Protecting what’s dear to us is a priority in our ever-changing world. The power of life insurance guarantees financial stability and tranquility for individuals and their loved ones. Whether you’re embarking on a promising career or navigating parenthood, life insurance provides an indispensable safety net that cannot be underestimated.

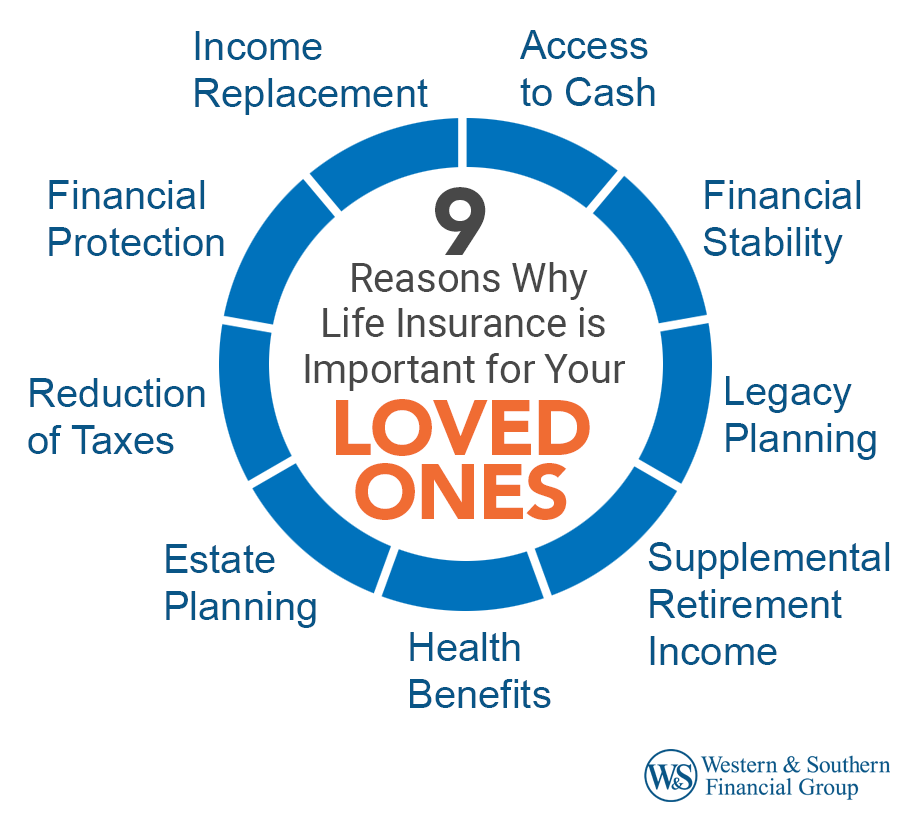

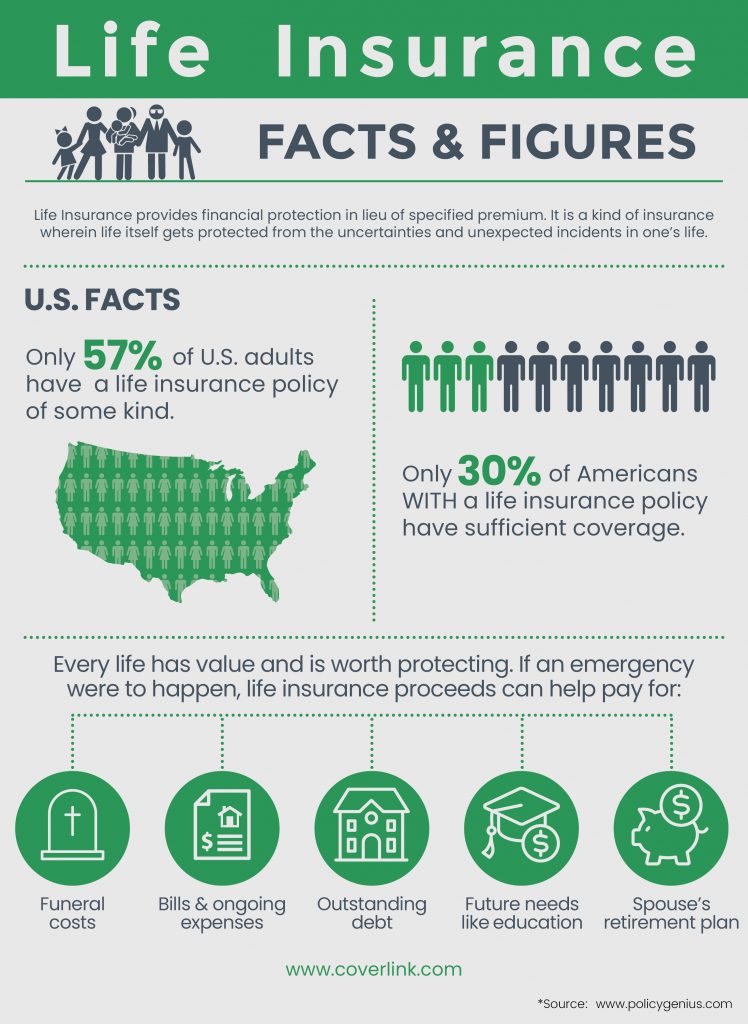

Picture this: your loved ones are left with no worries about financial burdens if anything happens to you unexpectedly. Life insurance grants them the means to settle debts, cover funeral costs, maintain their lifestyle, and pursue long-term aspirations. And the best part is life insurance policies can be tailored to fit individual needs and financial goals. You can align the coverage with your unique objectives with options like term or whole-life insurance.

