Due to their abundant choices and intricate terminologies, deciphering insurance plans may seem daunting. Nevertheless, understanding varied insurance types is crucial for securing you, your family, and your wealth. This condensed manual simplifies diverse insurance types, elucidating their specifics. Whether you’re a novice insurance shopper or reassessing your current protection, this piece is your handy guide. It covers areas from life to auto, health to home insurance, outlining their objectives, advantages, and crucial factors. At this guide’s conclusion, you’ll be equipped to make educated insurance choices and confidently traverse the insurance domain. Let’s begin our journey through the insurance world!

Life Insurance Policies

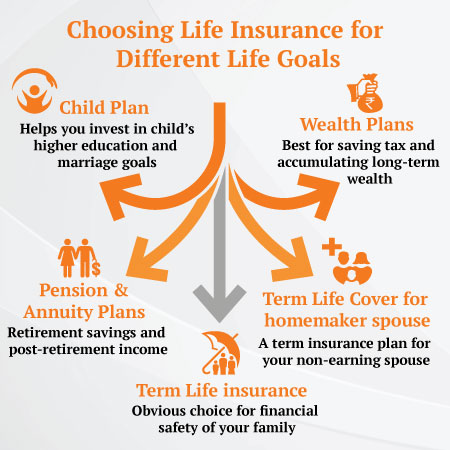

Life insurance is a valuable policy that financially protects your family in case of death. This type of insurance comes in three primary categories:

- A time-bound policy

- A lifelong policy with cash value growth

- A versatile policy with flexible premiums and death benefits

The first type, term life insurance, offers a straightforward and cost-effective approach. It covers a specific period, typically ranging from 10 to 30 years. When the policyholder dies, the death benefit is paid to the beneficiaries. Outlived policyholders do not receive payouts.

The second category is whole life insurance, which provides lifelong coverage. It combines death benefits with cash value that grows over time. The premiums for whole life insurance are higher compared to term life insurance due to the accumulation of cash value, which can be borrowed against or withdrawn.

Finally, universal life insurance offers policyholders flexibility in adjusting premiums and death benefits over time. Similar to whole life insurance, it also includes a cash value component. However, universal life insurance provides more freedom regarding payments and coverage. Additionally, it allows policyholders to invest their cash value, potentially earning additional returns.

Credit: canarahsbclife.com

Health Insurance Policies

Health insurance, an essential protection plan, plays a significant role in offsetting medical-related costs. Numerous variants of such coverage plans exist, classified into three main categories: private healthcare coverage for individuals, collective healthcare coverage schemes, and state-funded healthcare programs.

Private healthcare coverage for individuals is an option that can be directly acquired from coverage providers by individuals or families. This coverage version is customizable, granting policyholders the privilege of selecting healthcare providers as per their preference. The costs associated with these individualized coverage plans, known as premiums, can fluctuate depending on elements such as the age of the insured, the state of their health, and the extent of coverage selected.

Collective healthcare coverage, often facilitated by corporations for their workforce, offers protection for a group, which usually results in more affordable premiums than private healthcare coverage for individuals. Such group-oriented coverage plans typically include extensive protection, encompassing medical but also dental and optical benefits.

State-funded healthcare programs, such as Medicaid and Medicare, provide healthcare coverage to distinct demographics. The Medicaid program targets people with limited resources, while Medicare serves seniors and people with disabilities. These programs receive financial support from governmental funds and deliver diverse coverage levels and benefits.

