet your basic needs. This situation can precipitate a cycle of indebtedness, where you rely on credit cards or loans to cover your expenses, ultimately leading to overwhelming high-interest repayments.

Another consequence is the incapability to save for future contingencies. Lacking proficient money management skills can make allocating funds for emergencies, retirement, or other financial objectives arduous.

Furthermore, inadequate money management can give rise to stress and strain within personal relationships. Financial difficulties can generate tension among partners, family members, and friends while impinging on your mental and emotional well-being.

The ramifications of deficient money management extend far and wide, substantially impacting your overall quality of life.

The benefits of good money management

Conversely, possessing effective money management skills offers numerous advantages.

Primarily, it grants you financial stability and safeguards. By skillfully handling your finances, you can establish a contingency fund, settle debts, and save for future aspirations. This fiscal stability fosters tranquility and diminishes anxiety, ensuring you possess a safety cushion.

Proficient money management also empowers you to make well-informed financial choices. When you comprehend your earnings, expenditures, and financial objectives, you can opt for actions that align with your priorities and principles. This engenders a heightened sense of authority over your financial affairs and accelerates the achievement of your goals.

Furthermore, adept money management can enhance your credit rating and unlock opportunities for more favorable loan terms and credit card rates.

The merits of cultivating strong money management extend beyond mere monetary implications; they positively influence your overall well-being and quality of life.

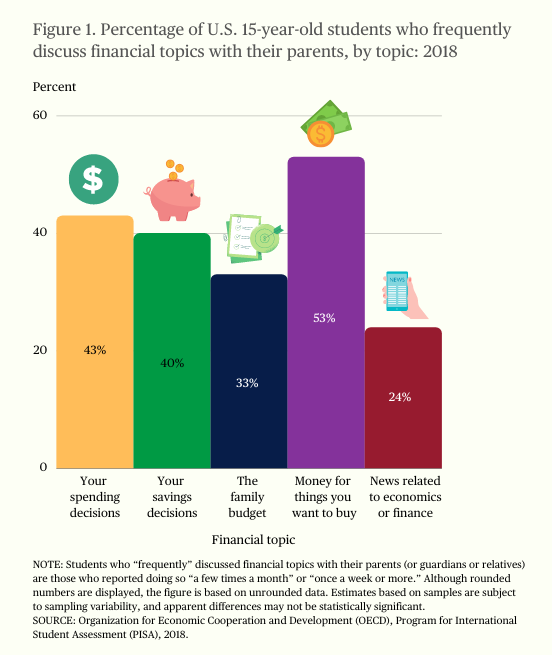

Credit: nces.ed.gov

How to develop money management skills

Acquiring and refining money management skills is an ongoing endeavor that demands dedication and application.

The initial stride involves enhancing your understanding of personal finance. Engage in reading materials, participate in knowledge-sharing gatherings, and follow trustworthy financial sources to gain insights into budgeting, investment, and various facets of adept money management.

Subsequently, conduct a thorough evaluation of your present financial standing. Scrutinize your earnings, expenses, and debt situation meticulously to ascertain your position and identify potential areas for enhancement.

With this knowledge, you can establish financial objectives and formulate a comprehensive budget. These financial goals provide you with targets to strive for and enable you to prioritize your expenditures effectively.

Conversely, a budget is an explicit roadmap delineating how you intend to allocate your income and meticulously track your expenses. Regularly reviewing and adapting your budget in response to evolving financial circumstances is crucial.

Another vital element of effective money management is the vigilant monitoring expenses and adept debt handling. Maintaining a record of all expenditures and categorizing them enables you to identify opportunities for prudent reductions.

Additionally, devising a well-structured plan to handle and diminish your debt is paramount. This may include consolidating high-interest debt, negotiating with creditors, or seeking professional guidance if necessary.

Setting financial goals and creating a budget

Developing practical money management skills involves the process of establishing clear financial objectives. Maintaining motivation and making progress toward financial success can be challenging without well-defined targets.

To ensure meaningful and measurable goals, it is crucial to be specific, measurable, attainable, relevant, and time-bound (SMART). For instance, rather than having a vague objective such as “increase savings,” a SMART goal like “save $5,000 over the next two years for a house down payment” can be set. This goal possesses specificity, measurability, achievability, relevance, and a clear timeframe.

