Managing debt can feel like navigating a labyrinth in times of economic uncertainty. Yet, you can turn this maze into a manageable path with strategic planning and prudent financial practices. This article unravels critical strategies such as prioritizing debts and building a repayment plan, etc. All these tools can help safeguard your financial health in even the most turbulent economic times. Equipped with these insights, you’ll be better prepared to tackle debt, reinforcing your financial stability amidst economic fluctuations.

Prioritize Your Debts and Build a Strategic Repayment Plan

As we navigate the choppy waters of economic uncertainty, mastering the art of debt management becomes critical. The first crucial step in this journey is to prioritize your debts. Begin by meticulously evaluating all your liabilities – from student loans to credit card bills. Pay attention to the interest rates and repayment terms; high-interest debts can quickly drain your financial resources.

Once you’ve got the lay of the land, it’s time to craft a strategic repayment plan. A key strategy is the ‘avalanche method,’ which first targets the highest interest debt while maintaining minimum payments on others. This approach accelerates getting out of debt and significantly reduces long-term interest costs.

The financial world and debt management are not one-size-fits-all. What works for one might not work for another. Hence, consider leveraging financial management tools or seeking professional advice to construct a repayment plan tailored to your needs and circumstances. The end goal? Smoother sailing through the uncertain economic seas with a robust debt management plan.

Maximizing Your Financial Stability: Income Diversification

Diversifying your income streams can be a game changer when building financial resilience, particularly during uncertain economic times. Think of it as having multiple financial safety nets; you have others to fall back on if one fails.

Diversifying income is possible in many ways. If you’re conventionally salaried, you could work as a freelancer or consultant in your field. Using your existing skills and experience can generate additional income.

Another avenue is through the creation of a side business. The possibilities are endless, from selling handmade products online to offering tutoring services. The digital economy has opened up numerous platforms and marketplaces that have simplified the process of starting a business.

Another way to diversify income is to invest. Dividends and rental income can be generated from stocks, bonds, and real estate investments, further strengthening your financial situation. Furthermore, these strategies protect you from the risk of having one source of income and increase your overall revenue. Therefore, you will be able to manage and reduce debt even during uncertain economic times.

