Are you prepared to seize the reins of your financial destiny and set your wealth on an upward trajectory? Dipping your toes into the world of index funds could be the savvy and novice-friendly first step on your path to fiscal autonomy. This comprehensive guide explains how to start investing with index funds. The insights and resources in this guide will prepare you to make astute investment decisions regardless of whether you are a beginner or have dabbled in stocks before. We’ll demystify index funds and how they operate and guide you in selecting suitable funds that align with your investment aspirations. So, if you’ve been pondering how to put your money into action, your search ends here. Let’s plunge into the thrilling realm of index fund investing and unravel its mysteries together.

What are index funds?

Imagine index funds as a mirror. An index fund reflects the performance of a specific market index, like the S&P 500 or the FTSE 100. In contrast to their high-maintenance siblings, the actively managed funds, index funds are the laid-back, go-with-the-flow types. They don’t try to beat the index they’re tracking; they’re content just to match its performance. When you invest in an index fund, you’re buying a tiny slice of a vast, diversified portfolio of stocks or bonds, depending on the flavor of index fund you pick.

Why are index funds the talk of the town among investors, you ask? Well, for starters, they give you a ticket to the broad market express, letting you invest in a wide array of companies or bonds with just one investment. This diversification is like a safety net, spreading the risk and buffering you from the blow of any single stock or bond hitting a rough patch.

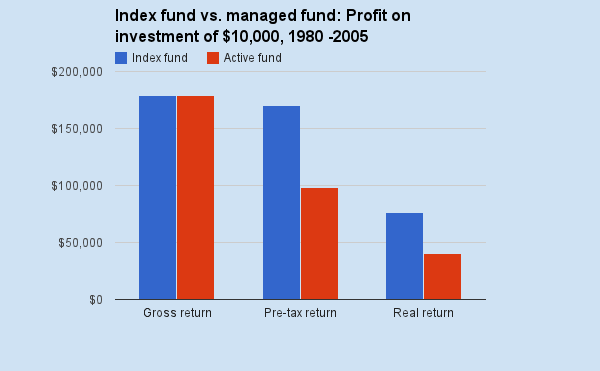

Index funds are also a budget-friendly option in the investment world. They don’t rack up high management fees since they’re not trying to outsmart the market. This means they have lower expense ratios than actively managed funds, leaving more of your hard-earned investment returns in your pocket. Now, who wouldn’t love that?

Benefits of investing in index funds

Diving into the world of index funds can be a rewarding experience, and here’s why. The beauty of index funds lies in their simplicity. They eliminate the need for exhaustive research and analysis associated with individual stock picking. Instead, they offer a more relaxed, passive investment strategy. No need to lose sleep over market timing or the quest for the ‘golden’ stock. When you align your investments with a broad market index, you essentially bet on the market’s long-term prosperity.

Cost-effectiveness is another compelling reason to consider index funds. Index funds aren’t burdened with high expense ratios, unlike their actively managed counterparts. Why? Because they’re not reliant on a battalion of analysts and fund managers to constantly scrutinize and select stocks. Their mission is simple – to mirror the performance of a market index, a task that demands fewer resources and manpower. Investors can enjoy enhanced returns over time thanks to this lean approach.

But there’s more. Index funds are a ticket to the world of diversification. When you invest in an index fund, you’re spreading your wings across a multitude of companies or bonds within a specific market index. This broad exposure helps dilute risk and lessens the blow of any single stock or bond falling short of expectations. Plus, it opens doors to multiple sectors and industries, further diluting your dependence on any single entity or sector. Index funds are a smart, cost-effective way to spread your bets and potentially reap the rewards of the market’s overall performance.

