Credit scores affect your financial health, affecting loan approvals, interest rates, and housing opportunities. What is its update frequency? While not daily, like social media feeds, credit scores undergo regular updates. Equifax, Experian, and TransUnion, the credit bureaus, receive monthly data from creditors, encompassing payment history, credit utilization, and other factors influencing your score. They recalculate it approximately once a month. Remember that not all creditors report simultaneously, leading to slight variations across bureaus. Knowing this, lenders can make informed decisions about your creditworthiness based on this monthly process.

The Importance of Credit Score Updates

You need to understand your credit score for financial stability. Lenders utilize your credit score to assess your creditworthiness, aiding them in determining loan approval and the associated interest rate. A higher credit score indicates financial responsibility, reducing risk in the eyes of lenders, whereas a low score raises concerns. Regular updates to your credit score play a vital role in this process.

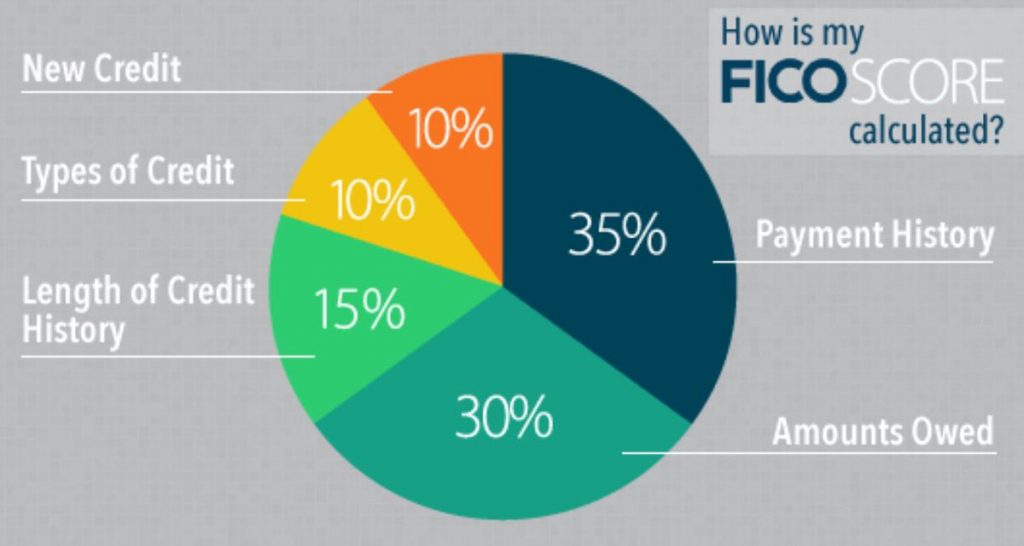

Periodic credit score updates give lenders an accurate picture of your financial standing. Analyzing your payment history, outstanding debts, and credit utilization enables lenders to make well-informed decisions about your creditworthiness. As your financial situation evolves—such as paying off debts or encountering missed payments—your credit score reflects these changes, conveying valuable insights to lenders about your credit management abilities and payment punctuality.

Moreover, staying updated on your credit score also benefits from your perspective. This allows you to track your finances and spot any potential issues or inaccuracies that could impact your creditworthiness. By identifying such concerns, you can take prompt corrective actions like disputing errors or enhancing your payment habits to maintain a healthy credit score. This vigilance helps you stay on top of your credit standing and paves the way for better financial opportunities in the future.

Frequency of Credit Score Updates

Understanding credit score updates is crucial, and these updates occur periodically based on data received by credit bureaus from creditors. The data includes payment history, credit limits, account balances, and other factors influencing the credit score. This information is used to calculate and refresh the credit score.

