Step into security and assurance in an ever-changing and uncertain world. Among the constants that provide peace of mind is the invaluable asset of health insurance. As healthcare costs continue to escalate and unforeseen medical events challenge our lives, the significance of the right health insurance coverage cannot be overstated. It acts as a guardian, ensuring you have a safety net of high-quality healthcare available when you need it most while shielding your financial stability from overwhelming medical bills.

Health insurance encompasses more than just physical well-being; it embraces the tranquility of your financial future. From routine check-ups to major surgeries, it empowers you to focus on the paramount aspects of life: your health and the well-being of your cherished ones.

This article serves as a guide to unlocking the myriad benefits of health insurance, ranging from proactive preventive care to robust financial protection.

Understanding the Importance of Health Insurance

Discover the transformative power of health insurance – it goes beyond being a mere document or an extra cost. Instead, it stands as a vital investment in your holistic welfare. Embracing health insurance means safeguarding yourself against potential financial uncertainties linked to healthcare. Picture this: without proper coverage, you might encounter daunting medical expenses that could significantly impact your financial equilibrium in the long run. But with health insurance by your side, you gain peace of mind, knowing you have a shield against such burdens.

Beyond financial protection, health insurance opens doors to diverse healthcare services. It grants you access to timely and appropriate care precisely when needed. This means you can confidently seek medical attention without being limited by financial constraints. Embracing health insurance empowers you to prioritize your well-being and confidently take charge of your health journey.

The Financial Impact of Not Having Health Insurance

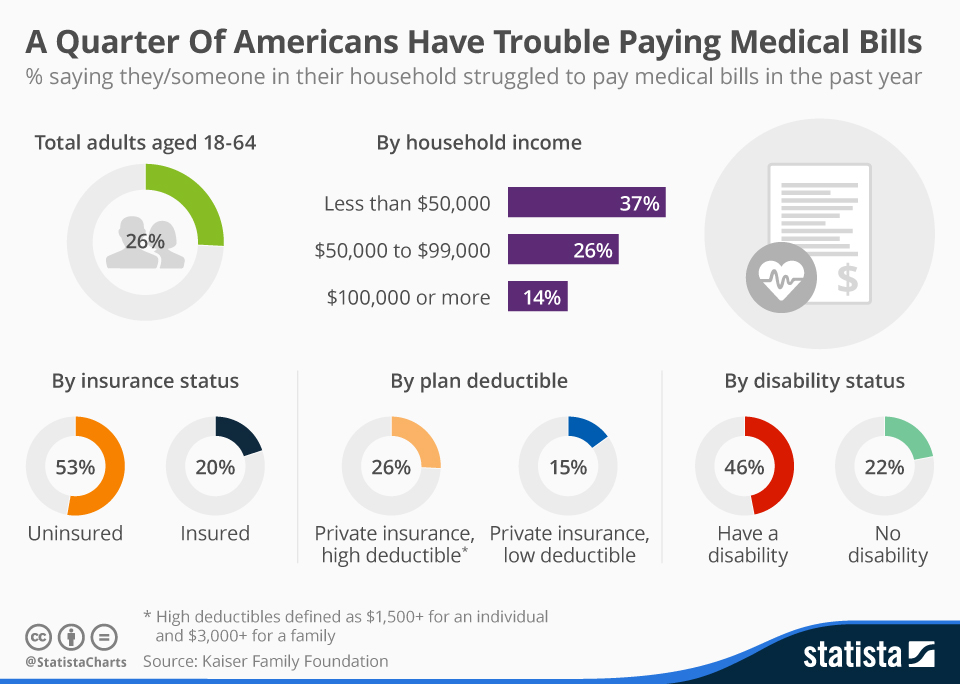

Without proper coverage, unexpected medical expenses can escalate rapidly, causing significant strain on individuals and families. A compelling study by the esteemed Kaiser Family Foundation highlights that uninsured individuals often hesitate or entirely avoid essential medical care due to cost anxieties. This can result in the exacerbation of health conditions and necessitate costlier treatments in the future.