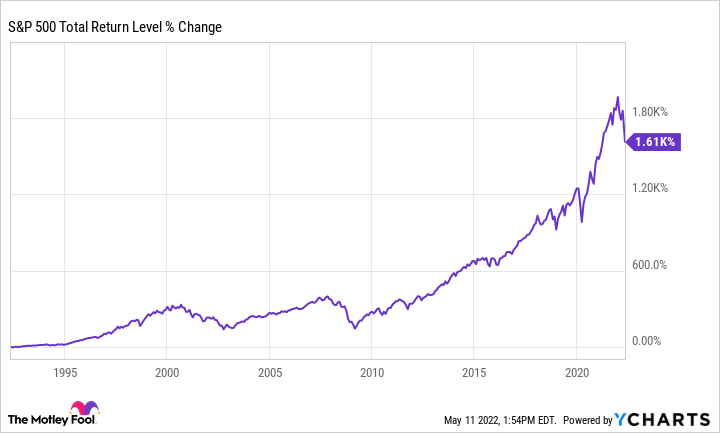

Credit: fool.com

Types of index funds

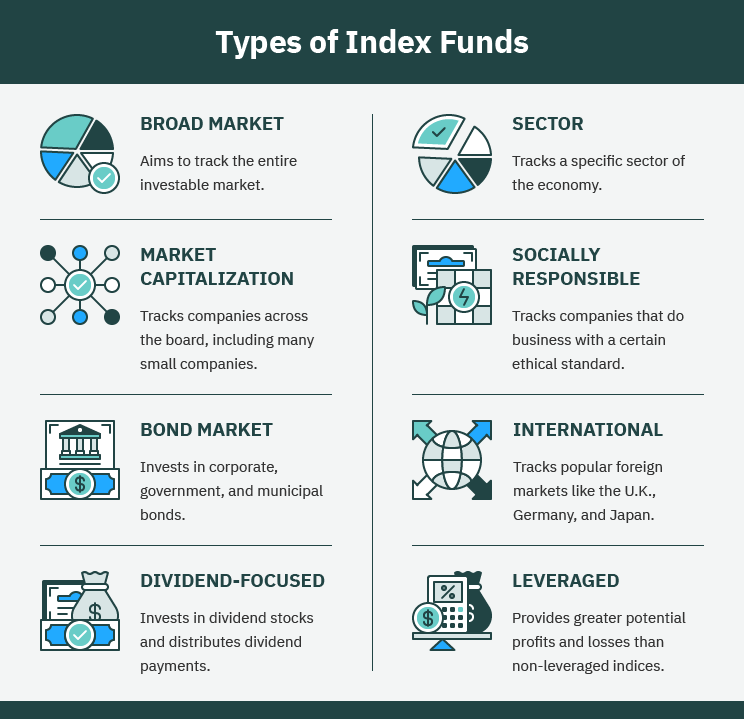

Welcome to the vibrant universe of index funds, a place where every investor can find something that aligns with their unique investment goals and strategies. Index funds come in various flavors, each offering a distinct blend of characteristics and investment approaches.

First off, let’s meet the crowd favorite – the equity index fund. These funds are mirror images of specific stock market indices, such as the illustrious S&P 500 or the dynamic NASDAQ. Imagine a colorful mosaic of stocks, each piece weighted according to its market capitalization, working together to replicate the value of a chosen index. That’s your equity index fund!

Next, we have the bond index fund, a steady player in the investment game. These funds aim to mimic the performance of specific bond market indices, like the renowned Bloomberg Barclays U.S. Aggregate Bond Index. Picture a diversified portfolio of bonds, each selected and weighted by its market value. If you’re an investor seeking fixed-income investments with a lower risk than stocks, these funds might just be your perfect match.

But the index fund universe doesn’t stop there. For those who wish to ride the waves of a specific sector or industry, say technology or healthcare, sector-specific index funds are your ticket. Funds such as these offer exposure to specific sectors or industries, bypassing the need to invest in individual stocks. These funds are a popular choice for investors seeking to take advantage of the growth potential of a particular industry or sector.

This is a quick overview of the diverse world of index funds. No matter what type of investor you are, there’s an index fund out there that’s right for you!

Understanding the risks of index funds

Index funds are a popular investment choice, offering numerous advantages. However, it’s crucial to be aware that they’re not without their potential pitfalls. One of the primary risks associated with index funds is market volatility. As these funds aim to mirror the performance of a specific market index, they’re inherently tied to the market’s fluctuations. When the market takes a nosedive, so too will the value of index funds.

Another potential pitfall to be mindful of is the tracking discrepancy. While index funds strive to emulate the performance of a particular market index, achieving an exact match is often elusive. This discrepancy, known as tracking error, can arise due to various factors such as administrative fees, trading costs, and the fund’s investment approach. While typically minimal, the tracking error can accumulate over time, subtly eroding your returns.

Lastly, it’s important to remember that despite their diversification benefits, index funds are not entirely insulated from individual stock or bond risks. If a specific security within the index falters, it can influence the overall performance of the index fund. However, the broad diversification offered by index funds serves as a buffer, mitigating the impact of any single underperforming security.

Credit: bogleheads.org

How to choose the right index fund

Embarking on the journey of choosing the right index fund can feel like navigating a complex maze. Despite this, you can increase your investment returns significantly with the right compass. You can find your way here.

Start by taking a good, hard look at your investment goals and risk appetite. Are you saving for a golden retirement, accumulating a nest egg for a home, or building a financial foundation for your child’s education? Your goals will guide you toward the right asset allocation and investment strategy.

Next, turn your attention to the index that the fund shadows. Each index is a unique beast, with different compositions and performance traits. Take the S&P 500, a mighty creature made up of 500 large-cap U.S. stocks, or the Russell 2000, a nimble critter composed of 2000 small-cap U.S. stocks. By understanding how an index works, you can decide whether or not it is a good partner for your investment journey.

