As we embark on the wealth creation journey, one concept stands out as a beacon, guiding us toward financial success: the power of compound interest. A modest investment today can turn into a significant fortune tomorrow with compound interest, often called the “eighth wonder of the world.” It’s a testament to the saying, “Time is money.” But, like all powerful tools, unlocking its true potential requires understanding and strategic maneuvering. This article navigates through the intriguing world of compound interest and long-term investing. From the magic of compounding to the play of different investment vehicles, from time’s role to invisible factors like inflation, we’ll delve deep into how you can harness this financial force to maximize your wealth. Embark on this journey with us, and let’s demystify the captivating symphony of compound interest.

Unleash the Magic of Compound Interest

One of the most fundamental concepts in finance is compound interest, often referred to as the “eighth wonder of the world.” It’s all about earning interest on interest. Investing money provides a return on investment. You can then reinvest your investment return to earn a return on your return, etc. Because of this, long-term investing produces exponential growth. Essentially, it is a process that self-replicates or amplifies itself.

Take a savings account with annual interest, for example. The interest you earn at the end of the first year gets added to your initial investment. The following year, you earn interest on that larger amount, and this pattern repeats, causing your savings to grow at an increasing rate over time. This shows how compound interest can significantly enhance the potential return on your investments, particularly in the long term.

Play the Long Game: The Importance of Time in Compounding

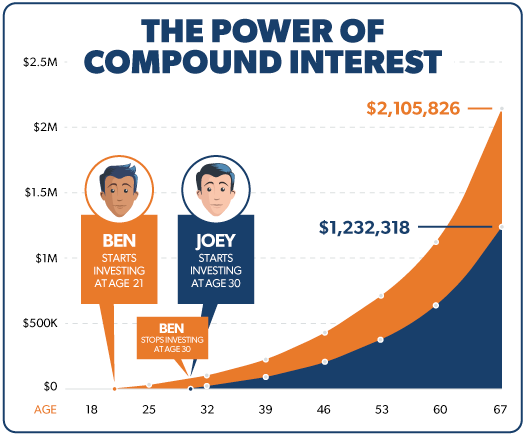

Time is a crucial ingredient in the recipe of compounding. The longer you keep your investment, the more profound the effect of compounding becomes. The aspect to think about here is “growth acceleration”. Over time, the speed at which your investment grows becomes faster due to the compounding effect.

For instance, consider two individuals, A and B, investing the same amount at an identical interest rate. If A starts investing 10 years earlier than B, A would accumulate significantly more wealth despite only a decade’s head start. This example is due to the additional compounding cycles A gains by starting earlier. Therefore, time is the investor’s best friend, and the earlier one starts investing, the greater the potential benefits from compounding.

Credit: ramseysolutions.com

Utilizing Diverse Investment Vehicles for Compound Interest

Leveraging a broad spectrum of investment vehicles is akin to constructing a symphony – different instruments play their part to create a harmonious tune. The cue here is “financial symphony” – a mix of diverse assets that, when played correctly, amplify the melody of compound interest.

When considering various investment avenues, envision each as a tool for achieving unique financial goals. Stocks, with their potential for high returns, are like your string section, powerful and impactful. Bonds, providing stability, are akin to the percussion section, steady and dependable. Mutual funds and ETFs, offering diversification, are like the woodwind section, balancing the high and low notes.

Each vehicle has its unique rhythm of compounding. For instance, when you reinvest dividends from stocks or coupon payments from bonds, they become principal for the next cycle, amplifying your wealth. Similarly, compounding works magic in retirement accounts, growing your nest egg over the long term.

Thus, a balanced “financial orchestra” with varied investment vehicles can enrich your wealth symphony, enabling you to harness the full potential of compounding. These different financial ‘instruments’ working together in your portfolio can generate a powerful compounding effect, accelerating your journey to financial independence.

The Rule of 72: A Quick Estimator of Compound Growth

Cracking the code of compound growth doesn’t need to be complex – in fact, you can simplify it using the rule of 72. This mathematical hack, or as we call it, the “investment time machine,” allows you to gaze into the future of your investments.

To use this time machine, divide the number 72 by your expected annual rate of return. The result is the approximate number of years it will take for your investment to double. For instance, if you’re expecting a return of 6% per year, your investment will double in around 12 years (72 divided by 6). The power behind this rule lies in its simplicity and effectiveness in illustrating the might of compounding interest.

This quick formula underscores the astonishing power of compound interest and the pivotal role of time in maximizing your investment growth. Hence, the rule of 72 is valuable in your financial toolkit, helping you plan your long-term investment strategy more effectively.

