Tired of worrying about taxes each year and ending up paying more than expected? Discover how to secure your financial future using 5 effective tax strategies that can help you save thousands. In this article, we’ll explore the world of tax planning, revealing techniques to increase deductions and reduce your tax burden. From grasping tax bracket details to using special investment accounts, learn how to smartly manage your money to keep more in your pocket. Whether you’re a business owner, freelancer, or conscientious taxpayer, these strategies are tailored to guide you through taxes with confidence. Say farewell to tax stress and welcome substantial savings with our expert tips. Get ready to unlock the secrets of tax planning and start saving big today!

The importance of tax planning

Tax planning isn’t solely reserved for the wealthy or business owners—it’s a vital part of managing your money that can benefit everyone. Effectively managing your taxes can legally reduce what you owe and help you retain more of your earnings. By utilizing smart strategies, you can make use of deductions, credits, and other ways to save on taxes.

Forecasting your tax liability for the year is a major advantage of tax planning. By studying your income, expenses, and possible deductions, you can estimate your tax amount and take steps to lower it. This proactive approach gets you ready and prevents any surprises during tax season.

Tax planning also lets you optimize your financial choices throughout the year. By considering how investments, purchases, and financial actions affect your taxes, you can make informed decisions that decrease your tax load. Including tax planning in your overall financial strategy ensures that your money is working for you in a tax-savvy manner.

Ultimately, tax planning is critical to maximizing tax savings. By proactively managing your taxes, you can legally lessen what you owe and hold onto more of your money.

Tax planning vs. tax preparation

Let’s differentiate between tax planning and tax preparation. These terms are sometimes used interchangeably but have distinct meanings related to managing your taxes.

Tax preparation means organizing and submitting your tax returns. You gather financial papers, calculate your income, deductions, and credits, then send your tax forms to the right authorities. Tax preparation usually happens after the tax year ends, and it focuses on reporting your financial activities accurately.

On the flip side, tax planning is about actively handling your taxes all year. You assess your financial situation, find chances to save on taxes, and use methods to reduce what you owe. Tax planning helps you make use of deductions, credits, and other strategies before filing your taxes.

While tax preparation is essential to meet your tax duties, tax planning is what truly boosts your tax savings. By adding tax planning to your financial routine, you can smartly manage your money and make choices that cut down your taxes.

Now that we grasp why tax planning matters and how it differs from tax preparation, let’s delve into the top 5 tax strategies that lead to big savings.

