Have you ever wondered how your debt affects your financial reputation? When managed wisely, debt can boost your credit score, showcasing your ability to handle credit responsibly. However, excessive debt or poor debt management can negatively impact your score, making it difficult to secure loans or obtain favorable interest rates. Understanding the delicate balance between good and bad debt is essential to maintaining a healthy credit score and financial stability.

Late payments and defaults

Delays and defaults affect your payment history, which is an important aspect of your credit score. Defaults occur when you fail to make payments for several months or more after the due date. Late payments occur when you don’t make payments on time. Credit bureaus consider both negative marks when calculating your credit score.

When you consistently miss payments and default on loans or credit cards, creditors may send reports to the credit bureaus, leading to a drop in your credit score. This action may remain on your record for many years and could cause lenders to view you as a high-risk borrower.

Moreover, getting approved for future loans could be challenging because financial institutions base their decision on your past behavior—regularly keeping track of payment history.

It’s imperative to ensure all bills are paid on time each month; set up automatic bill payments if possible. Doing so helps avoid late fees and penalties from accruing. And consequently, impacting your credit score negatively.

High credit utilization

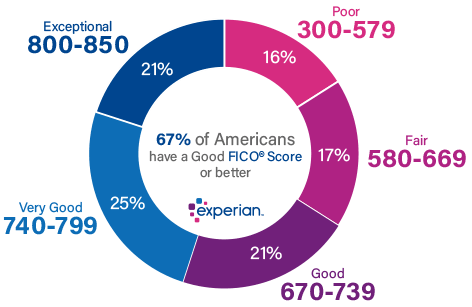

Regularly using a significant portion of your credit limit may seem necessary, but it can hurt your credit score. When you overextend yourself and reach high credit utilization rates, the amount of credit card balances compared to credit limits, you risk damaging your financial reputation.

High credit utilization indicates that you are relying heavily on borrowed funds and pose a higher risk of being unable to pay back debt. Lenders may view this as financially irresponsible behavior, and it can lead them to reject any future applications for loans or credit cards.

It’s recommended to keep your usage below 30% of available credit at all times to maintain a healthy credit score. In addition, regularly reviewing your balances and ensuring they stay within this threshold can help improve or sustain a decent financial reputation.

An acquaintance of mine revealed that her high outstanding balance led to several rejections from mortgage lenders despite repaying the balance soon after realizing her mistake. It took years before she could build enough trust with the lending authorities who would extend their offers again. The lesson here was quite apparent – be mindful when using services that rely heavily on borrowed money and maintain low credit utilization rates for prolonged financial stability.

Credit: experian.com

Length of credit history

The duration of your credit history plays a significant role in determining your creditworthiness. Your borrowing and repayment habits track record creates the foundation for potential lenders. The longer your credit history length, the more information lenders gain about your financial behavior. This enables them to make informed decisions on whether to extend credit or not. A long-standing history also showcases stability and responsibility regarding money management.

You should be aware that having a short credit history can negatively impact your score, making you appear to be a higher-risk lender. It may be a good idea to open and use a new credit line responsibly – making timely payments, reducing balances, and not applying for multiple accounts simultaneously.