Auto Insurance Policies

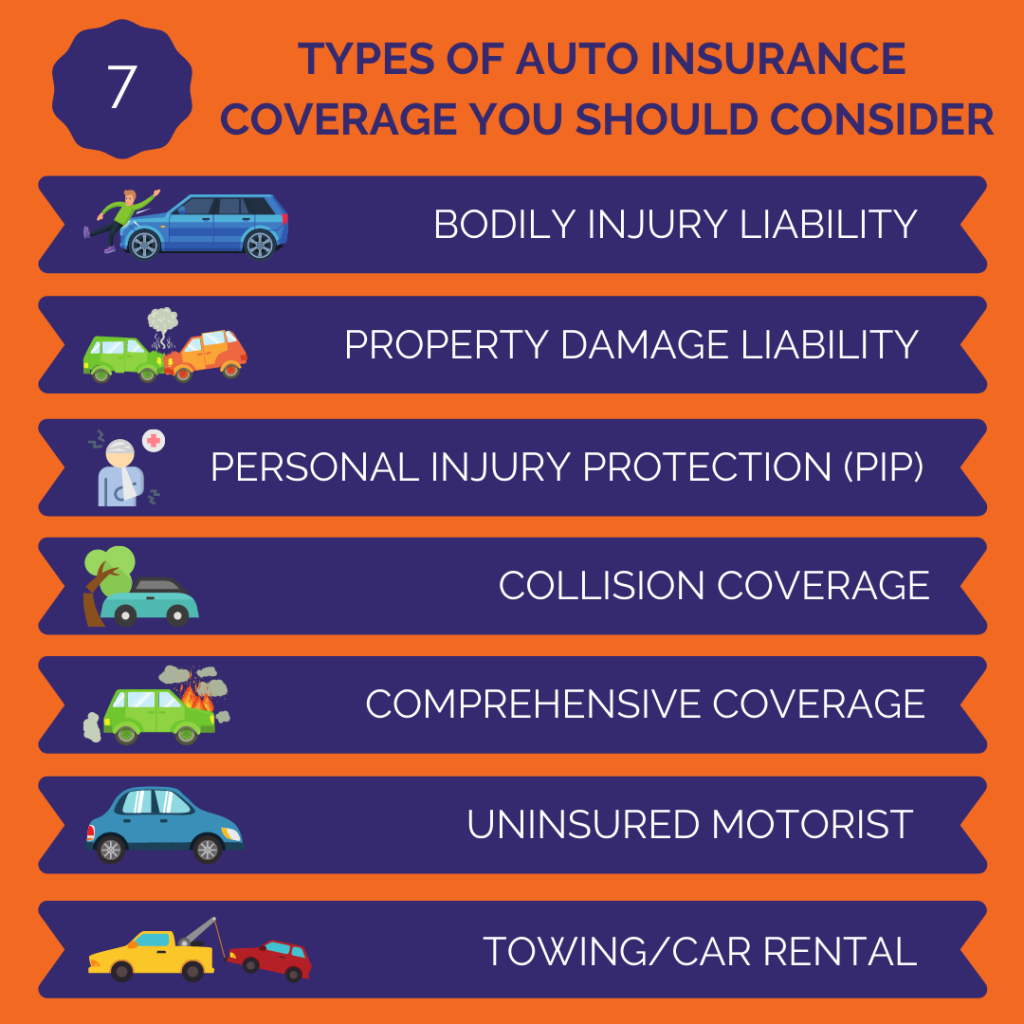

Mandatory vehicular insurance, commonly expected across several jurisdictions, functions as a financial safeguard in mishaps or vehicular harm scenarios. It can be segmented into three major categories: responsibility coverage, crash protection, and all-inclusive assurance.

Liability insurance is the fundamental facet of vehicular insurance, addressing damages inflicted upon third parties due to accidents for which you are liable. This encompasses bodily harm liability, which takes care of medical expenditures and earnings lost by the affected party, and property destruction liability, which manages repair costs or replacement needs of the impacted party’s automobile or other possessions.

Crash protection caters to harm incurred by your own vehicle in a collision, independent of who’s at fault. This type of insurance covers the cost of repairs or replacement of your automobile up to its monetary worth. It proves to be particularly crucial if you possess a more recent or high-end vehicle, the repair or replacement of which could prove expensive.

All-inclusive assurance provides a safety net for damages inflicted upon your vehicle that are not a result of a collision. This includes theft, acts of vandalism, natural calamities, and other non-collision-related occurrences. It further extends to damage from colliding with a creature on the roadway. This sort of coverage is typically mandatory when financing or leasing a vehicle.

Credit: insuranceppl.com

Home Insurance Policies

Residential insurance is a fundamental tool for safeguarding your most sizable investment, be it a residence you own or a leased living space. Predominantly, there are two categories of residential insurance policies: those oriented toward property owners and those tailored for leaseholders.

Property owner’s insurance extends its coverage to homeowners, sheltering their estate and personal items from potential harm or loss. It encompasses dwelling protection, which safeguards the physical infrastructure of the house, along with personal asset protection, which covers items within the domicile. In addition, this form of insurance provides responsibility coverage for situations where an individual might be harmed within the premises.