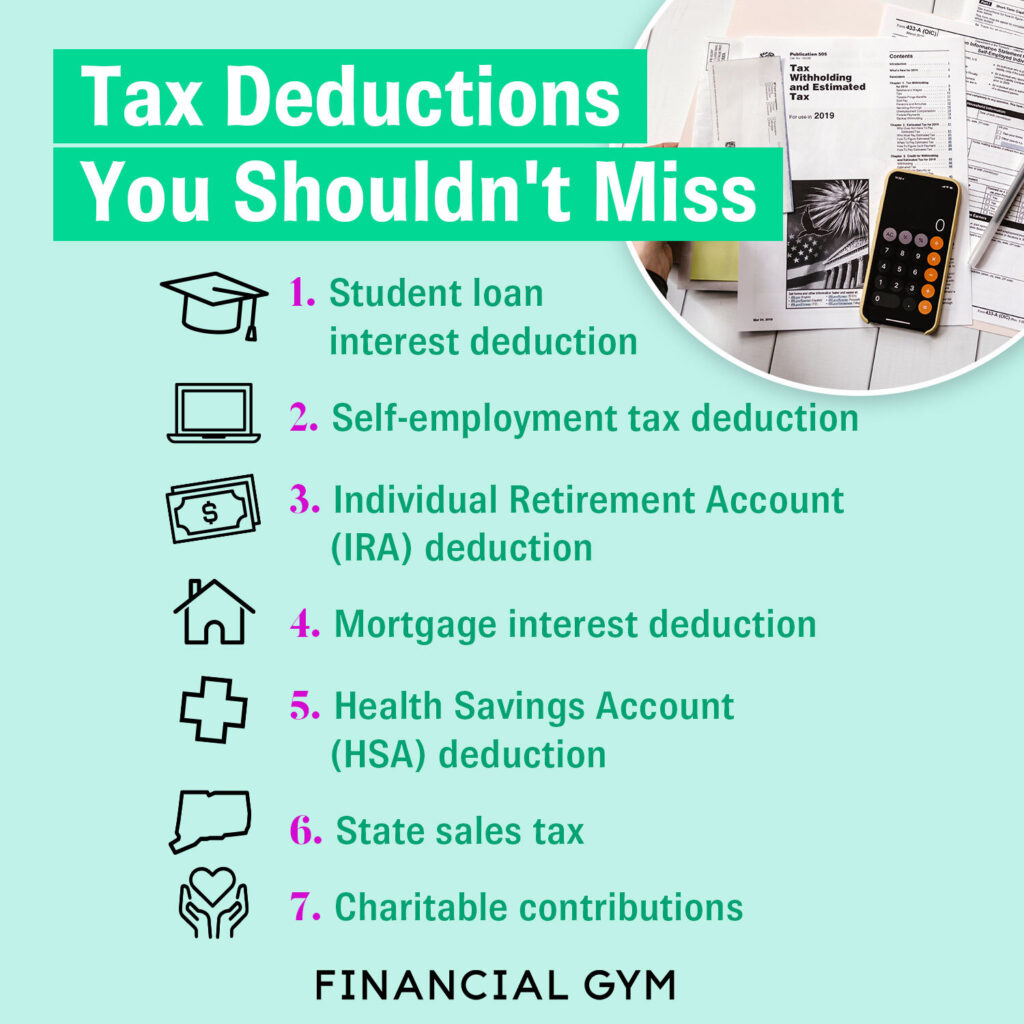

Credit: financialgym.com

Tax planning strategy #1: Take advantage of tax deductions

Discover a powerful method to lessen your tax obligations: by increasing your deductions and credits. Deductions are subtracted from your income, while credits directly reduce taxes you owe. By using all possible deductions and credits, you can notably decrease your tax amount.

Begin by noting all your expenses during the year, including business costs if you freelance or have a side job. Also, keep track of personal expenses that could be deductible, like mortgage interest, medical costs, and charitable donations. Keep your receipts and organized records to back up your deductions.

Moreover, look into tax credits you might qualify for, like the Child Tax Credit, Earned Income Tax Credit, or education-related credits. These credits lead to substantial savings, so research and understand the requirements to claim them correctly.

Tax Planning Strategy 2: Utilizing Tax-Advantaged Accounts

Discover a smart approach to minimize your taxes with tax-advantaged accounts. These special accounts offer impressive tax advantages, helping you hold onto more money and slash your taxable earnings.

Ever heard of a Health Savings Account (HSA)? It’s a smart option for keeping your medical expenses in check. By contributing money before taxes, you’re not only lowering your taxable income but also ensuring that any earnings or withdrawals used for medical bills stay completely tax-free. If you qualify for an HSA, it’s wise to contribute as much as possible to capitalize on these tax perks.

Looking to safeguard your financial future? Meet the 401(k) and Individual Retirement Account (IRA), your partners in tax-efficient saving. When you put money into these accounts, you get to subtract that amount from your taxable income. The earnings within these accounts grow without being taxed until you decide to use them in retirement, likely when your tax rate is lower. Don’t miss out on company-sponsored retirement plans or opening an IRA – both are solid ways to stash away money for your golden years while decreasing your tax load.

