Credit scores have a profound impact on shaping your financial life. Lenders use a three-digit number to assess your debt repayment ability. Your credit score can impact your financial opportunities, from mortgages to credit cards. To achieve financial freedom and health, you must understand your credit score.

Understanding Credit Scores

Based on your credit files, your credit score measures your creditworthiness. Payment history, debt, and credit history length are all considered in calculating a credit score.

Several factors influence your credit score:

- Payment History: This is the most significant factor. It reflects whether you’ve paid past credit accounts on time.

- Credit Utilization: This is the ratio of outstanding credit balances to credit limits. Lower utilization is better for your credit score.

- Length of Credit History: It consists of the date of opening of your oldest credit account, the date of opening of your newest credit account, and the average age of all of your debt accounts.

- Credit Mix: It examines your credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans.

- New Credit: This includes the number of recently opened accounts and recent inquiries from lenders.

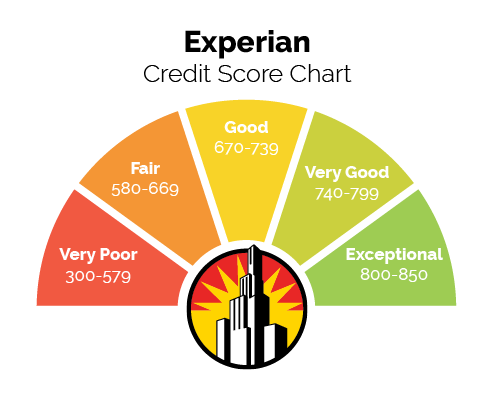

A credit score typically ranges between 300 and 850. Here’s what these scores generally mean:

- Poor Credit: 300-579

- Fair Credit: 580-669

- Good Credit: 670-739

- Very Good Credit: 740-799

- Excellent Credit: 800-850

A good credit score makes lenders trust you more. You can achieve better financial opportunities if you understand these ranges.

The Impact of Credit Scores on Loans and Interest Rates

When individuals submit a loan application, lending institutions analyze their credit score to evaluate their creditworthiness. The credit score serves as an essential risk indicator for the lender. A higher credit score reflects lower risk, enhancing the likelihood of loan approval. Conversely, a lower credit score may result in loan denial.

Credit scores also affect interest rates on loans. Generally, a higher credit score enables borrowers to secure lower interest rates. This is attributed to a high credit score reflecting responsible borrowing behavior, prompting lenders to offer more favorable terms. In contrast, lenders may increase interest rates on individuals with low credit scores.

Suppose two people apply for a mortgage. One has a 750 credit score, the other has a 600. Higher credit scores are likely to result in lower interest rates, which can result in substantial savings over the loan’s lifetime.

Credit: checkcity.com

The Role of Credit Scores in Securing Housing

The credit score holds significant importance in the process of obtaining housing, whether through renting or buying. Both landlords and real estate agencies routinely assess the credit scores of potential tenants or buyers as part of their evaluation process.

When applying to rent a house or apartment, landlords commonly review the applicant’s credit score. A higher credit score indicates responsible payment behavior, reassuring landlords that the rent will likely be paid promptly each month. Conversely, a lower credit score may raise concerns about financial reliability, leading to potential hesitation in renting the property.

Likewise, when purchasing a house, mortgage lenders carefully examine the credit score as a component of their approval procedure. A favorable credit score facilitates obtaining a mortgage and may secure a better interest rate. On the contrary, a lower credit score can present challenges in mortgage approval, potentially resulting in higher interest rates if the approval is granted.

To summarize, the credit score significantly influences various aspects of one’s financial life, including loan approvals, interest rates, and acquiring housing. Maintaining a solid credit score is imperative for ensuring financial well-being.

Credit Scores and Employment

In the present competitive employment landscape, your creditworthiness can significantly impact securing your desired position. Many employers are now incorporating an applicant’s financial background assessment into their hiring process, particularly for roles involving financial accountability or access to sensitive financial data.

The rationale behind this practice lies in the belief that an individual’s financial conduct, as indicated by their creditworthiness, can offer valuable insights into their dependability and trustworthiness. A less-than-favorable credit history, marked by delayed payments or excessive debt, might raise concerns about a candidate’s capacity to handle responsibilities, adhere to deadlines, or manage financial resources.

It’s important to clarify that employers cannot access your precise credit score. Instead, they review a modified version of your credit report that omits certain personal details and the credit score itself. Nevertheless, the information they peruse can significantly influence their decision-making process.