The uncertainties of life are undeniable, but life insurance offers a way to shield your loved ones from any unforeseen hardships that may arise. By investing in life insurance today, you secure their future regardless of what the future holds. Don’t delay – take charge of your family’s financial well-being and enjoy the peace of mind that life insurance brings.

Securing Your Future: The Power of Life Insurance

Life insurance is an indispensable pillar of a comprehensive financial strategy, offering a reassuring safety net for your family’s well-being. In those challenging times when a loved one passes away, the emotional toll is profound, and the added financial burden can intensify the distress. Enter life insurance – a guardian angel that ensures your family need not worry about the financial repercussions of such a loss, allowing them the space to heal and forge ahead.

At its core, life insurance guarantees a lump sum payout, known as the death benefit, which is bestowed upon your beneficiaries upon your passing. This resource can be deployed to cover various expenses, including funeral costs, outstanding debts such as mortgages or loans, and day-to-day living expenses.

The support it provides extends even further, serving as a funding source for your children’s education or securing a comfortable retirement for your surviving spouse.

With life insurance in place, your loved ones can navigate their future without the looming anxiety of maintaining their current lifestyle or realizing their long-term financial aspirations. It’s a prudent step towards peace of mind and prosperity for those you hold dear.

Understanding the Different Types of Life Insurance

There is no doubt that life insurance is an essential financial tool that ensures protection and peace of mind for your loved ones. With numerous policies available, understanding the different types can be empowering. Today, we’ll delve into the two main categories: term life insurance and whole life insurance.

- Term life insurance grants you protection for a specific amount of time, ranging from 10 to 30 years. This type of policy is affordable and perfect for those with specific financial commitments, like mortgages or a child’s education. While term life insurance doesn’t accumulate cash value, it guarantees a death benefit if the policyholder passes away within the specified term.

- On the other hand, whole life insurance offers lifelong coverage and boasts a cash value component that grows with time. This remarkable feature provides greater flexibility and even opens doors to potential investment opportunities. Although whole life insurance comes with higher premiums compared to term life, the premiums remain level throughout the policyholder’s lifetime.

By familiarizing yourself with these diverse life insurance options, you can make an informed decision tailored to your unique needs and secure a brighter future for your loved ones.

Credit: westernsouthern.com

What to Consider When Choosing Life Insurance

Discovering the ideal life insurance policy is a journey that demands thoughtful exploration of multiple factors. One of the most crucial considerations is your financial status, which involves analyzing your current income, expenses, and outstanding debts to determine the most suitable coverage amount. By aligning your chosen policy with long-term financial aspirations like securing your children’s education or leaving a lasting legacy, you can ensure that your family’s future remains safeguarded.

Age and health are vital factors that significantly influence life insurance premiums. You can lock in more favorable rates by opting for a policy while you’re young and in good health. Being transparent about any pre-existing health conditions with the insurer is essential, as it can impact your eligibility and premium rates.

Furthermore, the stability and reputation of the insurance company play a crucial role. Seek providers with robust financial ratings and a proven track record of handling claims promptly and fairly. Checking customer reviews and consulting qualified financial advisors can help you choose an insurer that’s reputable and reliable. Choosing life insurance wisely can lead to peace of mind for everyone.

Life Insurance vs. Other Financial Tools

Unlock the secrets of financial safeguarding with life insurance, a powerful tool that sets itself apart from alternative options. While savings and investment accounts may seem enticing, they lack the comprehensive protection that life insurance offers. These accounts can erode over time or be allocated for other purposes, potentially leaving your loved ones vulnerable if the unexpected happens.

Another avenue to explore is employer-provided life insurance, often included in attractive benefits packages. Though valuable, this coverage may come with certain limitations and might not adequately address your family’s unique financial requirements. Moreover, if you change jobs, you could lose this protective shield, underscoring the importance of securing an individual life insurance policy to ensure lasting peace of mind.

Common Misconceptions About Life Insurance

Misunderstandings about life insurance prevent many people from taking advantage of its benefits. Among the misconceptions, one prevalent belief is that life insurance is solely relevant for older individuals or those with dependents. No matter how old or what type of family you have, life insurance can benefit anyone with financial obligations or who wishes to leave a financial legacy.

Another misconception revolves around the affordability of life insurance. Even though premiums may vary based on factors like age, health, and coverage amount, life insurance can be surprisingly affordable, especially if you get it when you are young. Compare quotes from different insurers and select a policy that aligns with your budget to ensure adequate coverage.

