Are you considering acquiring a new car? Before initiating your hunt for the ideal vehicle, comprehending the implications of your credit score on your auto financing is fundamental. The credit score is a significant determinant in shaping the interest rate, loan conditions, and the likelihood of loan approval. Whether your credit rating is stellar or subpar, it’s vital to recognize how your credit history may influence your potential to secure car financing. This composition delves into the interplay between your credit score and auto loans, equipping you with the knowledge to make judicious choices concerning financing your succeeding vehicle. Hence, let’s unearth how your credit score can bear upon your automobile loan.

Importance of credit scores in car loan applications

Let’s begin by understanding the significance of credit scores concerning car loans. A credit score refers to a numerical representation of your creditworthiness, indicating your likelihood to repay debts, which lenders take into consideration. The widely used credit scoring model is the FICO score, that goes from 300 to 850, where higher scores improve your chances of obtaining favorable loan terms.

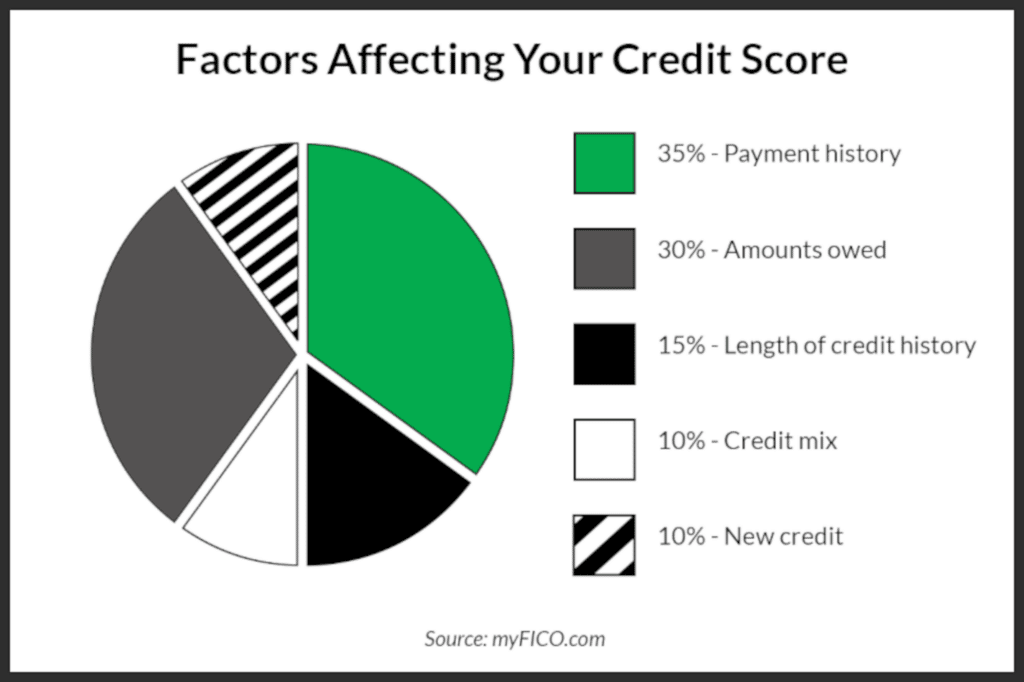

Your credit score is calculated by multiple factors, encompassing your payment history, credit utilization ratio, length of credit history, a mix of credit forms, and new credit applications. Among these, payment history holds the most weight, contributing 35% to your credit score. Lenders must demonstrate a consistent record of timely payments and responsible credit management.