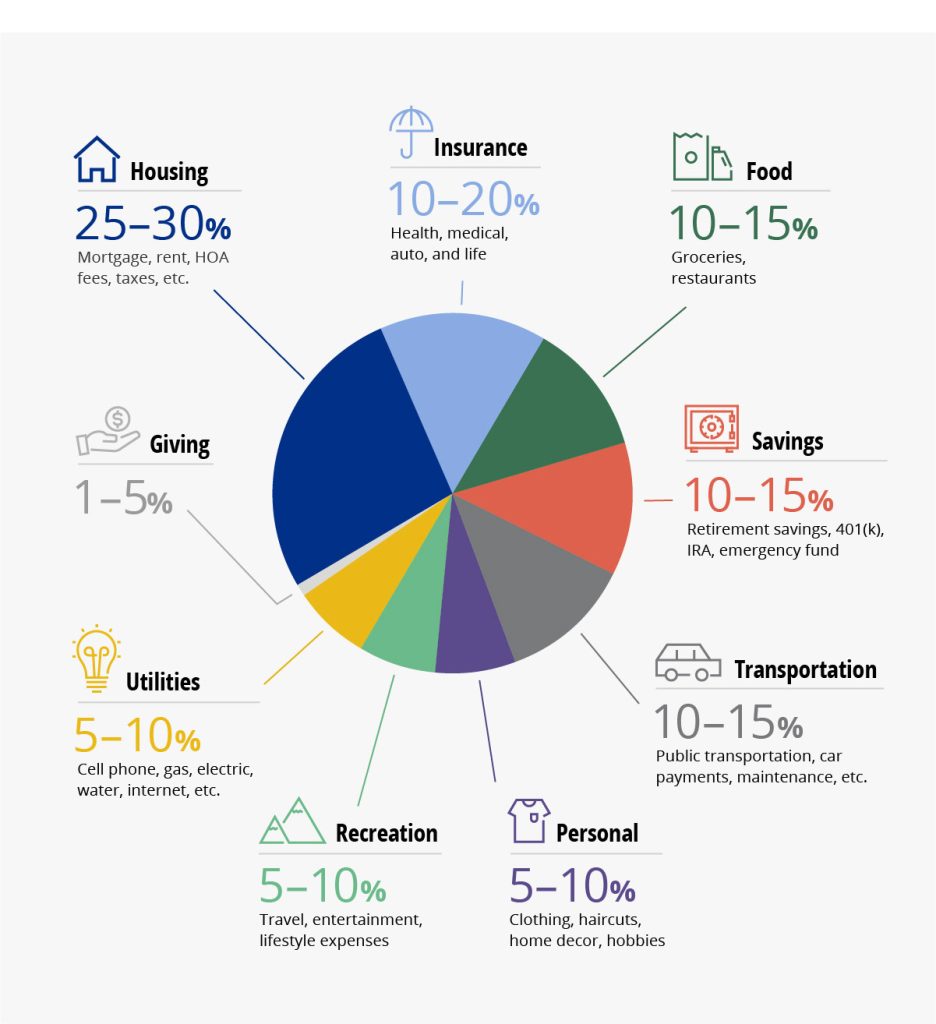

Once financial goals are established, the subsequent step entails crafting a budget. A budget aids in allocating income towards various expenses and savings objectives. Initiate the process by recording monthly income and categorizing expenses into fixed costs (e.g., rent, utilities) and variable expenses (e.g., groceries, entertainment). It is crucial to include savings as a designated category in the budget.

By consistently allocating a portion of the income to savings, progress toward financial goals can be ensured. Budgets must be regularly reviewed and adjusted to accommodate evolving financial needs.

Credit: fultonbank.com

Teaching money management skills to children

Acquiring proficiency in handling financial matters is an invaluable skill to bestow upon children, ensuring their prosperous journey in personal finances. To commence this process, it is advisable to introduce the concept of monetary transactions early.

Provide them with fundamental knowledge on saving, spending, and giving while also considering the provision of an allocated sum of money and emphasizing the significance of saving a portion. As they mature, involve them in family conversations concerning budgeting and financial choices. Enlighten them about establishing financial objectives and the merits of deferring immediate gratification.

Once they reach their teenage years, encourage them to explore part-time employment opportunities, allowing them to acquire firsthand experience in earning and managing their financial obligations.

Educating them on the concept of credit and the potential repercussions of indebtedness is crucial, enabling them to make informed decisions upon entering adulthood.

Furthermore, contemplate involving them in family financial deliberations, such as planning vacations or making significant purchases.

By equipping your children with a solid foundation in money management skills, you are effectively preparing them for a future characterized by financial independence and triumph.

The role of technology in money management

Advancements in technology have brought about a significant transformation in the realm of money management skills. Mobile applications and smartphones have provided unparalleled convenience in tracking expenses, devising budgets, and monitoring financial progress.

A wide array of available applications can assist individuals in optimizing their money management endeavors discreetly. These apps offer the capability to synchronize with various financial accounts, including banking, credit cards, and investments, providing real-time updates on financial status.

Furthermore, these apps offer functionalities such as expense categorization, deep insights into spending habits, and timely alerts for budget overages.

Moreover, technological advancements have simplified the process of automating financial tasks. Establishing automatic transfers to savings or retirement accounts ensures consistent saving habits while utilizing bill payment services facilitates the automation of payments and avoids late fees.

The advent of technology has also democratized investment opportunities, making them more accessible to the general public. Online brokerage platforms enable effortless trading of stocks, bonds, and diverse investment instruments. Robo-advisors offer personalized investment advice based on individual goals and risk tolerance, leveraging automated algorithms.

By harnessing the power of technology, individuals can streamline their money management processes, optimizing convenience and efficiency.

Conclusion

Acquiring effective money management skills is crucial in the contemporary era. These skills empower individuals to control their financial well-being, shield themselves from financial stress and setbacks, and foster a stable and prosperous future.

Inadequate money management practices can lead to a harmful cycle of debt, living paycheck to paycheck, and strained interpersonal connections. Conversely, adopting sound money management practices results in financial security, informed decision-making, and enhanced authority over financial affairs.

Cultivating money management skills necessitates obtaining knowledge, setting goals, creating budgets, monitoring expenses, and handling debts. It is vital to save and invest for the future, as these are integral elements of long-term wealth accumulation. Employing strategies to reduce expenses and increase income can further enhance one’s financial situation. Equipping children with money management skills paves the way for their future financial success. Technological advancements significantly simplify and streamline money management processes, making them more convenient.

Additionally, many resources and tools, such as books, courses, blogs, podcasts, and financial advisors, are available to enhance money management skills. Refining your money management skills allows you to seize control of your financial future and accomplish your objectives. Therefore, embrace the significance of money management and embark on your journey toward financial triumph today.