In one’s life, a significant milestone comes when they leave the workforce and enter the retirement phase. This particular period represents the conclusion of a long professional journey, and the beginning of a new chapter characterized by the enjoyment of the rewards reaped over the years. Nevertheless, determining the ideal retirement time is a critical decision that merits careful consideration.

The retirement age holds far more significance than just a numerical value; it can profoundly affect the quality of life experienced during retirement. It necessitates thoughtful contemplation, meticulous planning, and a comprehensive examination of personal and financial aspects.

Grasping the concept of retirement age and establishing the optimal moment to retire assumes paramount importance. It is crucial to acknowledge that a universal retirement age cannot be uniformly applied, as it varies significantly from person to person. Numerous factors include financial stability, health condition, personal aspirations, and job satisfaction.

This article delves into the intricacies of determining the most suitable retirement age. We explore the factors that impact this decision, outline the advantages and disadvantages of retiring early or late and present strategies to facilitate an informed choice. Our objective is to furnish you with the necessary knowledge and insights to plan for a comfortable and gratifying retirement effectively.

Financial considerations

When picking retirement age, financial considerations are critical. These factors significantly affect a person’s future financial security and prosperity.

- First, it’s vital to inspect one’s savings and investments. Are they enough to support them in retirement? This should involve looking at inflation rates, expected costs, and income after retirement.

- Next, social security benefits or pension plans should be considered. Knowing their eligibility and expected payouts can show if retiring at a certain age is financially feasible.

- Debts and financial obligations must be assessed too. Clearing these, like mortgages or loans, can reduce monthly costs and give a better financial outlook for retirement.

- Then, healthcare costs should be taken into account. As people get older, medical bills go up. Evaluating health insurance or planning for long-term care is necessary to have enough funds.

- Lastly, the impact of inflation should be looked at. Inflation eats away purchasing power over time, so considering how inflation rates may influence future expenses helps decide the right retirement age.

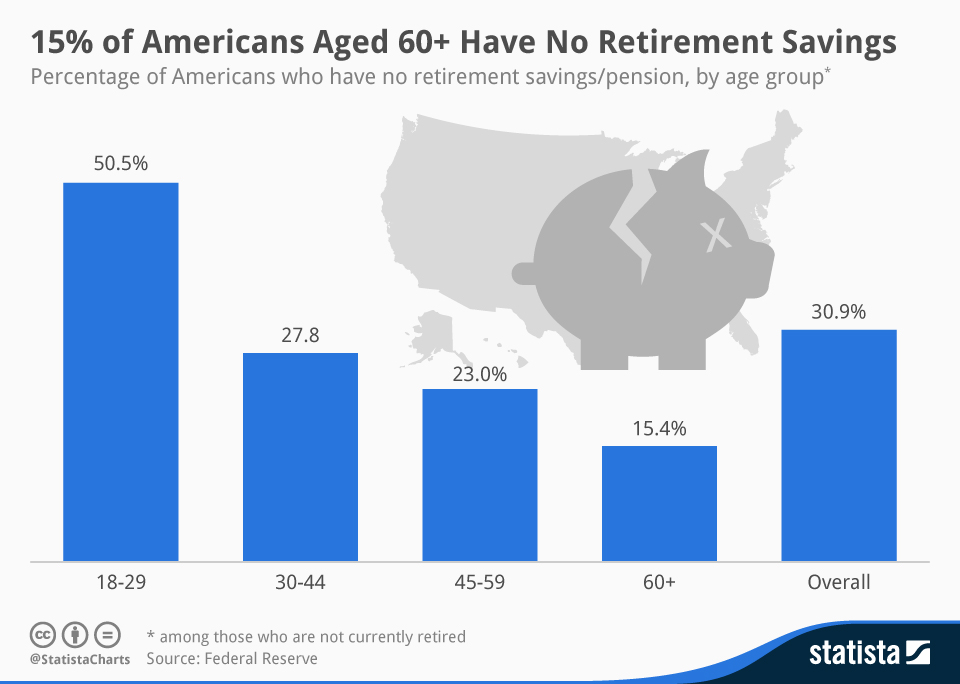

Credit: statista.com

Savings and investment strategies

Savings and investment strategies are important for deciding the perfect retirement age. Risk tolerance, financial objectives, and market conditions should be considered. Adequate savings, diverse investments, and regular retirement contributions are essential strategies for a comfy retirement. Monitoring and tweaking these strategies regularly can maximize returns and reduce risks. Consulting with a financial advisor can give beneficial advice for creating tailored savings and investment plans according to individual needs and objectives. Planning and executing successful strategies can significantly affect one’s ability to retire at the wished age with financial stability.