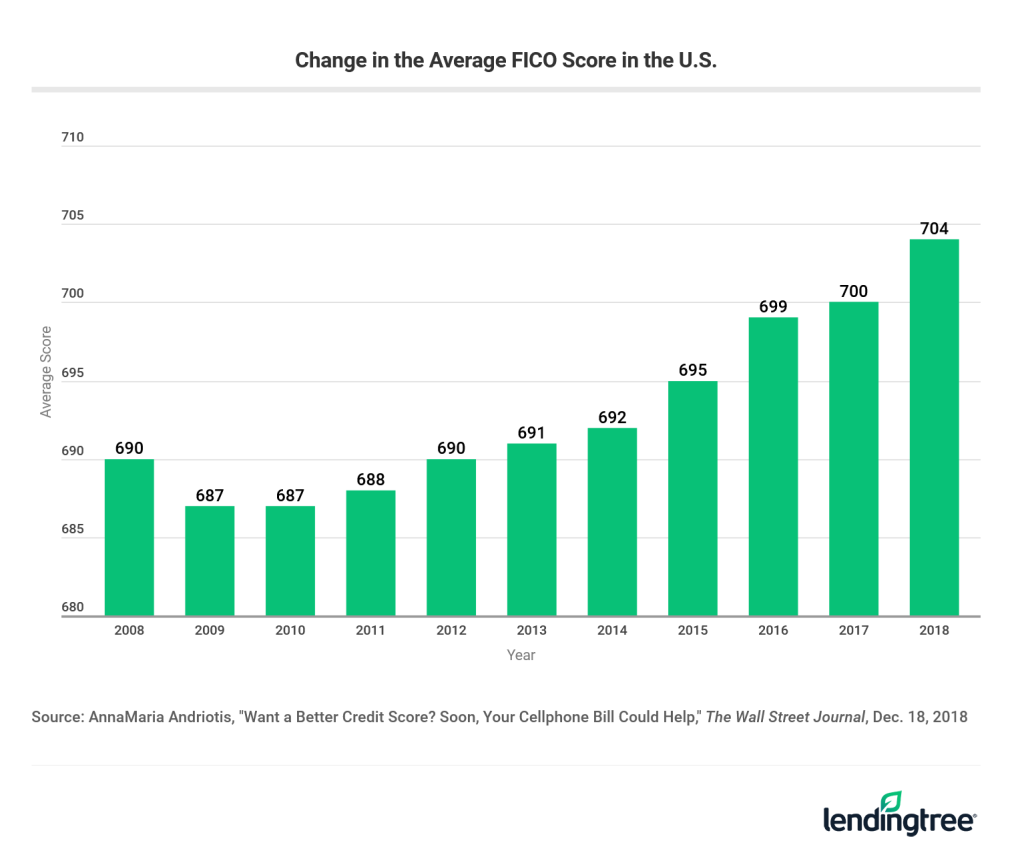

Credit: lendingtree.com

How to Improve Your Credit Score

Enhancing your credit score involves following prudent tactics and maintaining a firm grasp of credit management principles. The following key steps will guide you on this journey:

- Familiarize Yourself with Your Credit Report: Your credit report holds vital information in determining your credit score, encompassing your payment history, debt amount, and credit history duration.

- Timely Bill Payments: Paying your bills on time significantly impacts your credit score. Late or missed payments can dramatically impair your score. To circumvent this, establish reminders or opt for automatic payments to ensure timely settlements.

- Keep Your Credit Utilization Low: Credit utilization denotes the percentage of your available credit being utilized. A lower credit utilization ratio has a positive influence on your credit score. As a guideline, endeavor to maintain credit utilization below 30%.

- Don’t Close Old Credit Cards: The longevity of your credit history holds significance in determining your credit score. If you possess unused old credit cards, refrain from closing them. This practice fosters a lengthier credit history, thereby elevating your credit score.

- Limit New Credit Applications: Every credit application results in an inquiry on your report. An excess of inquiries in a short span may reduce your score. Hence, limit new credit applications only to instances where they are genuinely necessary.

- Diversify Your Credit: A diversified credit portfolio (credit cards, retail accounts, installment loans, mortgage) can positively impact your credit score. However, do not pursue credit you do not genuinely require. Prioritize responsible credit management.