Additionally, some people mistakenly believe life insurance isn’t necessary if they lack dependents or outstanding debts. However, there are various ways life insurance can still be valuable in such scenarios. It can serve as a means to cover funeral expenses, create a lasting impact by supporting charities or loved ones, or even provide for elderly parents or siblings who may depend on your financial support.

Embracing life insurance as a financial safeguard is a wise decision, and understanding the realities behind these misconceptions empowers individuals to make informed choices. By breaking free from these misconceptions, one can unlock the full potential of life insurance and ensure a secure future for themselves and their loved ones.

How Life Insurance Works

Life insurance, a remarkable financial tool, operates on an ingenious principle known as risk pooling. Policyholders contribute regular premiums into a collective pool, creating a safety net for themselves and their loved ones. In return, the insurance company pledges to provide a death benefit to the beneficiaries upon the insured’s passing.

When a policyholder passes away, a supportive process comes into action. The beneficiaries submit a claim to the insurance company, accompanied by essential documentation, such as a death certificate. Once verified, the insurance company efficiently disburses the death benefit to the beneficiaries.

Imagine the peace of mind knowing that your loved ones will be financially secure during a challenging time. The beneficiaries can utilize the lump sum payment from the insurance policy as they see fit, ensuring their stability and well-being.

Credit:coverlink.com

Determining the Right Coverage Amount

Securely safeguarding the future of your loved ones calls for a careful assessment of your life insurance coverage. Ensuring sufficient protection requires taking into account various financial responsibilities, such as outstanding debts, mortgage or rent, and ongoing living expenses. Consider potential future expenses like your children’s education or your spouse’s retirement needs.

Though a standard guideline is to aim for coverage equivalent to at least 10 times your annual income, every individual’s circumstances are distinct. It is imperative to assess your unique requirements and, if necessary, seek guidance from a financial expert. Moreover, as life’s circumstances evolve, so may your life insurance needs. Therefore, it is prudent to periodically review your coverage and make any necessary adjustments to maintain optimal protection for your loved ones.

The Benefits of Purchasing Life Insurance at a Young Age

Purchasing life insurance while young presents an extraordinary opportunity to secure affordable coverage. At its core, life insurance premiums are predominantly influenced by your age and health status, meaning securing a policy early on can lead to remarkably lower rates. By seizing this chance, you can secure a budget-friendly insurance plan that will stay with you for the duration of the policy.

Picture this—obtaining life insurance while you’re in the prime of your health safeguards you from the uncertainties of life. Illnesses and health issues are unpredictable, and the chances of facing them inevitably increase as you age. By acquiring coverage at a young age, you establish a solid financial shield for yourself and your loved ones, safeguarding them from the potential impact of unexpected health challenges.

Life is an adventure filled with surprises, but we must confront the reality of our mortality. Yet, while this prospect may feel uneasy, obtaining life insurance offers tremendous peace of mind. By securing a policy now, you can rest assured that your loved ones will be shielded from financial burdens, regardless of the future.

How to Save Money on Life Insurance Premiums

There’s no harm in seeking ways to save money on premiums without compromising on the quality of coverage. Check out these strategies to secure affordable life insurance:

- Compare Quotes: Getting multiple quotes is the key to better deals. Through online comparison tools, you can easily identify the most competitive rates and offerings.

- Maintain Good Health: A healthy lifestyle improves your well-being and can lead to lower life insurance premiums. A healthy diet, regular exercise, and avoiding smoking or excessive alcohol consumption can work wonders for your policy rates.

- Choose Term Life Insurance: Evaluate your specific needs and consider term life insurance as an option. It usually comes with more budget-friendly premiums than whole life insurance, providing temporary coverage that might be ideal for your situation.

- Bundle Policies: Combine your life insurance policy with your home or auto insurance to get discounts. Combining policies could be the secret to maximizing savings.

- Pay Annually: Some insurers reward policyholders who make upfront annual premium payments instead of monthly installments.

It’s essential to remember that finding affordable coverage shouldn’t mean sacrificing the level of protection your loved ones deserve. Strive for value by choosing a policy that meets your specific needs while being mindful of costs. Balancing both aspects will ensure you secure the best of both worlds regarding life insurance.

Conclusion: The Peace of Mind that Comes with Life Insurance

Life insurance is more than a financial tool; it protects your family’s future. In the event of the loss of a loved one, life insurance ensures that your loved one can maintain their standard of living and pursue their long-term goals. Life insurance provides peace of mind no matter how old you are or if you have dependents.

Avoid leaving your loved ones vulnerable to life’s uncertainties. Instead, take the opportunity to explore a range of options, fully comprehend your needs, and discover a life insurance policy that perfectly aligns with your financial objectives. The peace of mind that accompanies knowing your loved ones are safeguarded is truly invaluable. Take the proactive step today to invest in life insurance and secure a brighter, more promising future for those you cherish most.