One compelling advantage of health insurance is its ability to secure negotiated rates with healthcare providers, which can significantly reduce the burden of healthcare costs. Having the safety net of insurance gives you access to these advantageous rates that can make a substantial difference in your overall expenses. Protect yourself and your loved ones by exploring the numerous benefits of health insurance, ensuring peace of mind and access to necessary medical care when it’s most needed.

Credit: libguides.llu.edu

Health Insurance Options – Employer-Sponsored Plans, Individual Plans, and Government Programs

Navigating the intricate world of health insurance doesn’t have to be a daunting task. Multiple avenues are open for securing coverage, each catering to various needs and preferences.

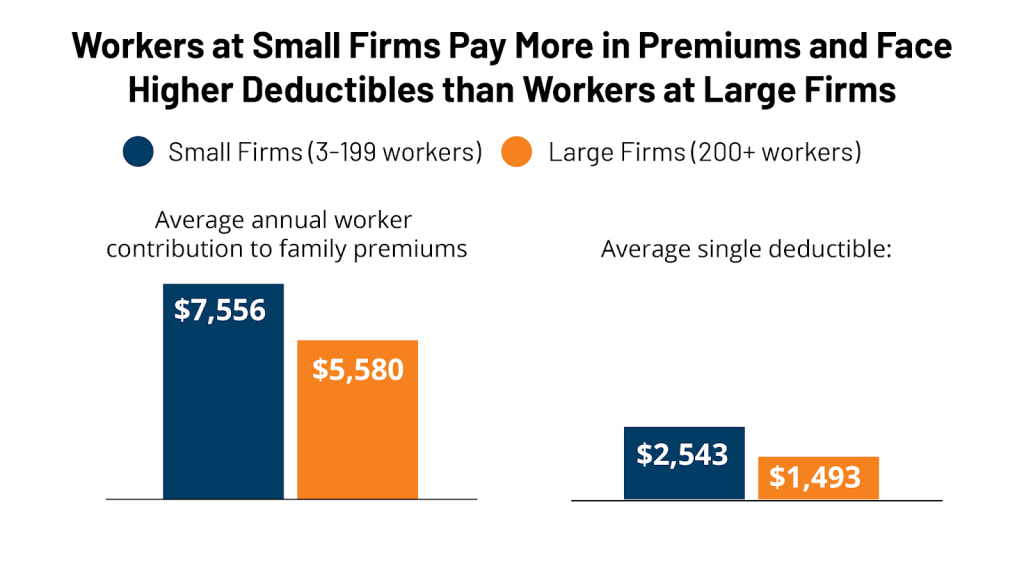

Firstly, there are employer-sponsored plans, a popular choice for many. Companies typically provide these as a perk to their employees, packaged within a broad benefits portfolio. Not only do these plans often deliver expansive coverage, but they also usually come at a more economical price than their counterparts. The advantage? A vast network of health services is accessible without breaking the bank.

But what if you’re not part of an organization offering such benefits? That’s where individual plans step into the spotlight. Available for purchase directly from insurance providers, these plans provide a spectrum of coverage options designed to align with diverse needs and financial circumstances. From basic protection to premium care, individual health insurance ensures that you don’t need to be part of a corporate structure to enjoy peace of mind regarding healthcare.

Last but not least, the government plays a pivotal role in funding health insurance. Those with low incomes and seniors have access to programs like Medicaid and Medicare. Health insurance should not be a privilege, but a right.

In summary, whether through the collaboration of employers, individual plans’ flexibility, or government programs’ inclusivity, health insurance coverage is within reach. The key is understanding your unique situation and exploring the options tailored to your life, ensuring that you are always one step ahead of unforeseen medical expenses.

How Health Insurance Works – Premiums, Deductibles, and Out-of-Pocket Costs

Knowing the jargon of health insurance is essential to understanding the complexities of the policy.

- Premiums: Your insurance provider charges you a monthly fee in order to continue to cover you. Think of them as the gateway to your health protection.

