Are you aspiring to purchase your dream house? Before embarking on your house-hunting adventure, a crucial factor demands your attention: your credit score. This often-overlooked numerical representation significantly influences your ability to secure a mortgage and the specific terms you’ll be offered. Real estate is a fast-paced market, so understanding the impact of your credit score is crucial.

Whether you’re buying a first home or upgrading, your credit score matters. This article sheds light on how credit scores can affect your home-buying decisions. From comprehending the importance of a high credit score to learning about actionable steps for improving it, we’ll empower you with the indispensable knowledge and tools required to transform your homeownership dreams into reality.

Understanding Credit Scores and Their Importance in Buying a House

The credit score holds the utmost importance in the process of purchasing a house, as lenders heavily consider it. This score represents your creditworthiness numerically and is based on factors like payment history, credit utilization, credit history length, credit types, and new credit inquiries. Lenders rely on this score to evaluate the level of risk involved in lending you money. A higher credit score signifies lower risk, enhancing your chances of qualifying for a mortgage with favorable loan terms.

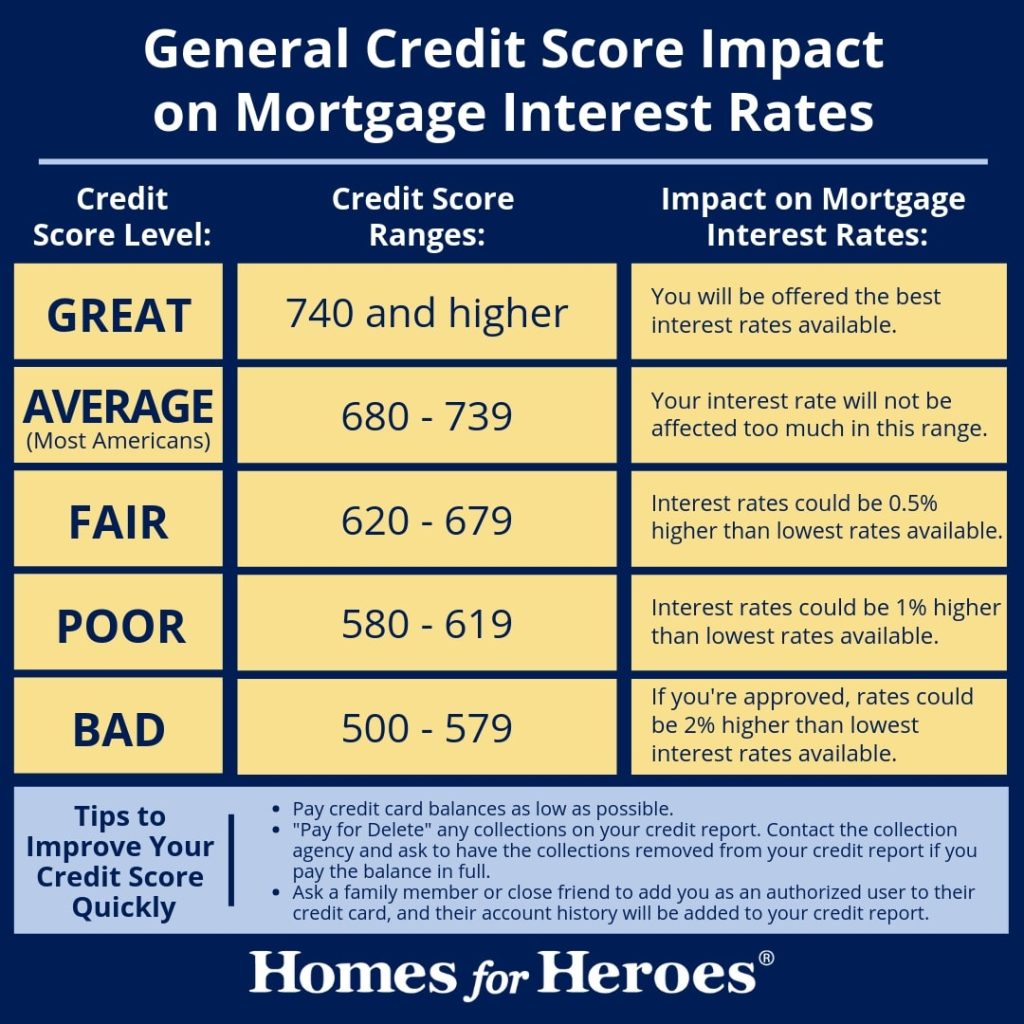

Maintaining a good credit score is critical since it determines your eligibility for different mortgage options, influences the interest rates offered to you, and affects the loan terms you can secure. A higher credit score opens doors to superior loan choices, lower interest rates, and potential savings of thousands of dollars over the mortgage’s lifetime. Conversely, a lower credit score can limit your options, lead to higher interest rates, and make mortgage approval more challenging.

