Owning a home is a wonderful experience, but paying the monthly mortgage can be a real burden. Getting rid of your mortgage early can help you save on mortgage interest and free up your finances. Here are some tips on how to pay back your loan faster and wave goodbye to those hight monthly payments. We’ve compiled a list of practical tips and strategies to help you navigate the path to mortgage-free living while saving you thousands in interest payments. Now let’s discover how to unlock financial freedom by paying off your mortgage early!

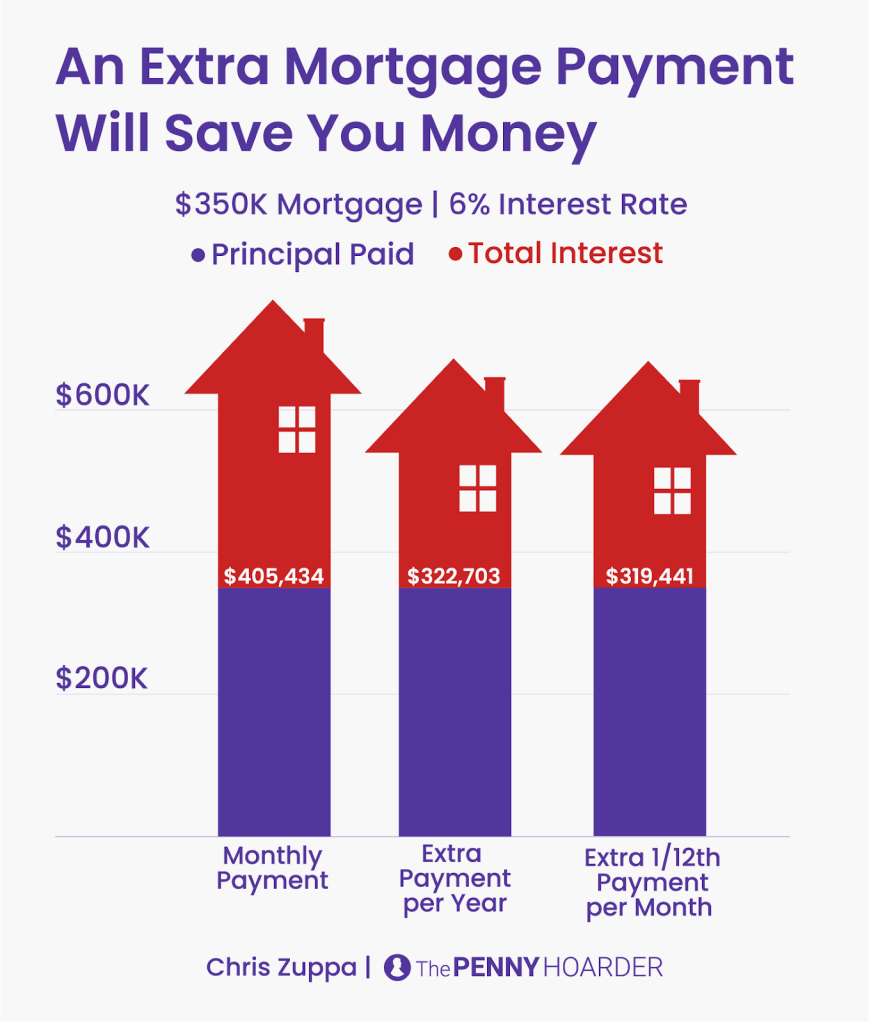

1. Making additional payments on your mortgage

Lower your mortgage debt faster by paying extra toward the principal amount rather than only paying the minimum monthly payment. This saves you money on interest over time and potentially reduces your repayment term.

You can make extra payments manually or set up automatic bi-weekly payments to your lender. Consider refinancing options to lower interest rates, removing Private Mortgage Insurance (PMI), and taking cash-out to pay off other debts.

Tip: To keep track of extra payments and stay motivated, print out an amortization table from your lender’s website, and mark each payment made toward the principal.

2. Refinancing your mortgage to a lower interest rate or a shorter loan term

Refinancing your mortgage to a better interest rate or a different loan term will reduce your total debt and save thousands of dollars in interest payments.