How credit scores affect interest rates on car loans

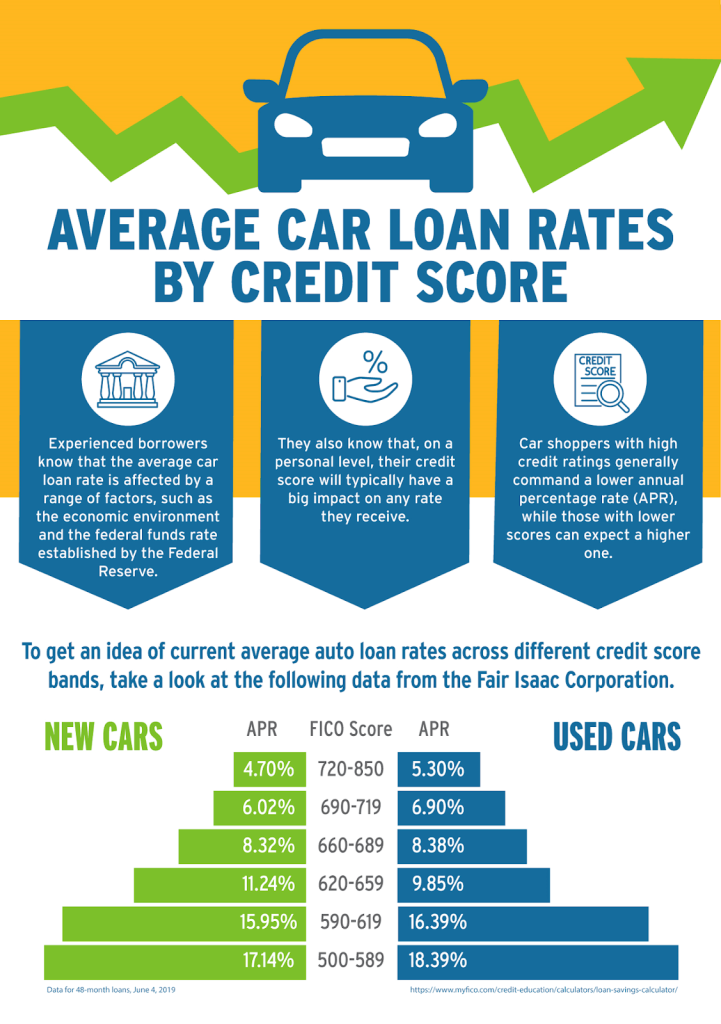

Your credit rating greatly influences automobile financing by affecting the interest rate offered. Financial institutions consider your credit rating as an indicator of potential risk before deciding to extend credit. The perceived risk directly influences the interest rate attached to your loan.

Usually, applicants with better credit ratings enjoy the advantage of lower interest rates. They are deemed more trustworthy borrowers, less likely to default on their repayments. On the other hand, applicants with poorer credit ratings are perceived as more risky, which is balanced by offering them a steeper interest rate.

Your auto loan’s total payment can be dramatically impacted by increases in interest rates. Let’s say you’re financing a $25,000 vehicle over five years. If your credit rating is 750, you might qualify for a rate of 4%, translating to a total interest cost of approximately $2,600. But, if your credit rating dips to 650, the offered interest rate might be 8%, inflating your total interest cost to nearly $5,200. Thus, maintaining a better credit rating can lead to substantial savings in interest payments.

Credit: loanry.com

Impact of credit scores on loan approval

Your credit rating influences the interest rate you’ll receive and substantially affects the probability of obtaining a car loan initially. Financial institutions use this rating as a metric to gauge your adeptness in responsibly managing debt. A low credit rating could signify you as a borrower with substantial risk, leading to increased reluctance from lenders when considering your loan application.

Each lender’s criteria for loan approval can differ, but a credit rating of 670 or higher is usually regarded as favorable, while those below 580 are viewed as unfavorable. Securing a car loan via traditional financial institutions could become more difficult if your rating is categorized as negative. However, do not despair, as there exist alternative avenues, which we’ll explore further in this write-up.

Steps to improve your credit score before applying for a car loan

Suppose you have ambitions to become a vehicle owner in the not-so-distant future and aspire to obtain the most favorable lending conditions. In that case, it’s prudent to enhance your credit standing before initiating a loan application. Here are some constructive strategies to augment your credit credibility:

- Timely bill payments: Ensuring payments are made promptly and consistently is the most potent strategy to uplift your credit score. Establish automatic payment procedures or set reminders to avoid missing any deadlines.

