Having debt affects more than just our finances—it also affects our mental health. Relationship issues, stress, and anxiety are some of the emotional effects of debt. We must learn practical strategies to cope with these challenges in light of how debt impacts our daily lives. Managing debt’s financial and emotional aspects will be discussed in this article. A healthier and happier future is possible if you understand the connection between debt and mental health.

1. Anxiety and stress

The psychological impact of indebtedness and financial stress can be overwhelming. The strain on the mind caused by anxiety and stress related to debt can disrupt one’s daily life, leading to general worries, sleep disorders, mood swings, and even depression.

Persistent worries about meeting bills or credit repayments can trigger anxiety and other negative emotions that are challenging to manage. Not only compounded by the lost sense of control over one’s finances but also feelings of embarrassment, failure, or shame.

When one cannot cope with mounting debts by avoiding payments – as this only worsens the situation – it’s essential to consider ways to combat their anxiety without further financial damage. Several courses of action include seeking professional assistance like credit counseling or speaking with experts in financial planning.

2. Depression

The psychological burden of dealing with debt can significantly impact one’s mental health, leading to discomfort. Managing financial pressure while struggling with despair and hopelessness can be challenging.

In difficult times, it is essential to seek professional help. A therapist can provide coping mechanisms such as positive self-talk, creating a budget, or even offering support groups for individuals going through similar situations.

I recall when my mother struggled with debt after her business closed unexpectedly. She would often spend hours pacing around and crying about her financial load. As her son, I had challenges understanding the sense of worthlessness she felt due to her situation. However, I was still grateful to watch her come out on the other side after finding help and utilizing new coping skills.

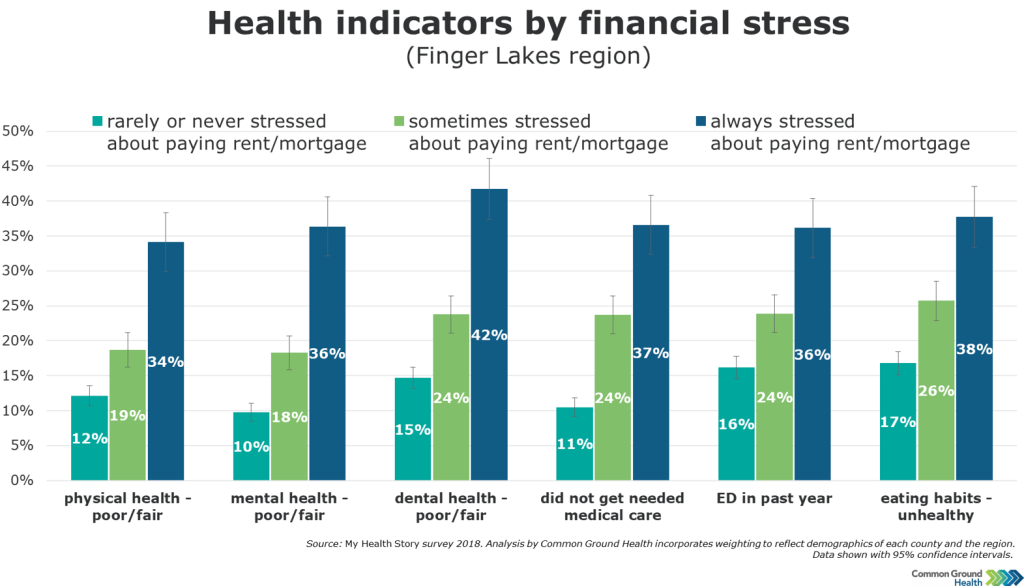

Credit: commongroundhealth.org

3. Relationship strain

Managing financial stress and debt in any relationship can be challenging, causing undue strain that affects both parties’ mental and emotional well-being. Tensions escalate when communication breaks down, escalating disagreements into full-blown arguments that eventually affect intimacy.

The stress of indebtedness impacts personal finance and the people involved in a romantic or familial relationship. Couples may experience reduced satisfaction with their partners and lower self-esteem due to perceived financial failures.

It is essential to communicate honestly and regularly about finances, set achievable goals, prioritize expenses and find ways to lower overall costs. Open communication helps foster trust between partners to strengthen relationships while avoiding conflict whenever possible.