Remember that improving your credit score is a gradual process, necessitating persistence, patience, and consistent financial practices. Adhering to these strategies can progressively enhance your credit score and unlock new financial possibilities.

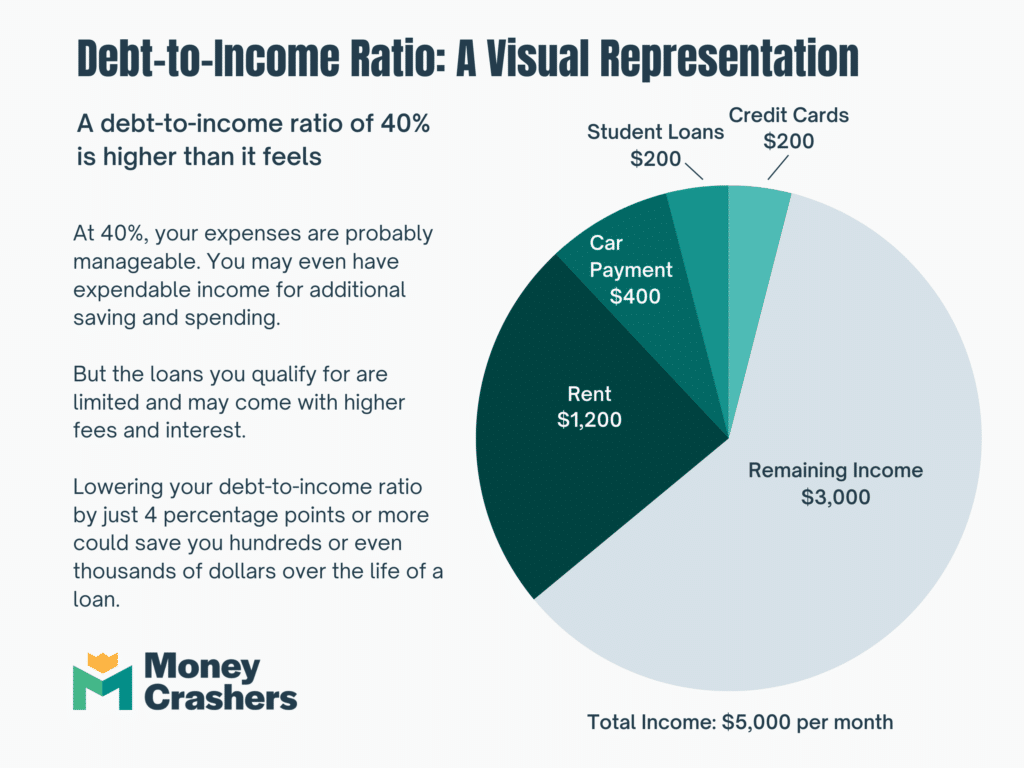

Credit: moneycrashers.com

The Long-term Benefits of a Good Credit Score

The significance of a strong credit score extends beyond mere digits; it serves as a crucial gateway to a financially secure future. By showcasing your fiscal prudence and creditworthiness, a good credit score presents a realm of opportunities.

- Financial Freedom: A commendable credit score facilitates financial independence by securing loans at reduced interest rates, leading to substantial long-term savings. These savings can be redirected towards investments, thereby bolstering your overall financial well-being.

- Better Opportunities: An impressive credit score also unlocks broader horizons, enabling you to realize your aspirations. Whether it involves obtaining a mortgage to acquire your dream home or receiving funding to start a business venture, a good credit score enhances accessibility to these possibilities.

- Negotiating Power: Possessing a good credit score empowers you with negotiating leverage over interest rates for loans and credit cards. Creditors tend to provide more favorable terms to less risky individuals, a status reinforced by a solid credit score.

- Easier Approval for Rentals and Jobs: Credit scores often factor into assessments made by landlords and employers. A robust score simplifies renting a home or securing employment, particularly for positions involving financial responsibilities.

Conclusion

Ultimately, your credit score holds significant importance beyond being a mere number; it mirrors your financial practices and well-being. It significantly impacts your financial journey, affecting aspects like loan acceptances and job prospects.

Hence, it becomes crucial to routinely assess your credit score and adopt strategies to enhance it when required. Keep in mind that building a favorable credit score requires consistent and responsible financial conduct, and although it might not happen overnight, it’s a feasible objective.

Begin shaping your financial prospects by prioritizing the preservation and enhancement of your credit score today. You’ll thank yourself for this thoughtful approach in the days to come.