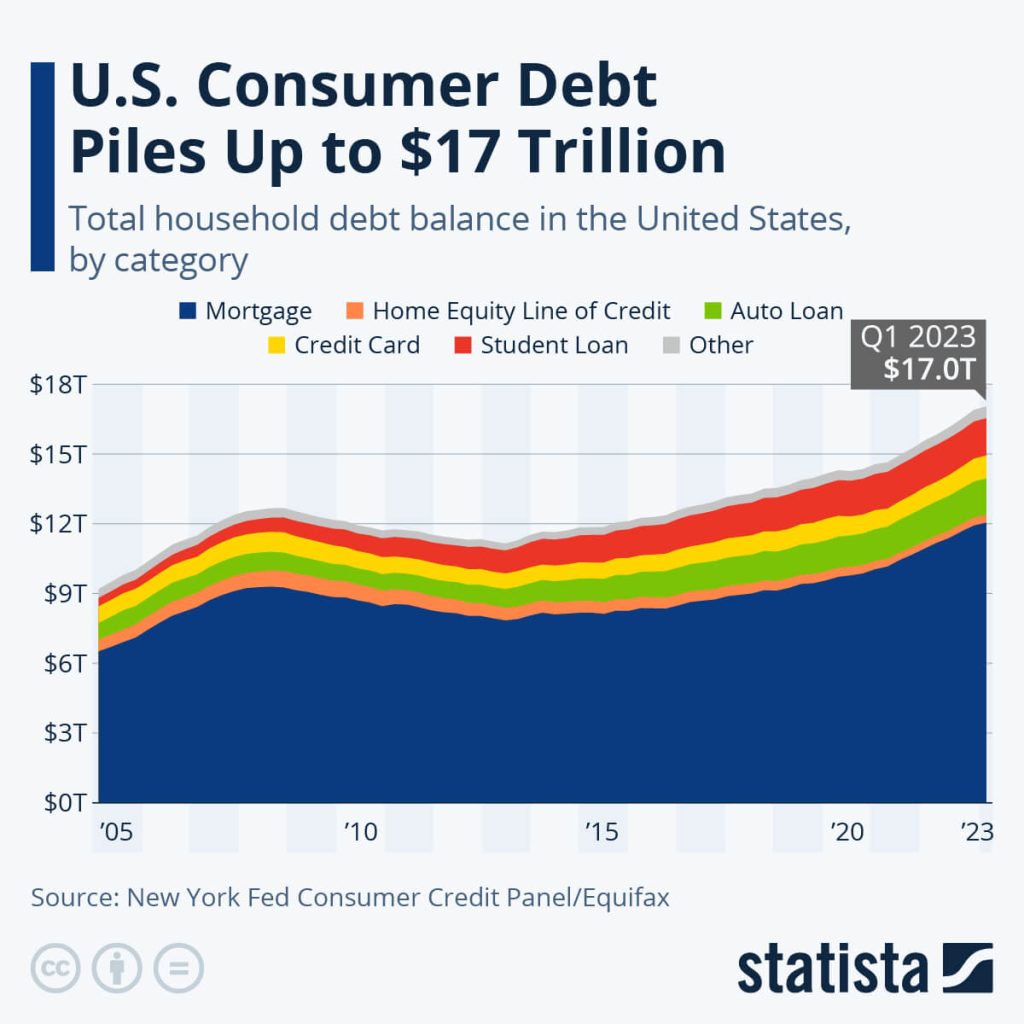

Credit: statista.com

Establish an Emergency Fund

Creating an emergency fund serves as your financial safety net during times of uncertainty. This reservoir of funds can be particularly crucial when you’re navigating the choppy waters of an unstable economy and struggling to manage existing debt.

But what does building an emergency fund involve? It’s all about consistency and discipline. Start by setting a goal – typically, a sound target is to save enough to cover three to six months’ worth of essential expenses. Put aside a part of your monthly income for your emergency fund to achieve this. Small contributions can add up over time.

The beauty of an emergency fund is its function as a buffer against sudden financial shocks, such as layoffs or unforeseen medical expenses. Having this safety net prevents you from taking on additional high-interest debt, thereby maintaining your financial health. And remember, the essence of an emergency fund lies in its accessibility. Therefore, your fund should be kept in a readily accessible account, like a high-yield savings account, to ensure you can get it when you need it most. By being financially prepared, you secure your present and protect your future from potential debt stressors.

Regularly Review Your Budget

In a climate of economic uncertainty, your budget is your financial compass. By regularly reviewing your budget, you can analyze your spending habits and pinpoint areas where you might cut back. Focus on eliminating non-essential expenses and funneling those funds toward debt repayment. Regular budget reviews also inform you about your financial situation, helping you make necessary real-time adjustments. During a recession, as an example, you should allocate more towards essentials, such as groceries, and less towards discretionary expenditures, such as dining out. In any economic situation, proper budgeting can aid you to stay on top of your debt obligations.

Benefits of Seeking Professional Financial Guidance

The path to effective debt management can be a complex journey, particularly during economic uncertainty. At such times, seeking professional financial guidance can be your compass, directing you toward sound financial decisions.

A professional financial advisor or credit counselor can offer invaluable insights tailored to your specific financial circumstances. They can assist in devising a strategic debt repayment plan, creating a realistic budget, and suggesting viable investment opportunities. By aligning their professional advice with your financial goals, they provide a roadmap to navigate economic instability confidently.

In addition, professional advisors can educate you about different financial products and services, ensuring you have a comprehensive understanding before committing. This knowledge can protect you from unfavorable terms and conditions that may exacerbate your debt situation. Engaging in professional financial services is akin to investing in your financial health. The expert guidance can empower you to make informed decisions, ultimately leading to effective debt management and financial stability, even amid economic uncertainty.

Credit: statista.com

The Power of Communication with Creditors

One often overlooked strategy in managing debt amid economic uncertainty is maintaining open lines of communication with your creditors. Lenders often collaborate with borrowers experiencing financial difficulties, even though it might seem counterintuitive.

When you find yourself in a tough spot, instead of falling behind on payments or accruing late fees, proactively reach out to your creditors. Explain your current situation and discuss potential hardship programs or loan modifications they may offer. These could involve temporary reductions in interest rates, extended repayment periods, or even payment deferrals. Such modifications can significantly alleviate the pressure of debt repayment, particularly in a shaky economy.

Staying in touch with your creditors is also about maintaining a positive relationship. A solid rapport can prove advantageous when negotiating loan terms or requesting future credit. Remember, your creditors would rather receive some form of payment rather than none at all, making communication a vital tool in your debt management arsenal.

Should you pay off debt during a recession?

The question of whether to pay off debt during a recession baffles many. During a recession, businesses slow down, jobs become less secure, and uncertainty pervades the financial landscape. Preserving as much cash as possible may seem logical in such a negative situation. Nevertheless, this is where the nuanced concept of ‘good’ and ‘bad’ debt comes in.

‘Bad’ debt, such as credit card debt with high-interest rates, should ideally be cleared soonest, recession or not. These types of debt can quickly snowball, causing more significant financial distress in the long run. Paying them off relieves the burden and potentially improves your credit score, positioning you better for any future borrowing needs.

‘Good’ debt, on the other hand, like low-interest student or mortgage loans, may not necessarily need to be rushed off during a recession, especially if it strains your emergency fund or cash reserves. This is where balancing debt payments with savings becomes crucial.

Every situation is different. In certain cases, it makes sense to conserve cash during economic downturns, while reducing debt might be more beneficial in other cases. Advice from a professional can help you navigate these decisions.

Add Comment