A typical story goes like this: If one spouse hides his debt from another, it leads to bitterness in their marriage years later when they finally find out. Making intelligent repayment choices has more pros than cons over the long term.

4. Social isolation

People suffering from financial distress tend to withdraw from their support network, leading to what is commonly known as ‘isolation.’ Often, debt stresses people out, and they avoid discussing things that might hurt their self-esteem.

Support from friends and family is essential to an individual’s recovery from debt-related stress. However, individuals in financial trouble tend to refrain from reaching out to friends and family members. The lack of communication worsens feelings of isolation, making it harder to overcome them.

I know someone who struggled financially after their partner was made redundant at short notice. Not wanting to burden others with their troubles, they tried desperately to keep up appearances. They avoided socializing altogether, which only deepened their anxieties about getting further into debt. If you’re finding yourself in similar circumstances, remember not having all the answers your own is okay. Sometimes discussing issues with someone you trust helps make perspective visible again, lessening anxiety levels.

5. Sleep disturbances

Debt-related financial stress can disrupt sleep. It is hard for insomniacs to fall asleep or stay asleep all night long. It can negatively affect an individual’s mental state. As an example, sleep disturbances can cause difficulties with cognitive functions, such as memory loss and decision-making abilities.

Establishing a regular bedtime routine and practicing relaxing exercises such as breathing exercises and yoga can help you maintain good sleep hygiene.

One true story is about a woman who struggled with chronic insomnia due to her mounting debt and financial stress. After seeing a therapist, she learned healthy coping mechanisms and managed her finances better. As a result, she overcame her insomnia and improved her mental health and overall quality of life.

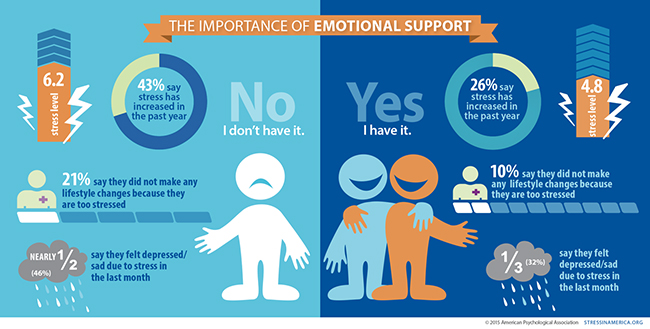

Credit: apa.org

6. Financial denial

Some people experience a state of mind known as financial denial, where they ignore their debt problems or resist taking action to improve their financial situation. This can come from shame or anxiety about money, fear of change, or a desire to maintain one’s lifestyle.

Facing reality is the first step to overcoming financial denial. Identifying the problem and taking responsibility for it is critical. Creating an achievable budget that includes regular payments on debts is also crucial. Seeking professional advice may help reframe and reduce feelings of anxiety and fear.

It’s essential to note that denial can exacerbate financial issues over time and lead to more significant problems such as garnished wages or bankruptcy. But remember, no matter the level of debt owed, seeking help is always possible.

7. Professional help

When struggling with debt, seeking professional assistance can help alleviate the psychological stress it brings. Debt counseling and financial advisors offer practical solutions to reduce debts, organize finances, and create a sustainable budget. Their expertise can also provide knowledge on how personal credit affects financial abilities. Professional help limits the pressure of coping with debt alone, helping to prevent any emotional strain that may be experienced in such situations.

Debt counseling offers one-on-one sessions focused on assuring individuals have a clear understanding of their financial situation while guiding reducing or eliminating debt. Financial advisors provide personalized strategies that consider saving compared to paying off debt and explain the potential tax implications of financial decisions while creating a long-term plan for achieving the individual’s unique financial goals.

Professional assistance not only provides practical solutions but also alleviates psychological tension related to struggles with debt. In dire cases where anxiety is prolonged, qualified mental health professionals can provide additional support.

8. Debt management plan

Debt repayment strategies provide individuals with a step-by-step plan to regain control. Here are five points to consider when creating a debt management plan:

- Create a detailed budget based on your current financial situation.

- Prioritize debts with the highest interest rates and pay them off first.

- Try to negotiate lower interest rates or payment plans with creditors.