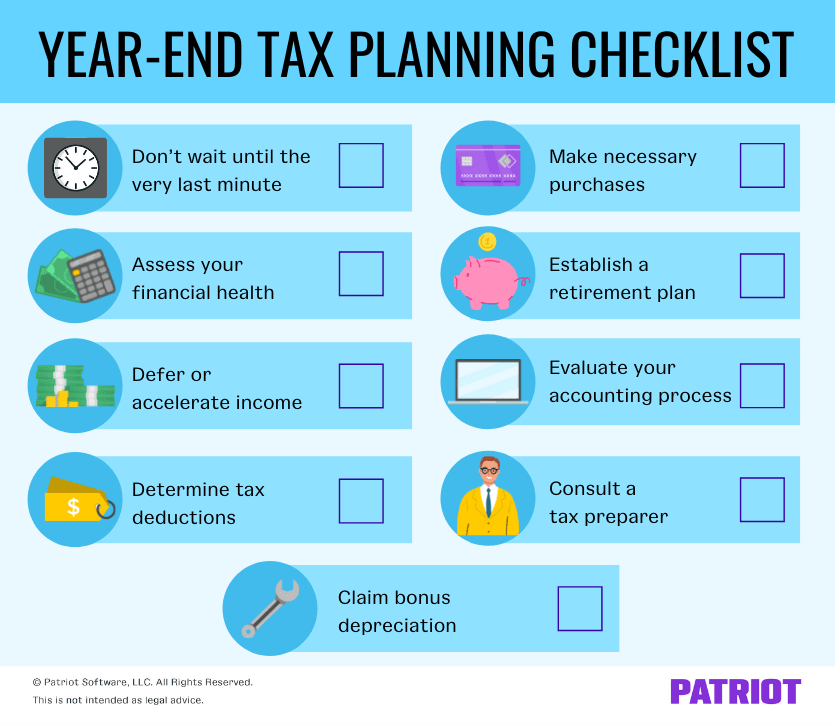

Tax Planning Strategy 3: Timing Income and Expenses

Discover the power of timing when it comes to your money. Making intelligent choices about when you earn and spend can significantly impact how much you owe in taxes.

Imagine this: by moving around when you receive money or pay for things, you could decrease the taxes you have to pay overall.

If you think you’ll earn more this year than next, consider putting off getting that money. That means waiting to get things like bonuses or payments for freelance work until the following year. This trick could mean paying taxes on that money when the tax rates are lower, saving you a lot.

But, if you’re guessing you’ll make less money this year, you could try to speed up when you pay for things you can deduct from your taxes. This could be stuff like giving more to charities, paying property taxes early, or paying in advance for business expenses. By doing this, you can lower the amount of your income that gets taxed and lower the total taxes you have to pay.

Credit: patriotsoftware.com

Tax Planning Strategy 4: Taking Advantage of Tax Exemptions

Discovering the world of tax exemptions could lead to valuable savings. By understanding and utilizing exemptions, you can decrease the amount of income that is subject to taxes. These tax breaks are like bonus deductions and differ based on factors like your marital status, how many people depend on you financially, and other particular circumstances.

For instance, if you’re supporting dependents, you might qualify for the Child Tax Credit or Dependent Care Credit. These credits can assist in covering expenses related to raising kids or arranging childcare, all the while decreasing the total taxes you owe. Remember to thoroughly investigate all the available exemptions and credits to maximize potential opportunities to save money.

Tax Planning Strategy 5: Charitable Contributions and Tax Benefits

Finally, contributing to charitable donations isn’t just about assisting causes you care about – it can also grant you tax advantages. When you donate to approved charities, you might be able to slash the amount of your income that gets taxed.

To make the most of this approach, remember to note down your charitable gifts all throughout the year. Give to well-known charities that meet the requirements for tax deductions, and make sure to get receipts or confirmations for your donations. By following these steps, you can cut down the income that gets taxed and still make a good difference for your supported causes.

To sum up

In summary, using smart methods to plan your taxes well is vital for lowering the amount you owe and increasing your savings. You can do this by finding more deductions and credits, using special tax-favored accounts, picking the right times for your earnings and spending, using available tax benefits, and making thoughtful charitable donations. These steps can greatly decrease the taxes you have to pay. Begin using these tactics now to have better control over your financial future and keep more of your earned money. Don’t let taxes empty your account – take steps today to build a better financial future.