Don’t forget to scrutinize the fund’s expense ratio. While index funds are known for their lean expense ratios compared to their actively managed counterparts, there’s still variation within the species. It’s crucial to weigh the expense ratios of different funds and select one that strikes a harmonious balance between cost and performance.

Also, take a peek into the fund’s historical performance. While it’s not a crystal ball for future results, it can offer a glimpse into how the fund has weathered different market climates. Seek out funds that have consistently outpaced their benchmark index.

Finally, consider the fund’s investment minimums and fees. Some index funds roll out the red carpet for investors with no minimums, while others set a high bar. Plus, some funds may levy transaction fees or other administrative costs. Make sure you’re aware of these potential tolls on your investment journey.

Remember, choosing the right index fund is like choosing the right guide for your investment adventure. Find the perfect companion for your journey by taking your time and doing your research.

Setting investment goals and timelines

Embarking on the journey of investing in index funds? Hold your horses! First, you need to map out your investment goals and timelines. This is the compass that will guide your asset allocation and investment strategy. Are you saving for a sun-soaked vacation or the down payment on your dream house? Or perhaps you’re looking towards the future, investing for a comfortable retirement? Recognizing your investment objectives will help you gauge the suitable level of risk and the timeline for your investments.

When it comes to setting investment goals, precision and realism are your best friends. Rather than vaguely aspiring to “make a fortune,” set tangible financial goals like “I aim to accumulate $100,000 for my retirement in 20 years.” This approach will keep your eyes on the prize and fuel your motivation throughout your investment voyage.

Having established your investment goals, the next step is to figure out the optimal asset allocation. This refers to the division of your portfolio among different asset classes. Stocks, bonds, and cash, for example, make up the different classes. The ideal asset allocation hinges on your investment objectives, risk appetite, and investment horizon. A handy rule of thumb is that younger investors with a longer runway can shoulder more risk and thus allocate more to stocks. On the other hand, older investors nearing their investment destination might opt for a safer route with a higher allocation to bonds.

Credit: tokenist.com

Monitoring and adjusting your index fund portfolio

Embarking on the journey of index fund investing is just the beginning. Like a seasoned sailor navigating the vast ocean, keeping a keen eye on your investment vessel and making course corrections as necessary is crucial. Remember, index funds are crafted for the long haul, but that doesn’t mean you set sail and forget. Regular check-ins and adjustments ensure your investment journey stays on course.

A crucial part of this navigation is rebalancing your portfolio. Think of it as adjusting your sails to the shifting winds. Over time, the performance of various asset classes can cause your portfolio to drift from its original course. Rebalancing is realigning your portfolio to its initial asset allocation, helping you avoid unnecessary risks.

The rhythm of rebalancing is a personal choice influenced by your investment strategy and risk appetite. Some investors prefer the consistency of a set schedule, such as annual or bi-annual rebalancing. Others opt for a more dynamic approach, rebalancing whenever their portfolio strays from their target allocation by a specific percentage, say 5% or 10%.

However, when adjusting your sails, be mindful of the potential tax squalls. Selling securities might trigger capital gains taxes if you’re sailing in taxable waters. It’s crucial to balance the potential tax implications against the benefits of rebalancing and, if needed, seek guidance from a tax professional.

Beyond rebalancing, it’s also vital to periodically reassess your financial goals and risk tolerance. As life’s tides change, so might your financial objectives or situation. You may need to adjust your asset allocation or investment strategy accordingly. For instance, as you approach the shores of retirement, you might want to steer your portfolio towards safer waters with a higher allocation to bonds.

Tax implications of investing in index funds

Venturing into the world of index funds can bring along certain tax implications, particularly if your investments are housed in a taxable account. Here’s a simplified guide to some crucial tax aspects you should be aware of:

- Capital Gains Tax: Selling your index fund shares might lead to taxable capital gains. The tax quantum hinges on the duration for which you held the shares. You are taxed on short-term capital gains on shares held less than a year. Capital gains taxes are generally lower on shares held over a year.

- Dividend Tax: Index funds often reward their investors with dividends, which are also taxable. Dividends are treated differently depending on whether they are qualified or not. Capital gains tax rates are lower for qualified dividends, while regular income tax rates apply to non-qualified dividends.

- Tax-Efficient Funds: Certain index funds are crafted to be tax-efficient, aiming to curtail taxable distributions to investors. They employ strategies like sampling or optimization to mirror the index’s performance while reducing taxable events. Tax-efficient index funds may help minimize your investment tax impact.

- Tax-Advantaged Accounts: Consider channeling your index fund investments through tax-advantaged accounts like IRAs or 401(k) accounts. These accounts offer tax perks like tax-deferred growth or tax-free withdrawals (in the case of a Roth IRA). This strategy can minimize or even wipe out taxes on your investment returns.

Remember, seeking advice from a tax expert or financial advisor is crucial to comprehend the tax implications of index fund investments tailored to your unique circumstances.

Add Comment