In essence, your credit score serves as a financial report card and significantly impacts your ability to buy a house. Therefore, comprehending how credit scores influence mortgage applications is essential.

How Credit Scores Affect Mortgage Applications

For mortgages, the credit score is crucial in determining your creditworthiness. A strong credit score signifies a history of responsible debt management, which makes you a less risky candidate in the eyes of lenders. Consequently, you are more likely to have your mortgage application approved and receive more favorable terms.

Conversely, a lower credit score can raise concerns for lenders, indicating potential financial challenges in the past or a record of late payments and defaults. This may lead to hesitation in approving your application or result in less favorable loan terms with higher interest rates.

It’s important to note that different lenders have varying credit score requirements. Generally, credit scores of 620 or higher are needed for mortgage qualification. However, aiming for a higher credit score gives you more options and improved terms. Understanding the significance of credit scores in the mortgage application process allows us to delve into the minimum credit score requirements for various types of mortgages.

Credit: homesforheroes.com

The Minimum Credit Score Requirements for Different Types of Mortgages

The credit score criteria for each type of mortgage can vary. A brief overview of some common mortgage credit score requirements follows:

- Conventional Loans: Conventional loans, which are not government-backed, tend to have higher credit score requirements. Most lenders generally look for a minimum credit score of 620. Nevertheless, a credit score of 740 or above often qualifies for better interest rates and loan terms.

- FHA Loans: First-time homebuyers prefer FHA loans because they are federally insured. FHA loans typically have a lower minimum credit score requirement. While you may be eligible for an FHA loan with a credit score as low as 500, a credit score of 580 or higher is often necessary to take advantage of the low down payment option.

- VA Loans: Exclusively available to veterans, active-duty service members, and eligible spouses. The Department of Veterans Affairs backs VA loans. Technically, VA loans have no specific minimum credit score requirement, but most lenders prefer borrowers with a credit score of 620 or higher.

- USDA Loans: Available to low- to moderate-income families looking to buy homes in regional areas. The U.S. Department of Agriculture backs USDA loans. Typically, a credit score of 640 or higher is necessary to qualify for a USDA loan. However, some lenders may consider borrowers with lower credit scores on a case-by-case basis.

Please note that these are general guidelines, and each lender may have specific criteria. Moreover, meeting the minimum credit score may secure loan qualification, but it may not guarantee the most favorable loan terms. It’s essential to be aware of individual lender preferences and policies. Before proceeding, we should highlight that improving your credit score before applying for a mortgage can be beneficial. Now, let’s explore tips for enhancing your credit score effectively.

Getting a better credit score before applying for a mortgage

For a better credit score before a mortgage, there are constructive measures you can adopt. These guidelines aim to assist you in responsibly improving your credit score:

- Timely Bill Payments: A critical aspect influencing your credit score is your payment history. Ensure punctual payment of all your financial obligations, such as credit cards, loans, and utilities.

- Manage Credit Utilization: Reduce your credit utilization rate to below 30% by utilizing less credit than you have available. This showcases responsible credit management.

- Limit New Credit Accounts: Refrain from opening several new credit accounts within a short timeframe, which may harm your credit score. Instead, focus on managing your existing accounts effectively.

- Review Credit Report: Regularly assess your credit report and promptly address any inaccuracies. Correcting errors is crucial, as they can negatively affect your credit score.

- Settle Outstanding Debts: Prioritize settling high-interest debts to enhance your credit utilization and demonstrate your capacity to handle financial responsibilities.

- Preserve Old Accounts: The length of your credit history significantly affects your credit score. Instead of closing old credit accounts, retain them to maintain a lengthy credit history.

Adhering to these recommendations can steadily improve your credit score and increase the likelihood of mortgage approval. Remember, initiating these actions well before your mortgage application grants sufficient time for substantial enhancements.