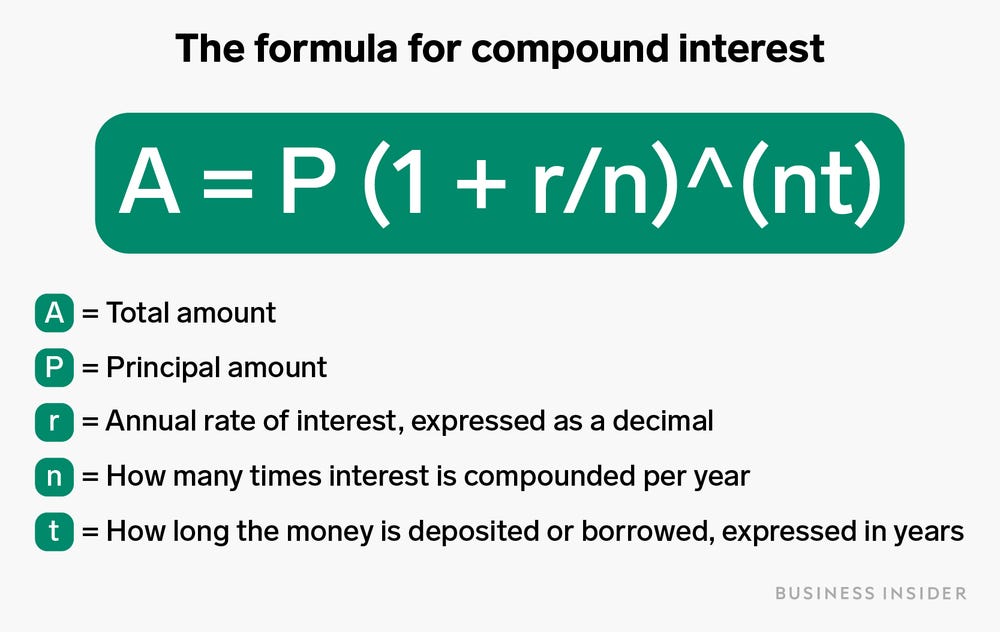

Credit: businessinsider.com

The Impact of Regular Contributions: Harnessing the Power of Dollar-Cost Averaging

Beyond just the money you initially invested, regular contributions over time can significantly amplify the effects of compound interest. Regular contributions allow you to capitalize on a concept known as “dollar-cost averaging.“

By consistently investing a fixed amount, you’re buying more shares when prices are low and fewer when they are high. Over time, this can potentially lower the average cost per share of your investments. And as these investments generate returns, the returns compound not only on your initial capital but also on the returns of your regular contributions, accelerating the growth of your investment.

Beware of Fees and Taxes: The Silent Killers of Compounding

The last point revolves around the dark side of compounding – fees, and taxes. While compounding can work in your favor, it can also work against you when it comes to costs.

Every dollar paid in fees or taxes is a dollar less that can be compounded for future growth. High fees can erode the beneficial effects of compounding over time. Likewise, taxes can considerably impact your net returns, particularly if your assets are not held in tax-advantaged accounts (such as IRAs and 401(k)s). Consequently, comprehending and minimizing fees and taxes is crucial in fully reaping the rewards of compound interest in long-term investing.

The Effect of Inflation: The Invisible Erosion of Your Compounded Returns

When charting your long-term investment strategy, there’s a sneaky element that can impact the real growth of your compounded returns: inflation. Often dubbed as the “invisible thief,” inflation steadily erodes the purchasing power of your money over time.

Inflation can subtly chip away at the value of your investments, making it crucial to consider when calculating your future compound returns. For example, an asset may double over a decade, but when adjusted for inflation, the actual purchasing power of these returns may have increased less dramatically.

Consequently, you should strive to outpace inflation with your return rates. Only then can the true power of compound interest come to light, allowing your wealth to grow in real, tangible terms. As a financial time traveler, staying ahead of inflation helps ensure the journey to your financial goals isn’t undermined by the reduced purchasing power of your compounded returns.

To sum up

In the grand symphony of wealth creation, compound interest plays the role of a powerful maestro. From unleashing its magic to utilizing diverse investment vehicles, and understanding rules like ‘Rule of 72’, every note is crucial in creating a harmonious financial future. Regular contributions amplify the melody while being mindful of fees, taxes, and the silent rhythm of inflation can ensure your composition doesn’t miss a beat. By mastering these elements, you’re not just an audience in this performance; you become the conductor, guiding your wealth to grow over time. Remember, compound interest is a long game – the longer the performance, the sweeter the music. So, start early, stay consistent, and let the financial symphony of compound interest lead you toward a prosperous future.

Add Comment