- Create small achievable goals and celebrate progress along the way.

- Research and seek professional help from credit counseling services if needed.

It is essential to remember that debt management plans are not one-size-fits-all and may require adjustments. Creating a realistic budget is also fundamental in assessing where to allocate funds.

Anxiety, stress, or shame can arise when beginning a debt repayment journey. It is critical to approach this process with self-compassion and focus on progress rather than perfection.

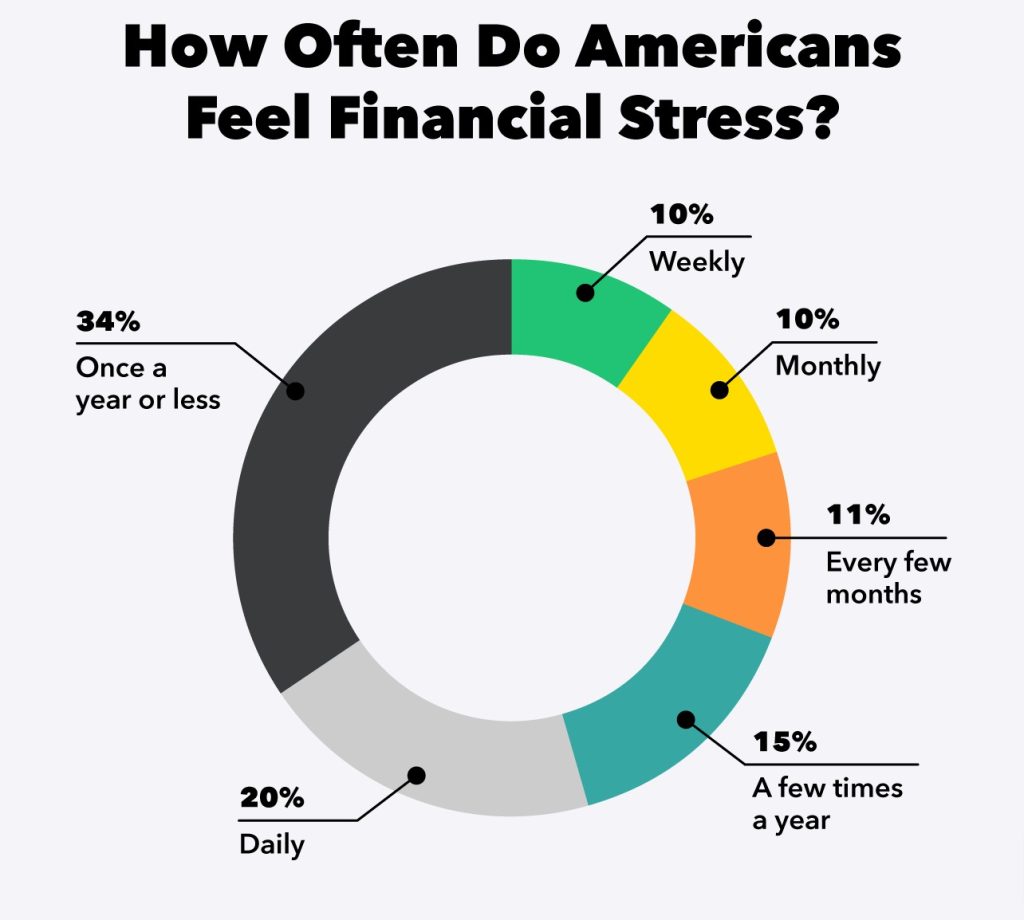

Credit: mint.intuit.com

9. Focus on progress

It’s essential to maintain a positive mindset when paying off debt. Instead of focusing on the amount owed, concentrate on progress made towards financial goals. Celebrate small accomplishments and set achievable monthly targets to gain momentum and stay motivated. Building good financial habits leads to progress and long-term success.

Staying focused on one’s achievements can instill motivation during debt repayment. Recognizing each milestone takes precedence over emphasizing the overall sum remaining. Adapting such an approach cultivates a solid positive attitude, empowering individuals with renewed zeal for meeting their financial obligations.

Making progress in improving one’s finances is a crucial aspect that generates great satisfaction, giving tangible evidence to one’s efforts as opposed to immense pressure felt by solely focusing on reducing debt levels.

Add Comment