Negotiating lower interest rates with creditors can be a daunting task. Still, it is essential for reducing your financial burden and maximizing your savings. As interest rates vary based on market conditions and personal creditworthiness, understanding the best strategies to negotiate more favorable terms is crucial. By researching market rates, assessing your credit history, contacting creditors, and presenting a solid case, you can increase your chances of securing a lower interest rate. This guide will provide practical tips to help you navigate this process confidently and achieve better financial outcomes. So let’s dive into these strategies and start saving money today!

1. You should know the market rate and your credit score before negotiating.

Knowing the prevailing interest rates and your credit score is crucial before entering any negotiations to lower the interest rates with creditors. This will give you a clear understanding of the market rates and help you prepare for the talks.

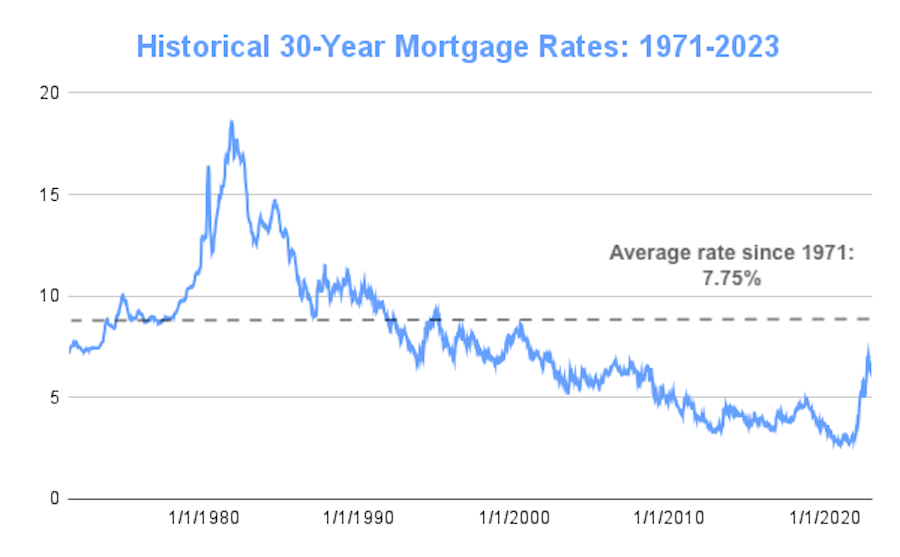

- Gather data on current market rates to understand what competitors are offering.

- The credit report indicates your payment history, pending debts, and account age all reflect your credit score.

- A high score indicates a good financial standing and could be used as leverage.

- Historical data on prior APR at which lenders have offered loans could also aid in negotiating skills.

- Being prepared with this research gives one insight into fair terms achievable.

It’s important to note that having a good credit score alone does not guarantee lower interest rates, be savvy with their negotiation strategies too. Speak with creditors calmly, making it clear they’re struggling financially. Explaining why one is seeking this reduction can stir some sympathy from creditors.

For example: “When Sarah approached her creditor, she shared that she’d been unable to repay much of her owed loan due to her current salary cut. The creditor then empathized and agreed to reduce Sarah’s interest rates by 2%.”

Researching current market trends and knowing your credit rating is as important as preparing for financial negotiations. Doing so allows individuals opportunities like Sarah’s – saving time, money, and unpleasantness.

2. Make sure you’re up-to-date on all payments and review your credit report.

Ensuring that all your payments are current and reviewing your credit report are crucial steps when negotiating lower interest rates with creditors. Verify the accuracy of your credit report, identify discrepancies, and check if late payments have been reported correctly. This information provides leverage for securing reduced rates with creditors.

An individual’s credit history plays a significant role in determining the interest rate charged by lenders. By keeping up-to-date on all payments, individuals can demonstrate responsible borrowing habits. Reviewing a credit report helps to identify any inconsistencies or errors that could affect future loan applications. Addressing these issues can help strengthen negotiation efforts with creditors.

In addition, checking a credit report before approaching lenders allows individuals to explain their repayment history and propose lower interest rates confidently. This strategy promotes trust between borrowers and creditors, leading to more favorable outcomes.

Credit: themortgagereports.com

3. Get in touch with your creditor to express your concerns and negotiate a lower interest rate.

Communication with creditors to reduce interest rates requires professionalism, courtesy, and negotiation skills. Contact your creditor and voice your concerns about the high-interest rates. Through effective communication and negotiation strategies, it’s possible to find a mutually beneficial solution.

- Investigate other lenders’ options for lowering interest rates.