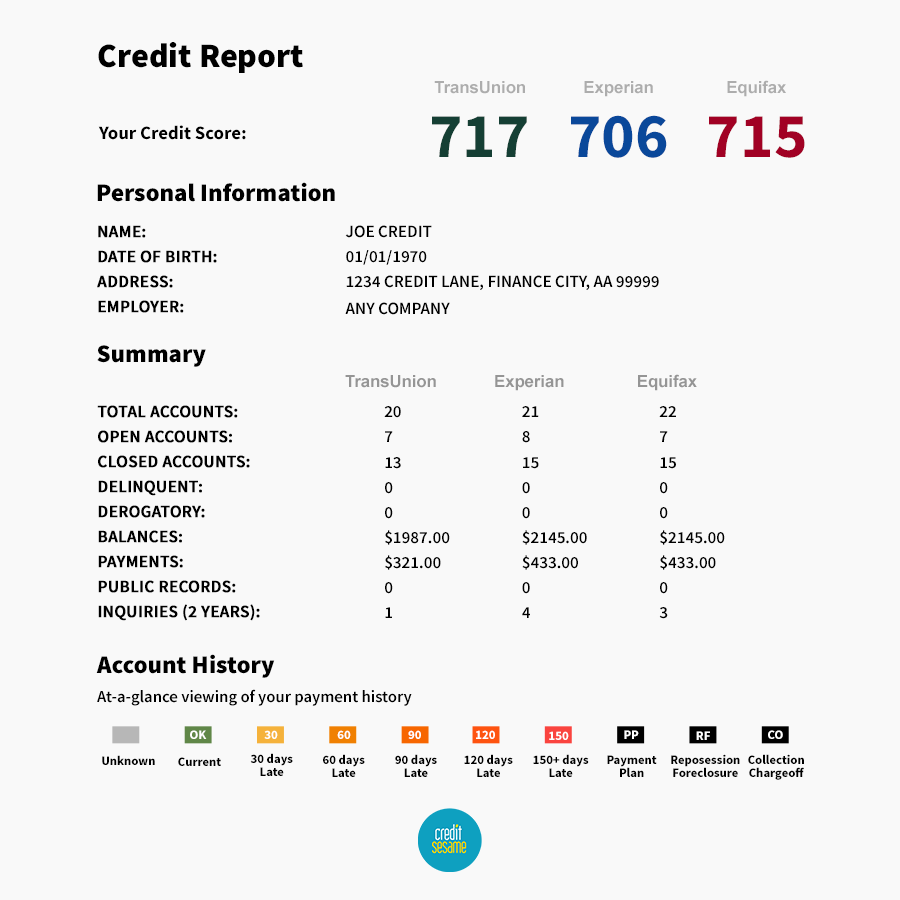

Typically, credit bureaus update credit scores once a month. However, it’s essential to know that creditors don’t all report simultaneously. While some submit data early in the month, others later. Therefore, credit scores may differ slightly between bureaus. Monitoring your credit score from all three major credit bureaus is advisable to get an overall picture of your creditworthiness.

It’s worth noting that credit score updates are not immediate. It takes time for bureaus to receive data from creditors, process it, and recalculate credit scores. So, expecting overnight changes, especially after recent financial behavior adjustments, is unrealistic. Practicing patience is essential when dealing with credit score updates.

Factors That Affect Credit Score Updates

Factors influencing credit score updates include the timing and frequency of creditor reporting. Creditors may not report to credit bureaus simultaneously, with reporting periods varying from monthly to quarterly or less frequent. Consequently, any alterations in payment behavior or credit utilization may take time to manifest in the credit score.

The type of credit you hold is another determinant of credit score updates. Credit cards, mortgages, and personal loans have different reporting schedules. For instance, credit card issuers might report monthly, while mortgage lenders may do so less often. Knowing your creditors’ reporting schedules lets you predict when your credit score will likely be updated.

Moreover, credit score updates are influenced by the accuracy of data provided by creditors. Inaccurate or incomplete information can result in discrepancies in your credit score. To maintain accuracy, regularly review your credit reports and address any errors or inconsistencies you discover.

Credit: creditsesame.com

How to Monitor Changes in Your Credit Score

It is essential to understand how frequently your credit score receives updates and the various factors influencing it. To maintain financial well-being and promptly address potential issues, knowing how to monitor changes in your credit score is crucial.

Equifax, Experian, and TransUnion are three of the major credit bureaus. Federal regulations entitle you to receive one annual free credit report from each bureau. By acquiring these reports, you can thoroughly review their information and identify inconsistencies or inaccuracies.

Additionally, numerous online services and applications are available for credit monitoring. These services enable you to monitor fluctuations in your credit score and receive timely alerts about significant updates. Some even offer valuable extras like credit score simulators and identity theft protection features.

Another valuable resource is credit monitoring software. This automated tool continuously tracks changes in your credit score, providing comprehensive reports and in-depth analysis. Utilizing such software empowers you to recognize patterns, assess your progress, and take proactive measures to enhance your creditworthiness.

Common Misconceptions About Credit Score Updates

Understanding how credit scores are updated can be confusing due to common misconceptions. One such misconception is that credit scores are updated every time a payment is made or a credit card is used. While these factors do influence your credit score, immediate updates do not occur. Instead, credit score updates take place on a monthly basis, relying on information provided by creditors to credit bureaus.

Another prevalent misconception is the belief that checking your own credit score harms it. This is not accurate. When individuals check their own credit scores, it constitutes a soft inquiry, which does not impact their credit score. However, if a lender or creditor assesses your credit score during a loan application or credit approval process, it is considered a hard inquiry, which may temporarily affect your credit score.

Credit: thecreditpros.com

Why Credit Score Updates May Vary

With credit scores, it’s important to recognize that updates to this metric can differ among various credit bureaus due to the varied timing of creditor reporting. Equifax, Experian, and TransUnion may receive information from creditors at different intervals, leading to slight discrepancies in your credit score across these bureaus. Regularly monitoring your credit score from all three sources is the best way to understand your creditworthiness comprehensively.

Moreover, the frequency of credit score updates can also be influenced by the type of credit you hold and the reporting schedules of your creditors. Different credit types might have distinct reporting frequencies; some creditors may report less frequently than others. Awareness of these variations can help you anticipate when your credit score will likely be updated.

Notably, significant changes in your credit behavior, such as missed payments or substantial increases in credit utilization, may prompt more immediate updates to your credit score. Conversely, routine changes like regular payments and minor fluctuations in credit utilization typically follow the monthly credit score update process.

Conclusion

Credit scores are key metrics lenders utilize to assess your creditworthiness. While less dynamic than your social media feed, your credit score undergo periodic updates. Credit bureaus receive data from creditors monthly, utilizing this information to recalculate your credit score. However, due to varying reporting times among creditors, slight discrepancies in your credit score across different bureaus may occur.

Understanding the frequency of credit score updates is paramount for effectively managing your financial well-being. Regular updates enable lenders to make well-informed decisions about your creditworthiness while allowing you to track your progress and identify potential concerns.

By attentively monitoring fluctuations in your credit score, comprehending the factors influencing updates, and dispelling prevalent misconceptions, you can remain well-informed and take proactive measures to sustain a healthy credit score. It is advisable to regularly review your credit reports, leverage credit monitoring services, and demonstrate responsible credit behavior to uphold your creditworthiness effectively.