Furthermore, individuals should think about the tax effects when planning retirement savings. Roth IRAs and 401(k) plans can potentially reduce future tax burdens. It is also essential to match investment decisions with long-term financial goals while considering the time until retirement. Young people may have a higher risk tolerance and pursue more aggressive investment plans. Meanwhile, those close to retirement may choose more conservative portfolios.

Another significant aspect of savings and investment strategies is controlling inflation risk. Since retirements can last decades, account for inflation by investing in assets that have previously outpaced inflation rates, like stocks or real estate. Examining investments frequently ensures they stay consistent with individual changes or market conditions.

In conclusion, picking appropriate savings and investment strategies is essential for deciding the optimal retirement age. Understanding risk tolerance, setting clear financial goals, diversifying investments, monitoring progress often, considering tax implications, managing inflation risk, and getting professional advice are all crucial parts of an effective retirement plan.

Social security benefits

Benefits from social security influence retirement age. These benefits are designed to assist you during your retirement years. When deciding, remember these points:

- Eligibility criteria: You usually need to pay payroll taxes to get social security benefits. The rules may differ according to age and work history.

- Retirement age: Getting full social security benefits depends on your birth year. You can get reduced benefits at 62, but waiting until full retirement age (66-67) gives higher payments.

- Spousal and survivor benefits: Being married can mean you’re eligible for extra benefits from your spouse’s work record. These additional benefits provide security and should be considered when deciding the best retirement age.

These factors can help determine the best retirement age and get the most from social security. Each person’s situation is unique, so it’s wise to seek more information or advice from a financial advisor. By examining these points, you can ensure a secure retirement and take advantage of social security benefits.

Health considerations

How old should you retire? Health matters when deciding. Evaluate physical and mental wellness before you make the big call.

It’s essential to stay healthy in retirement. Our bodies change as we age, which can affect our health. Consider any medical conditions or potential issues that may arise in the future. Conditions such as diabetes and heart disease can impair your movement and daily chores, meaning you might need to retire earlier.

Mental health is just as important. Retirement can bring major life changes, leading to boredom, isolation, or loneliness. Assess your mental resilience and ability to adjust to this new phase. Look for activities that give cognitive stimulation and social interaction.

Don’t forget about healthcare costs. As we age, the need for medical attention grows. Make sure you have enough savings and access to insurance plans that cover medical expenses. Retiring at the right age can ensure you have enough money to keep fit and well.

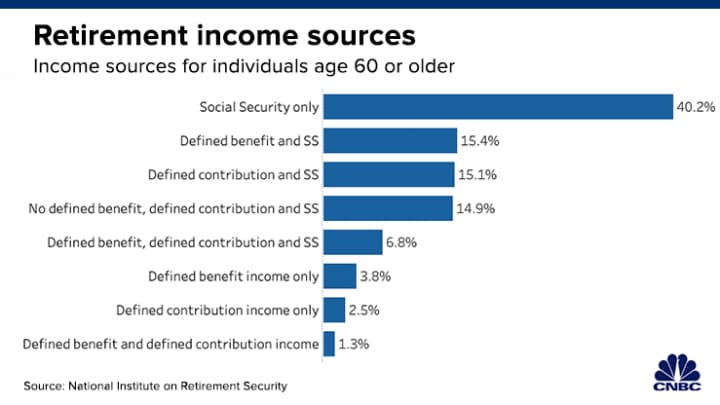

Credit: www.cnbc.com

Personal goals and aspirations

Personal aspirations and goals are critical when deciding on the best retirement age. These vary from person to person and greatly impact when they choose to retire.

- Finances: Many desire specific financial stability before retiring. This includes having enough savings and investments to live the expected life during retirement.

- Travel: Some long to explore new places during their retirement years. To make this a reality, they may opt for an earlier retirement.

- Hobbies: Retirement can provide the time to pursue hobbies, e.g., painting, gardening, or playing music.

- Family: For some, spending quality time with family, especially grandkids, is a deciding factor.

- Health: People with health issues may opt for earlier retirement to focus on well-being and medical treatments.

- Fulfillment: Retirement offers the chance to find fulfillment beyond work. Individuals may pursue volunteering or new career paths that align with their passions.