- Discuss your financial situation with your creditor and mention alternative lenders.

- If your creditor is willing to negotiate a lower rate, ask for specific terms in writing before committing to any agreements or changes.

- If your creditor is unwilling to work towards a compromise, consider speaking with a credit counseling agency for additional support or advice.

- Stay organized by keeping track of all communication and documents related to the negotiation process.

Different situations require different strategies for success. For example, if you have a history of timely payments or are experiencing temporary financial hardship, these factors could influence the creditor’s willingness to negotiate.

A true story shared by an individual who had accumulated significant debt and realized their interest rates were suffocating their ability to make timely payments. They decided to reach out directly to their creditors through letters explaining their hardship while providing personal context, such as children’s expenses. Eventually, this approach led them towards building successful direct relationships with creditors as payment agreements shifted away from original formal contracts into revised custom-served plans enabling greater payment flexibility and creating a win-win for both parties involved.

4. Give reasons for the lower interest rate, such as financial hardship, changes in your credit score, and a better offer from a competitor.

Potential strategies for negotiating lower interest rates with creditors may include citing reasons for the request. Such causes may consist of periods of financial hardship, improvements to credit scores, or better offers from competitors. These reasons can be supported through documentation such as bank statements or proof of alternative proposals.

- Financial hardship – provide evidence of job loss, medical expenses, or other extenuating circumstances.

- Credit score changes – present credit bureau reports illustrating improved credit standing.

- Better offer from a competitor – share copies of a competitive offer to demonstrate an alternative rate exists.

- Documentation – provide supporting material that validates the reason for requesting the lower interest rate.

It’s crucial to approach negotiations professionally and remain composed when making these requests. If initial discussions are unsuccessful, scheduling a follow-up call or submitting a written appeal may be beneficial. Individuals can often secure agreements for significantly reduced interest rates by taking an assertive approach and using evidence appropriately.

Credit: news.gallup.com

5. Negotiations can take time. Positivity and patience are key.

When negotiating with creditors, staying focused and persevering through what may be a long process is important. Flexibility, positivity, and patience are essential ingredients in obtaining lower interest rates from lenders. Approaching the negotiation table with a positive mindset allows for productive conversation that can lead to an agreement that benefits both parties. Patience is critical when dealing with creditors who may take time to assess and approve a lower rate.

Be willing to compromise and explore alternative solutions throughout the process, while remaining calm and level-headed. Openness and adaptability can help you find mutually beneficial options that can reduce interest rates.

6. Compare interest rates with a competitor if your creditor is unwilling to negotiate.

When facing reluctance from creditors to negotiate for lower interest rates, consider exploring the rates offered by competing companies. A potential competitor’s proposal may be the key bargaining chip for a better deal. This technique works best for consumers with good credit scores and history, as it makes them attractive to other lenders.

In addition to comparing interest rates with competitors, a balance transfer is another effective method to secure lower rates. If done correctly, transferring outstanding balances onto a new card with a much lower rate can save thousands in interest fees. However, remember that most cards charge a transfer fee of 3% or 5% of the total amount transferred.

Credit: sanfranciscofcu.com

7. Keep good financial habits by paying bills on time and managing your credit utilization.

Maintain a sound financial behavior pattern by ensuring timely payments and professional management of credit utilization.

- Timely payments: Pay your bills without delay and avoid accumulated interest on outstanding balances.

- Regular monitoring of credit utilization: Keep an eye on the amount of credit you incur relative to your spending.

- Credit card balance should always be low: The higher the balance, the more the interest on unpaid amounts is amplified.

- Credit score improvement: Good payment history can improve your credit score, giving you the power to negotiate for better rates.

- Bargaining position improvement: Emphasize good financial habits while negotiating with creditors for more favorable rates.

Craft a unique narrative by considering these tips and improving your bargaining position with well-established and effective financial practices.

Pro Tip: Resetting terms through refinancing or transferring balances during 0% promotions can result in considerable savings.

To sum up

To summarize, negotiating lower interest rates with your creditors can make all the difference in your financial health. In this guide, we discuss how to unlock the power of negotiation by researching competitive offers, improving your credit score, and communicating assertively with your creditors.

Having read these valuable tips, take a moment to reflect on your financial situation. Ask yourself:

- Have I researched competitive offers from other creditors to leverage in my negotiations?

- Is my credit score in good standing, or are there steps I can take to improve it before approaching my creditors?

- Am I prepared to communicate effectively and assertively to present my case for a lower interest rate?

Take control of your financial future by actively engaging with these questions and implementing the strategies discussed in this blog.

Add Comment