Home insurance, often viewed as a mere formality in the homeownership process, plays a vital role in safeguarding your most valuable asset. It provides financial protection against unexpected damages like fire, theft, or natural disasters, ensuring peace of mind and security. From comprehensive coverage to liability protection, home insurance policies are an essential investment for homeowners. Besides the structure of your property, they also protect your possessions and personal liabilities. It is essential to be aware of the importance of home insurance and to find the right policy so that you will not suffer financial loss. Find out why home insurance is not just a safety net; it’s a must-have.

Safeguarding Your Finances

Financial Protection can be understood in four key points:

- Repair Costs: Home insurance offers financial assistance in covering the cost of repairs that may arise from damage caused by unforeseen accidents or incidents.

- Replacement Coverage: In case of significant loss or damage to the property, home insurance provides funds for replacing essential items and personal belongings.

- Loss Compensation: A comprehensive home insurance policy compensates homeowners for any monetary losses incurred due to theft or other covered scenarios.

- Fire and Natural Disasters: Home insurance plays a vital role in protecting against the devastating aftermath of fires and natural disasters, ensuring that individuals are not left financially burdened by these events.

Additionally, home insurance provides unique details that add value beyond what has been covered. With its comprehensive coverage, it goes beyond mere repair or replacement costs. Homeowners can also receive compensation for temporary living arrangements during repairs, liability protection against lawsuits arising from accidents on their property, and even coverage for personal injuries sustained by themselves or others while on their premises.

Enhancing Homeowner Security with Liability Coverage

Liability coverage safeguards homeowners from potential lawsuits resulting from accidents or injuries on their property.

- This coverage can help cover legal expenses if the homeowner is sued and needs to hire a lawyer.

- If a guest is injured in your home and requires medical treatment, liability coverage may assist in paying their medical expenses.

- Liability coverage can also extend beyond the boundaries of your property. For example, this coverage may still apply if you accidentally injure someone while on vacation.

- In addition to bodily injury, liability coverage protects against accidental property damage caused by you or a family member.

- The amount of liability coverage provided varies depending on the insurance policy, but it is generally recommended to have enough to cover potential legal costs and damages.

Having adequate liability coverage ensures financial protection and peace of mind for homeowners. In the unfortunate event of an accident or lawsuit, this type of insurance can play a crucial role in safeguarding assets and personal finances.

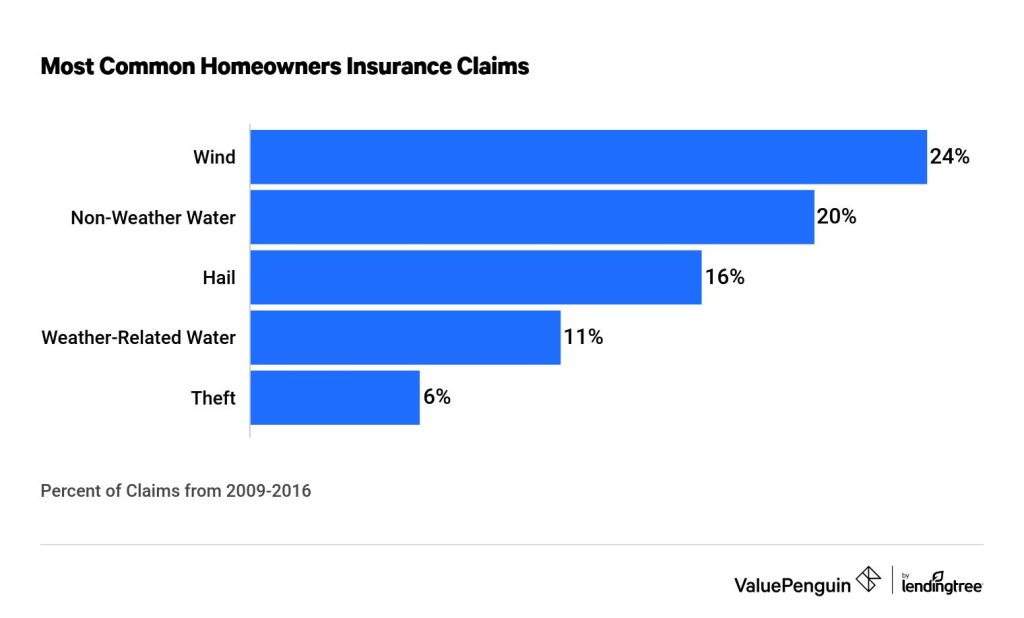

Credit: valuepenguin.com

Unlocking Your Mortgage Journey

To meet the prerequisites set by mortgage lenders, achieving specific standards for property protection becomes crucial. The significance of home insurance lies in its ability to safeguard against unexpected events, ensuring compliance with mortgage requirements.

Home insurance plays a pivotal role in meeting the mortgage requirements established by lenders. It assures lenders that the property has adequate coverage by mitigating potential risks and providing financial protection for the dwelling. This security encourages lenders to extend loans confidently, contributing to a smoother mortgage process.

In addition to fulfilling mortgage requirements, home insurance serves as a shield against unanticipated circumstances. It defends homeowners from liabilities arising from accidents or damages on their property, protects personal belongings from theft or destruction, and provides assistance in rebuilding after disasters. Such comprehensive coverage meets lender mandates and grants homeowners peace of mind.