These personal aspirations must be considered when deciding on retirement age. Each individual’s unique circumstances will dictate their decision to ensure they make the most out of their golden years.

Pros and cons of retiring early

To weigh the advantages and disadvantages of retiring early, delve into the pros and cons of retiring early. Explore the financial implications, health and well-being, and social impact as critical factors to consider when determining the optimal retirement time.

Financial implications

Retiring early could mean big money matters. Think carefully before deciding. A paycheck reduction could bring financial stress. But, it can also lead to life’s joys without a job.

Early retirement means a loss of income. Are there enough savings and investments to live on? An early retirement may also decrease Social Security benefits. This needs to be taken into account in planning.

Retiring early may mean no more work costs. Commuting fees, clothing purchases, and lunch costs could be cut. These savings could help to manage early retirement finances.

Additionally, more time to manage investments could bring higher returns. This option requires expert advice for long-term financial security.

To sum up, retiring early has pluses and minuses. Less income and possible trouble meeting money goals. Yet, a more affluent lifestyle and better control of personal finances. Those considering early retirement should look at all the facts and get professional advice.

Health and well-being

Early retirement offers many advantages for one’s health and overall well-being. Here are some key points to consider:

- Physical Health: Retire early and focus on physical fitness. With extra time, exercise and healthy eating are easier!

- Mental Well-being: Less work-related stress positively impacts mental health. Early retirement lets you prioritize self-care, hobbies, and interests.

- Rest and Relaxation: Enjoy ample relaxation periods. Establish healthy sleeping patterns and take breaks as needed.

- Social Connections: Nurture existing relationships and build new ones. Connections are important for mental stimulation and happiness.

Plus, enjoy traveling more, exploring new experiences, and growing personally. Early retirement allows individuals to dedicate time to physical health, mental well-being, rest, relaxation, and social connections, ensuring a fulfilling post-retirement life with no compromises!

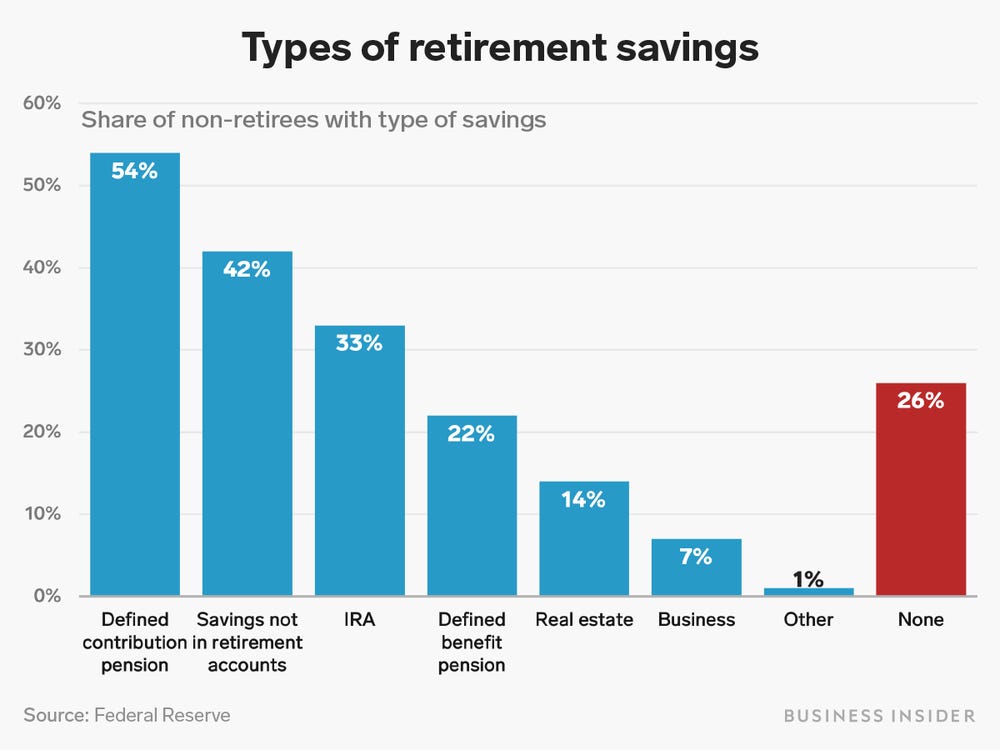

Credit: businessinsider.com

Social impact

Retirement early can affect your social life. Here’s how it can affect your relationships, community involvement, and a sense of purpose.

