Improve your credit score to secure better financial opportunities. A poor credit score can result in loan denials and higher interest rates. Don’t worry; enhancing your credit score is achievable with some knowledge and simple steps. In this article, we’ll share valuable insights and practical tips on understanding credit score factors and implementing effective strategies. Elevate your creditworthiness and unlock a brighter financial future. Let’s dive in!

Importance of a Good Credit Score

Financial responsibility is reflected in your credit score. A lender uses it to assess your lending risk. A higher credit score signifies a better likelihood of repaying debts on time, making you an attractive candidate for loans and credit cards. Conversely, a low credit score can limit your financial options and progress.

Credit scores can be improved and aren’t permanent. Better creditworthiness can lead to reduced interest rates, better loan conditions, and greater financial independence.

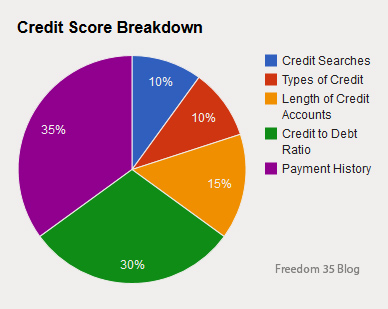

Knowing what influences your credit score is crucial for improving it. The widely used credit scoring model, FICO, considers several significant components. These factors include payment history, credit utilization ratio, length of credit history, types of credit used, and recent credit inquiries. Each aspect holds a varying degree of importance in calculating your credit score. Enhancing these areas can elevate your credit score and overall financial well-being.

Steps to Improve Your Credit Score

Paying Bills on Time

Keeping up with payments affects your credit score. Maintaining a consistent record of timely bill payments reflects responsible financial habits, conveying reliability to lenders. Conversely, delayed payments can negatively affect the credit score. Employing methods such as automatic bill payments or calendar reminders can assist in ensuring prompt payments. By prioritizing payment obligations and making them a primary focus, individuals can build a favorable payment history and enhance their credit scores.

Reducing Credit Card Balances

The credit score can be influenced significantly by the credit utilization ratio. This ratio measures the credit you presently utilize relative to your total available credit. Higher credit card balances might indicate an elevated possibility of payment default, negatively impacting your credit score. Maintaining low credit card balances is advisable to enhance your credit score. Ideally, keeping your credit utilization ratio below 30% is recommended. Reducing your debts and managing your balances prudently will improve your credit score and reduce long-term interest payments.

Keeping Credit Utilization Low

To optimize your credit score, it’s crucial to focus on managing your credit utilization ratio effectively. This ratio refers to the proportion of your available credit that you actually use. Lenders perceive individuals with low credit utilization ratios as less risky and more financially prudent. To achieve this favorable ratio, you can disperse your purchases among several credit cards or request higher credit limits. However, it’s essential to be cautious about increasing your credit limits, as the intention is not to encourage higher spending. Instead, the objective is to have credit at your disposal while judiciously using it to maintain a positive credit utilization ratio, thus benefiting your credit score.

Credit: freedomthirtyfiveblog.com

Avoiding New Credit Applications

When individuals apply for fresh credit, financial institutions conduct a rigorous evaluation of their credit history. These assessments can potentially adversely affect their credit score, mainly if numerous inquiries are made within a brief timeframe. To safeguard one’s credit score, avoiding unnecessary credit applications is advisable. Only submit credit applications when they are essential and when there is a strong belief in the likelihood of approval. For those seeking a loan or credit card, conducting thorough research and comparing different options before initiating any applications is recommended. By doing so, they can reduce the number of rigorous credit evaluations on their credit history and maintain a healthy credit score.

Checking Credit Reports Regularly

Maintaining a healthy credit score requires regular monitoring of your credit reports. Detecting and resolving errors promptly is crucial, as they can negatively impact your credit score. Under legal provisions, you have the right to access one free credit report annually from the major credit bureaus. Utilize this privilege to carefully examine your credit reports for any inconsistencies. If you encounter inaccuracies, promptly notify the credit bureau and request corrections. Vigilantly observing your credit reports enables you to ensure that your credit score precisely mirrors your financial activities.

Building a Positive Credit History

Understanding the significance of your credit score involves recognizing the role of your credit history’s length. Lenders tend to favor individuals with a longer credit history since it grants them a deeper understanding of their financial behavior. For those initiating their credit journey, exploring the possibility of obtaining a credit card or being authorized on an existing account may prove beneficial. Responsible credit usage and punctual payments are instrumental in progressively cultivating a favorable credit history. It is crucial to exercise prudent credit practices and refrain from excessive spending. Developing a robust credit history demands time, but demonstrating patience and self-discipline will yield favorable outcomes over the long term.

Conclusion

After applying the techniques mentioned earlier, monitoring your credit score regularly is essential. Several freely available tools and services let you track your credit score and receive alerts when it changes. This practice offers valuable insights into your progress and highlights areas needing attention. Moreover, it helps detect potential suspicious activities or signs of identity-related issues early. Remaining vigilant and proactive can help maintain a healthy credit score and safeguard against unexpected credit problems.

Improving your credit score gradually requires patience, discipline, and a commitment to responsible financial habits. If you know the factors affecting your credit score and follow the strategies discussed here, you can boost your credit score and improve your finances. Remember that optimizing your credit score does not happen overnight, but the benefits are undoubtedly worth the effort. Start taking the initial steps today and work towards achieving a better credit score. With perseverance and time, you’ll find yourself unlocking financial opportunities.