Preparedness for Unforeseen Natural Events

In protecting your residence, vigilance against natural disasters takes center stage. This involves preparing for potential harm from seismic activities, deluges, and powerful tropical storms. Securing coverage to address these possibilities proves pivotal, primarily if you reside in locales prone to such upheavals.

The unpredictability and potential for substantial devastation posed by natural disasters underline the importance of readiness. Earthquakes hold the potential to undermine a dwelling’s integrity and disrupt its foundational stability. On the other hand, floods bring about water-related havoc and the potential loss of cherished possessions. Meanwhile, hurricanes unleash fierce winds and torrents of rain, leaving behind a wake of extensive destruction.

To ease the financial strains that inevitably follow these natural crises, homeowners are well advised to contemplate securing insurance tailored to the specific risks of their geographic area. Through this proactive approach, individuals can ensure they possess the vital assistance required to navigate the aftermath and reconstruct their homes should a catastrophic event unfold.

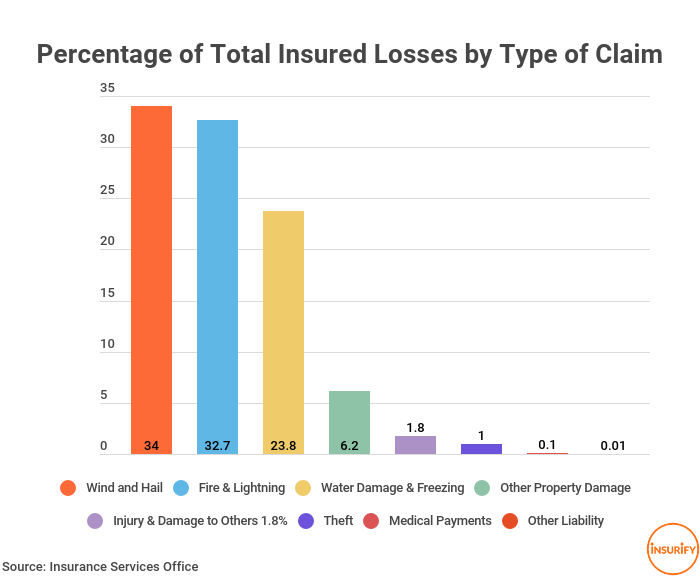

Credit: insurify.com

Safeguarding Your Treasures

When it comes to your prized possessions, such as furniture, electronics, and clothing, protecting them becomes crucial. Home insurance safeguards your personal belongings from being stolen or damaged. Having an insurance policy gives you peace of mind that even if something unfortunate happens, you will be compensated.

It can be life-saving if you’ve got home insurance in case of theft or damage to your belongings. Imagine returning home to find that your expensive electronics have been stolen or that a burst pipe has ruined your furniture. Without insurance coverage, replacing these items can put a significant dent in your wallet. However, with home insurance, you can file a claim and receive compensation for the valuable items that have been affected.

It is important to note that not all policies cover personal belongings equally. Some may provide limited coverage for certain items, such as jewelry or art pieces. Therefore, it is crucial that you thoroughly review your policy and consider additional coverage if necessary. You can enjoy peace of mind and financial security if your personal belongings are adequately protected.

Temporary Accommodation Coverage

Temporary accommodation is an essential aspect of home insurance coverage. It provides a safety net for homeowners in unexpected circumstances that render their homes temporarily uninhabitable. This coverage ensures that temporary housing expenses are covered, reducing the financial burden on homeowners during difficult times.

- Additional Living Expenses: Temporary accommodation coverage includes reimbursement for additional living expenses incurred when homeowners are forced to relocate due to covered events such as fire damage or natural disasters. These expenses may include hotel bills, rental costs, and even meals.

- Peace of Mind: By including temporary accommodation coverage in their home insurance policy, homeowners can have peace of mind knowing that they will have a place to stay while their homes undergo repairs or reconstruction. This minimizes the disruption caused by the loss and allows them to focus on rebuilding their lives.

- Cost Savings: Without temporary accommodation coverage, homeowners would be responsible for finding and paying for alternative housing during the repair process. This could result in significant out-of-pocket expenses, whereas with proper insurance coverage, these costs can be mitigated or eliminated entirely.

Temporary housing is not limited to just addressing immediate housing needs, however. During this time, it also covers additional living expenses, such as transportation and storage fees. By understanding and utilizing this aspect of home insurance, homeowners can better protect themselves financially and emotionally when unforeseen events occur.

To sum up

In conclusion, home insurance serves as a crucial safety net for homeowners, protecting against potential financial loss due to theft, damage, or natural disasters. It ensures peace of mind by covering essential aspects like dwelling, personal property, and liability coverage. By investing in a comprehensive home insurance policy, one can safeguard their most valuable asset and ensure uninterrupted living standards. Moreover, features such as additional living expenses (ALE) and replacement cost coverage enhance its importance. Through proper research and consultation with insurance experts, selecting the right policy becomes more straightforward, making home insurance not just a wise choice but an indispensable part of responsible homeownership.