- Debt mitigation: Decreasing your cumulative debt can positively impact your credit utilization ratio, a measure of how much of your available credit is in active use. Strive to maintain your credit utilization under the 30% mark.

- Verification of credit reports: It’s crucial to periodically scrutinize your credit report to confirm that all data is precise. Should you encounter any inaccuracies, lodge a contention with the respective credit bureau to rectify them.

By adopting these measures, you can steadily advance your credit standing over an extended period, rendering you a more appealing prospect for credit institutions.

Credit: marketwatch.com

Strategies to get a car loan with a low credit score

Possessing a less-than-stellar credit score may make the task of procuring a car loan more complex, yet it’s far from unfeasible. Explore these methods if you’re burdened with a weak credit rating:

- Seek out a loan guarantor: Should you have a close friend or relative with an impressive credit history, they could serve as your loan guarantor. Their robust credit standing can balance the financial risk tied to your weak credit score, improving the likelihood of your loan being approved.

- Opt for a sizable initial payment: By paying a substantial down payment, you lessen the overall sum you need to borrow, which could make credit providers more inclined to greenlight your loan request.

- Investigate various loan providers: Loan providers employ differing parameters for approving car loans. Certain providers focus on individuals who carry lower credit scores. Dedicate time to study and juxtapose loan providers to identify one with a higher probability of approving your loan request.

- Ponder over a collateral-based loan: Such loans necessitate an asset, like a vehicle or other valuable items, as collateral. The presence of an asset as a security makes lenders potentially more amenable to granting financing to individuals bearing weaker credit ratings.

Remember, despite these tactics aiding in securing a car loan with a low credit score, you might still encounter steeper interest rates and more rigorous loan conditions.

Alternatives to traditional car loans for individuals with poor credit

Alternative options are available for those who struggle to get a car loan from conventional lenders due to a low credit score. Although these alternatives could come with increased interest rates or necessitate a larger initial payment, they could provide the pathway to vehicle financing.

- Buy here, pay here dealerships: These dealerships extend direct financing, implying they grant the car finance directly to the purchaser. They typically exhibit greater leniency regarding credit scores but tend to apply higher interest rates.

- Credit unions: As non-profit monetary organizations, credit unions often tender more adaptable lending alternatives than traditional banks. They might be more accommodating to individuals burdened with low credit ratings.

- Peer-to-peer lending: Such platforms link loan-seekers directly with individual financiers willing to lend capital. These platforms generally possess more relaxed lending norms. Hence they represent a practical option for individuals with low credit ratings.

While these alternatives may enable you to finance a car despite poor credit, it’s vital to meticulously examine the terms and conditions, such as the interest rate and repayment tenure, to ascertain the loan’s affordability.

In Summary

The significance of your credit rating in the vehicle financing process cannot be overstated. It’s a key determinant in whether a lending institution grants you a car loan and the interest rate they provide. Comprehending the correlation between your credit rating and auto loan terms is essential for making educated decisions during vehicle acquisition.

Your prospects for attaining a car loan with agreeable terms are amplified if you possess a stellar credit rating. Conversely, a less-than-satisfactory credit rating could hinder obtaining a loan or result in less advantageous stipulations.

Irrespective of your current credit rating, adopting proactive measures to enhance and sustain it remains essential. Conscientious credit utilization and investigating other financing avenues, if required, can boost your likelihood of obtaining an auto loan that aligns with your financial capacity and requirements.

Note that your credit rating is merely one aspect of the lending institution’s evaluation process for your loan request. Other considerations include income, work history, and other fiscal parameters. By exhibiting a robust financial standing overall, you stand a better chance of receiving the desired auto loan. Hence, invest time in understanding your credit rating, strive to enhance it, and make educated choices about financing your forthcoming vehicle.