- Deductibles: This is the amount you must pay with your own money before your insurance begins to cover costs. It’s like a threshold you must cross, beyond which your insurance takes over.

- Out-of-Pocket Costs: These refer to the personal expenses that fall on your shoulders, including copayments and coinsurance. You must pay them directly, separate from your premium or deductible.

Understanding these components of health insurance is like having a map of a complex terrain. Understand healthcare expenses so you can make informed choices about your health insurance coverage. Making smarter, more budget-savvy decisions is easier when you have this knowledge at your fingertips.

Choosing the Right Health Insurance Plan for Your Needs

Navigating the maze of health insurance options might seem overwhelming, but with a pinch of strategy, you can find the perfect fit for your unique needs. Think of it as a personal journey – first, map out your health terrain. Are there any ongoing conditions or treatments to account for? What level of protection do you truly need? Dive deep into the nitty-gritty details, like checking if your favorite doctors and specialists are in-network. And remember, it’s always wise to shop around. Comparing various plans and tapping into the expertise of insurance gurus can steer you toward a decision that’s just right for you. Health insurance isn’t just about coverage; it’s about peace of mind. Make your choice a confident one!

Credit: kff.org

Tips for Saving Money on Health Insurance

Investing in health insurance isn’t just a wise financial decision; it’s an essential protection for your well-being. However, managing the cost of this protection can be manageable. Here’s how you can smartly navigate this terrain.

Start by diving into a comparative study of different health insurance plans. Investigate the offerings of different providers. A perfect outfit requires the right fit and the best price. Compare plans to find an affordable, tailor-made plan.

But don’t stop there! You can also control your medical expenses using tools like health savings accounts (HSAs) or flexible spending accounts (FSAs). These accounts are your personal financial assistants, helping you set aside pre-tax money specifically for healthcare needs. Not only do they allow you to plan and prepare for medical expenses, but they also offer potential tax advantages. It’s like having a coupon for healthcare – saving you money while providing the care you need.

By exploring these strategies, you can find a way to secure quality health insurance and reduce the financial stress associated with healthcare. It’s a journey towards not just saving money but also investing in a healthier future. Isn’t that something worth exploring?

Health Insurance and Preventive Care

Unlock the secrets to staying ahead of health challenges with the power of health insurance. This vital coverage goes beyond just taking care of medical expenses; it empowers individuals to embrace a proactive approach to their well-being. Health insurance nurtures a culture of wellness and self-care by offering comprehensive support for vaccinations, screenings, and regular check-ups.

Imagine a world where potential health issues are spotted early on, leading to better treatment outcomes and reduced healthcare expenses. That’s precisely the transformative effect of preventive care made possible by health insurance. Through the array of preventive services covered, individuals gain the upper hand in managing their health, shielding themselves from potential health woes.

Think of health insurance as a partner, not just a safety net for emergencies. Embrace the opportunities it provides for preventive care, and take charge of your well-being today. Your future self will thank you for the wise investment in your health.

Conclusion – The Importance of Prioritizing Health Insurance

In today’s uncertain world, health insurance is a vital investment to safeguard your future and financial security. As medical costs continue to rise, unforeseen health emergencies can leave you vulnerable to overwhelming bills and significant stress. But fear not! The right health insurance coverage acts as a protective shield, granting you access to top-notch healthcare without bearing the burden of excessive expenses.

Delving into health insurance, you’ll discover many benefits awaiting you. Firstly, it offers invaluable financial protection, shielding you from the potentially crippling impact of medical bills. Moreover, health insurance opens doors to an extensive network of skilled medical professionals, ensuring you receive the best care possible. Let’s not forget the importance of preventive care, which health insurance promotes, helping you proactively manage your well-being and stay healthy.

Remember, prioritizing health insurance is vital in securing your physical and financial well-being. Embracing this essential tool guarantees a worry-free future for yourself and your beloved family, empowering you to face life’s uncertainties confidently. So, unlock the power of health insurance and embark on a journey toward a brighter, healthier, and financially stable tomorrow!