On the other hand, insurance designed for tenants—known as leaseholder’s insurance—is geared towards those who don’t possess ownership of the dwellings they inhabit. This type of insurance provides coverage for personal items and offers protection against liability. Leaseholder’s insurance shoulders the financial burden of restoring or replacing personal goods in events such as burglary, combustion, or other risks specified within the policy. Similarly, it affords liability coverage in the event that a guest sustains injury within the leased premises.

Business Insurance Policies

Securing a business insurance safeguards your enterprise from potential hazards and accountabilities. Various classifications of such coverage exist, encompassing general accountability coverage, professional accountability coverage, and property coverage.

General liability insurance extends to situations involving third-party bodily harm, destruction of property, or personal harm claims. It fortifies your enterprise if someone incurs injuries within your facility or if your goods or services harm others. This coverage typically envelops legal costs, medical expenses, and damages as decreed in legal actions.

Professional liability insurance, colloquially known as errors and omissions coverage, is imperative for those who dispense services or counsel. It guards against accusations of negligence, mistakes, or omissions leading to financial losses for patrons. This form of coverage underwrites legal defense expenses and damages as declared in professional accountability legal proceedings.

Property coverage protects your commercial property, including structures, apparatus, and stock, against impairment or loss caused by fire, theft, vandalism, or other insured risks. It underwrites the expense of restoring or supplanting damaged property, ensuring your enterprise can rebound rapidly from unanticipated occurrences.

Credit: napkinfinance.com

Factors to Consider When Choosing Insurance Policies

In selecting insurance plans, various elements need to be examined to ensure you pick the suitable protection for your requirements. These elements comprise the limit of indemnity, premium costs, deductible amounts, and policy exclusions.

The coverage limit signifies the highest sum the insurance provider will disburse in case of a claim. It’s vital to evaluate your needs and ascertain the suitable limit of indemnity for the efficient safeguarding of yourself, your family, or your enterprise. Underinsurance can expose you to financial risk, while excessive insurance can cause avoidable expenditures.

Premium costs represent the periodic disbursements you contribute to the insurance firm to sustain your coverage. It’s necessary to take into account your financial situation and ascertain that the premiums are economically manageable. Premium costs can fluctuate according to variables like age, health status, driving history, property location, and the extent of coverage. Assessing quotations from diverse insurance providers can assist you in locating the most favorable rates.

Deductibles represent the sum you are obligated to disburse out of your pocket before the insurance protection comes into effect. Opting for a larger deductible can decrease your premiums. However, it also implies you must contribute more if a claim arises. Analyzing your financial standing and deciding on the deductible that fits your circumstances is indispensable.

Exclusions denote particular situations or conditions that are not included in the insurance contract. It’s necessary to thoroughly peruse the policy documents and comprehend the exclusions to avert unexpected pitfalls when initiating a claim. If certain exclusions pose significant risks for you, exploring supplemental coverage choices or procuring specialized policies might be necessary.

How to Buy Insurance Policies

Securing insurance can often be an intricate task, but there exist strategies that can simplify the ordeal. Collaborating with an insurance intermediary can offer invaluable counsel and aid in exploring diverse choices. Such an intermediary can evaluate your circumstances, propose fitting insurance plans, and guide you through the enlistment procedure.

Contrasting estimates from various insurance firms is crucial to ensure you receive optimal protection at the most economical pricing. Digital comparison platforms facilitate weighing insurance premiums, coverage provisions, and policy stipulations. Nonetheless, it is pivotal to contemplate beyond the mere cost and appraise the reputation and financial robustness of the insurance corporation.

Perusing insurance policy documents meticulously is vital before committing to a purchase. These documents encapsulate the rules, prerequisites, coverage ceilings, and exceptions of the insurance agreement. Grasping these policy nuances will empower you to make an enlightened decision and steer clear of unforeseen complications or misinterpretations down the line.

Conclusion

Understanding insurance plans and making educated choices is critical for safeguarding oneself, their family, and their possessions. Through the analysis of diverse insurance plans, this all-encompassing manual has endowed you with a lucid comprehension of each plan’s intent, advantages, and crucial factors. Whether you require life, health, automobile, property, or business coverage, you now possess the wisdom and assurance to traverse the insurance territory effortlessly. Always consider your requirements, contrast cost estimates, and meticulously scrutinize policy documents to guarantee you select the most suitable protection for your unique circumstances. With the correct insurance plans implemented, you can rest easy knowing that you are monetarily shielded from unforeseen incidents.