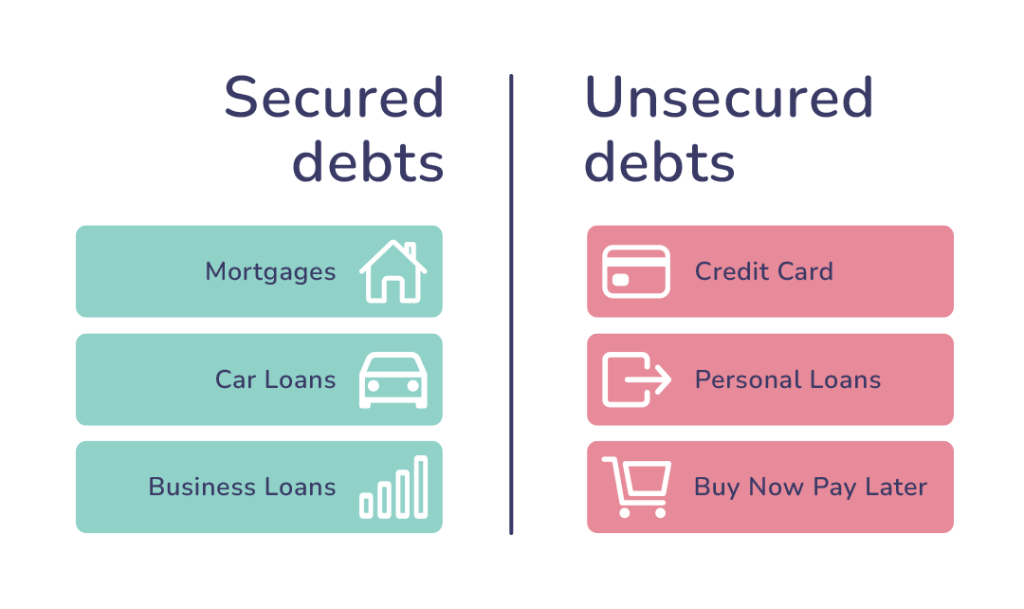

Different types of debt can have varying impacts

The debt category you hold can uniquely impact your credit score. For instance, credit bureaus view installment loans such as auto loans or mortgages positively. They may raise the credit score if paid consistently. Credit cards, and revolving debts, depend on lower credit utilization for improving scores. Unsecured debts result in a decline in credit scores since they depict high financial instability.

Credit mix is another area where lenders assess an individual’s ability to handle different types of debt efficiently. Credit utilization coupled with timely payments is optimal for good scores. Understanding how each type of debt affects the credit score can help individuals make informed decisions while borrowing money or taking out lines of credit.

Failing to understand these nuances can cost them potential financial opportunities like getting low-interest rates or access to better lending terms. Hence consumers must be aware and mindful before availing themselves of any debt-based product.

Credit: open-money.co.uk

Debt consolidation and credit inquiries

Consolidating debt can impact credit scores, as new credit inquiries may be recorded. Applying for multiple credit cards or loans quickly, known as hard inquiries, can lower your credit score.

When considering debt consolidation options, shopping around and making informed decisions that fit your financial situation is paramount. Balance transfer offers with low or 0% interest rates could save money on interest payments over time. Still, it is crucial to read the fine print and understand any fees involved.

You can also improve your credit score by increasing your credit history. When you consolidate your debt, you may close old accounts or open new ones, potentially lowering the average account age.

One person brought their high-interest debts to one account through debt consolidation at a lower interest rate which was beneficial in terms of payments and reducing stress levels.

Bankruptcy and debt settlements

When discussing debt management, bankruptcy, and debt settlements come to mind. These options typically arise when the borrower struggles to repay their debts regularly. Bankruptcy is a legal declaration of an individual or entity that they cannot pay off their outstanding dues. Debt settlements involve negotiating with creditors to accept less than the amount owed in exchange for a lump sum payment. While both provide immediate relief, there are long-lasting effects when it comes to credit score impact.

Bankruptcy can negatively affect a person’s credit score for ten years, making financing more challenging. You will have a high-risk borrower label on your credit report, making it difficult to qualify for credit cards or loans. A debt settlement may seem better because you pay back only part of your debt. However, this can also damage your credit.

If you cannot repay all your debts fully and want to avoid bankruptcy, consider seeking support from a reputable non-profit debt counseling organization. They may offer financial education programs and debt management plans that can help you stay on track while improving your credit score over time.

To sum up

To maintain financial well-being, you should consider the impact of debt on your credit score. Defaulting on loans or accumulating high debt levels will significantly lower your credit score. In contrast, managing your debt responsibly and making on-time payments can improve your credit scores.

To maintain a solid credit score, managing debt effectively is crucial. A few key tips and takeaways:

- Understand your credit report: Review your credit report regularly and deal with discrepancies as soon as they arise.

- Prioritize high-interest debts: Pay off debts with higher interest rates first to reduce overall interest costs.

- Maintain on-time payments: Make your payments on time and every time for a positive payment history.

- Limit new credit inquiries: Avoid applying for multiple lines of credit too quickly.

- Seek professional advice: Contact a financial advisor or credit counselor if you’re struggling with debt.

Using these strategies, you can improve your credit score and reduce the impact of debt. Don’t lose sight of your goals – patience and commitment are key!

Add Comment