- Relationships: When you retire early, it may alter your friendships. You won’t have the same experiences as when you were working. If they’re still working, you’ll also have less time to spend with your pals. Retiring allows you to create new connections and deepen existing ones.

- Community Involvement: Usually, work is a primary way to interact with your community. Retiring early could mean less participation in any community activities or organizations. Nevertheless, you can find fresh methods of contributing and giving back.

- Sense of Purpose: Work often provides a purpose and identity. When you retire early, you may feel lost and need direction. Discover other ways to find fulfillment, such as enjoying hobbies, volunteering, or doing personal growth activities.

- Social Dynamics: Retiring early may mean changes in your social circles or family ties. Your choice to retire early could be met with confusion or criticism from people who don’t get it. Be open about your decision and set expectations to maintain healthy relationships.

It is vital to recognize that retiring early’s social effects differ for everyone, depending on their preferences, support systems, and adaptability skills. Approaching this transition with an open mind and actively seeking social opportunities can help you enjoy retirement while managing the changes.

Pros and cons of retiring later

Consider the pros and cons of making an informed decision about retiring later. Explore the financial implications, health, well-being, work satisfaction, and fulfillment. Each of these sub-sections provides valuable insights into the impact of delaying retirement.

Financial implications

Retiring later has many financial implications. Working more can mean increased retirement savings and a more giant ‘nest egg.’ Also, Social Security benefits can be higher with more working years.

However, there are some less favorable financial considerations. Healthcare coverage until age 65 may require additional expenses. And working longer may affect one’s health and overall well-being. Lastly, retiring later could mean less time with family and missing out on life events. It’s important to consider all factors when deciding to retire later.

Health and well-being

Retiring later can bring many advantages to our well-being. We remain engaged and active, both physically and mentally. This gives us a sense of purpose and routine, which boosts our health.

- We also gain more time to focus on our personal health goals. With extra years in the workforce, we can save money for healthcare costs and invest in preventive measures like regular check-ups, exercise plans, and healthy diets.

- Staying employed longer helps us keep our social connections. The workplace may offer social interaction and friendships, giving us emotional support and reducing feelings of loneliness.

- Moreover, by retiring later, we can afford better healthcare options or comprehensive insurance plans.

- Nevertheless, we should evaluate our circumstances before deciding to retire later. Physical health conditions or high-stress levels might harm our well-being.

Therefore, when deciding when to retire, our health should be our top priority. We should consider all the potential benefits of quitting later when making this decision.

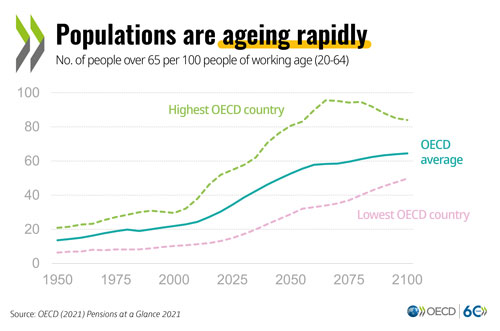

Credit: oecd.org/pensions

Work satisfaction and fulfillment

Work satisfaction is critical to job retention and career advancement. When individuals are happy in their work, they are likelier to stay with their role. This can help them gain stability and present new growth opportunities. Employers value those who are motivated and content in their roles as they are usually more productive and better team players.

Work satisfaction can also spill over into other areas of life. Those fulfilled in their career often have higher overall life satisfaction. They can balance their work and personal commitments better, creating fulfillment. Moreover, happiness at work provides more than just financial gain and professional success.

However, achieving work satisfaction may not be easy. Individuals must match their values with their career path and pave their own way. But, the rewards of finding work fulfillment are worth it – greater happiness, improved well-being, and higher quality of life.

Conclusion

Retiring at the right time is a major choice needing thought. To decide the ideal retirement age, you must ponder fiscal stability, health status, and personal aims.

Financial steadiness should be taken into account. Check your retirement savings and investments to ensure you have enough money for a relaxed lifestyle after retiring. Research pension plans, social security benefits, and other sources of income.

Health condition is an essential factor. As people age, their physical and mental health may decrease, affecting their job performance. Analyze your health and talk to medical experts to understand when to retire.

Personal goals are also vital. Consider the plans or dreams you wish to pursue after leaving the workforce. If traveling, starting a business, or spending time with family is your aim, consider it before deciding when to retire.