- Choosing the proper new loan term: Generally, the longer you borrow, the lower your monthly payment will be, but the interest you will pay will be higher. A shorter loan will increase your monthly payments but lower interest over time.

- Reduce interest rates by refinancing: It can lead to a significant reduction in interest payments over time.

- Mortgages with adjustable rates (ARMs): Their interest rates are initially low, but they fluctuate over time. They are suitable for those planning to sell or refinance soon.

- Do not forget closing costs: Refinancing costs can add up quickly, so factor these into your calculations.

- Ensure there is sufficient equity: To qualify for refinancing, it is crucial to have enough equity built up in the home. You may be unable to refinance if your mortgage exceeds the home’s value.

3. Use any unexpected windfalls or tax refunds to make lump-sum payments

Many homeowners see an opportunity to pay off their mortgages faster when they receive lump-sum payments, such as tax refunds or unexpected windfalls. It can shorten the loan term and reduce the mortgage principal.

Here’s a 3-step guide for using lump-sum payments to pay off your mortgage faster:

- Contact your mortgage provider to check if any prepayment penalties may apply. If so, compare them against the potential savings from making a lump-sum payment before you proceed.

- If there are no penalties, look at your most recent statement for the current principal balance. Decide how much you want to contribute to the principal amount and write a check or transfer funds accordingly.

- Once you have paid, confirm with your mortgage provider that it has been credited directly towards reducing your principal balance. This will help lower future interest charges on your mortgage loan.

A true story follows: A young couple put their annual tax refund towards paying off their mortgage early. The lump-sum payment and thousands in interest deductions knocked years off their loan. By seeking professional advice and utilizing prepayment options without additional costs and fees, they managed to pay off their loan eight years ahead of schedule!

Credit: thetruthaboutmortgage.com

4. Budgeting and tracking your expenses can help you identify areas for savings

Budgeting and tracking your expenses can save you a lot of money. If you monitor your expenses, you can find areas where you can cut costs and put those funds towards reducing your mortgage.

Here are five ways budgeting and expense tracking can help pay off your mortgage faster:

- Identify unnecessary expenses: Tracking your spending habits will allow you to identify any unnecessary or frivolous purchases that drain your finances. Eliminating these expenditures frees up money for mortgage payments.

- Increase income: Budgeting helps you allocate funds correctly, ensuring enough money is left for mortgage payments. Consider finding a side hustle or negotiating a raise at work to increase income.

- Control debt: Tracking all your debts, including credit cards and car loans, allows you to address high-interest debts first while paying the minimum requirements on others, thereby helping you manage total debt.

- Set financial goals: Setting financial targets will allow you to prioritize paying off your mortgage as quickly as possible. Start by setting small attainable goals before increasing them gradually over time.

- Monitor progress: Keeping track of how much progress has been made in mortgage payments encourages motivation to reach the end goal.

To further reduce expenses, consider creating a detailed monthly budget with allocated funds for each expenditure category.

Managing your budget also means making necessary sacrifices, such as eating out less frequently or reducing impulse purchases. Remember that these sacrifices lead to greater financial freedom in the future.

5. Making your mortgage payments rounded up

A good method for paying down your mortgage is to increase your mortgage payment by rounding up. It will dramatically decrease the interest you accrue and the length of time it takes to pay off your mortgage with this simple change.

By making additional contributions each month, this automated savings strategy is one of the simplest and most efficient methods to boost the amount of money that goes towards reducing your overall debt. Automated savings tools will automatically include these additional contributions in your monthly mortgage payment schedule.

By setting these additional payments at a constant rate, you’ll end up with roughly one extra full payment every financial year, directly contributing to knocking out principal loan amounts much faster.

6. Consider switching to an accelerated payment plan

By paying off your mortgage quicker, you save money in the long run because you will pay less interest. Accelerated payment plans can help you achieve this goal.

Here’s a simple 5-step guide on how to consider using an accelerated payment plan:

- Speak to your lender – Ask if they offer access to this type of plan.

- Evaluate budget – Determine if you can afford higher payments within budget.

- Select payment frequency – Choose getting paid fortnightly instead of monthly, reducing interest costs.

- Calculate regular repayments – Use calculators available online or from your lender to determine your new repayment amount.

- Get started and monitor progress – Set up automatic payments for ease and better management while keeping track of time.

Using this technique could help you pay off your mortgage quicker than paying once every month. By making it a short-term objective, adopting changes that may slightly alter your daily finical choices can increase savings.

It is pertinent to note that accelerated payments come with specific unique details such as reduced overall loan term, saving more in total interest, and even allowing for smaller deposits because the amount borrowed would be considerably less.

Credit: themortgagereports.com

7. A mortgage refinance is an option if you have a lot of savings

If you have significant savings, consider a mortgage refinance a viable option for managing and paying off your mortgage faster. This can reduce the interest rate of your current mortgage loan and lower your monthly payments.

Mortgage refinancing enables you to recast your mortgage and adjust its terms. This could be especially useful if you’ve built up a lot of equity and wish to leverage it to reduce borrowing costs.

The mortgage recasting process allows for a reduction in monthly payments while maintaining the original maturity date. By doing this, you can save more money, which can be invested elsewhere or used to hasten repayment.

This approach has helped many homeowners pay off their mortgages years earlier than they expected. Before refinancing, however, it’s crucial to analyze your financial situation and seek professional advice.

8. Consider renting out spare rooms or a separate living space to earn income

Optimizing your property investment is a smart way to earn rental income. Capitalize on empty rooms or living spaces by renting them out. Doing this can reduce the financial strain of mortgage payments and even make additional payments towards it.

Renting out spare rooms or separate living spaces is an ideal way to earn extra money, which can be utilized to pay off a mortgage faster. You can advertise on various platforms and websites providing room rental services. To ensure seamless transactions, draft an agreement outlining all terms and conditions related to the rental.

To get more sustainable income from renting, ensure the property is habitable and attractive for tenants by furnishing it properly, maintaining proper hygiene, and providing excellent safety. A good reputation will attract long-term tenants willing to pay more for better amenities.

Credit: thepennyhoarder.com

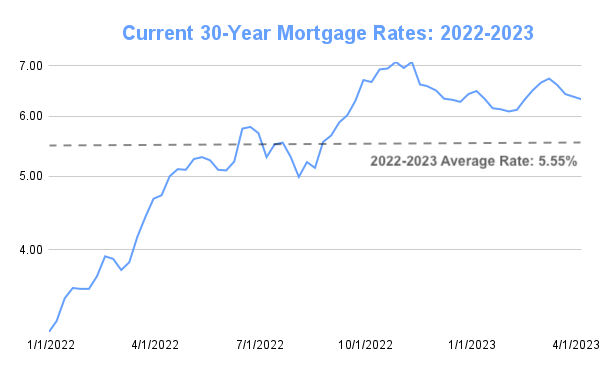

9. Monitor market trends, mortgage rates, and financial changes

Staying updated on market conditions, mortgage rates, and economic changes is crucial to successful mortgage management. Regularly check for fluctuations in interest rates and assess whether refinancing would benefit your financial goals. Stay informed about market trends, as they can impact your monthly payments and loan terms, enabling you to make informed decisions.

Monitoring the mortgage rates allows you to identify opportunities for lower monthly payments or faster repayment timelines. Rate changes even of a small magnitude can significantly affect your long-term financial planning. Keeping track of market trends helps evaluate your current interest rate against the average rate and consider adjusting it accordingly.

Proactively managing your mortgage payment plan gives you more flexibility when adjusting your monthly budget if unexpected financial hurdles arise. Ask your lender if they offer prepayment options allowing you to pay off the principal without penalty fees or add extra funds toward payments. This strategy will reduce the amount of debt over time and increase equity, thus giving you an edge to accelerate paying off the mortgage earlier.

Tip: Schedule periodic consultations with a mortgage specialist to track progress and find alternative strategies that align with your goals.

Add Comment