Are you a young individual eager to gain control over your financial situation and optimize your hard-earned resources? Look no further! In today’s rapidly evolving environment, the effective handling of personal finances is a vital aptitude for individuals of your age group to acquire.

Whether you are commencing your professional journey or have already spent a few years in the workforce, it is never too early to cultivate advantageous financial practices that will pave the way for enduring triumph.

This article aims to equip you with practical advice and proven strategies to navigate the intricate realm of managing your monetary resources. Prepare to assume authority over your financial prospects and unravel the clandestine methods behind amassing wealth and attaining financial autonomy.

Let’s delve into the indispensable money management insights that will enable you to make astute choices and secure a brighter financial future!

The Importance of Money Management for Young Adults

During your early adult years, focusing on the skill of money management may not be your primary concern. Nonetheless, cultivating sound financial habits early can significantly impact your future financial well-being. You can sidestep unnecessary debt, accumulate wealth, and attain financial freedom by effectively handling your finances. It goes beyond simply acquiring income; it entails knowing how to optimize it. Whether your earnings are modest or substantial, employing efficient money management techniques will ensure you live within your means, save for the future, and accomplish your financial objectives. Let’s delve into why money management is indispensable for young individuals.

First and foremost, money management empowers you with a sense of authority and tranquility. When you clearly comprehend your income, expenditures, and financial objectives, you can make well-informed choices regarding resource allocation. This command over your finances equips you to plan for the future, navigate unforeseen expenses, and alleviate financial pressure. Also, proficient money management permits you to seize opportunities, such as investing in education, embarking on a business venture, or purchasing a home. Having a firm grip on your finances, you can capitalize on these prospects and create a brighter financial outlook.

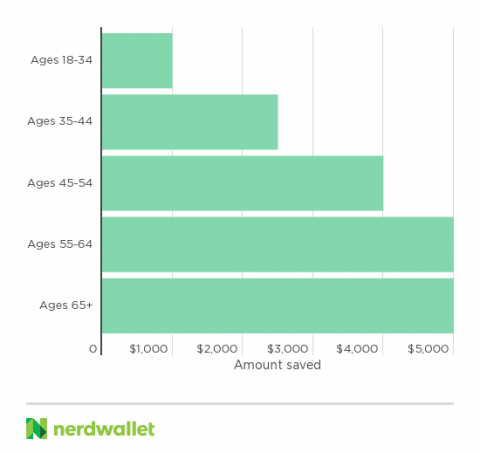

Credit: nerdwallet.com

Another imperative reason why money management is pivotal for young adults lies in its capacity to foster healthy financial habits. When you are just beginning, succumbing to overspending, accumulating debt, and living paycheck to paycheck is effortless. However, you can avoid these traps by embracing prudent money management strategies and establishing a foundation for long-term financial triumph. Budgeting, saving, and investing are all practices that can be cultivated gradually. Consistently adhering to these habits will forge a robust financial groundwork that will serve you well throughout your lifetime.

Last but not least, money management empowers you to accumulate wealth. Saving and investing wisely can help you build wealth steadily and create passive income streams. Money management is crucial to realizing your dreams, whether they involve early retirement, launching your own business, or exploring the world. By making astute financial decisions and taking command of your financial resources, you can construct a sturdy financial framework that empowers you to live life on your own terms.

Common Financial Challenges Faced by Young Adults

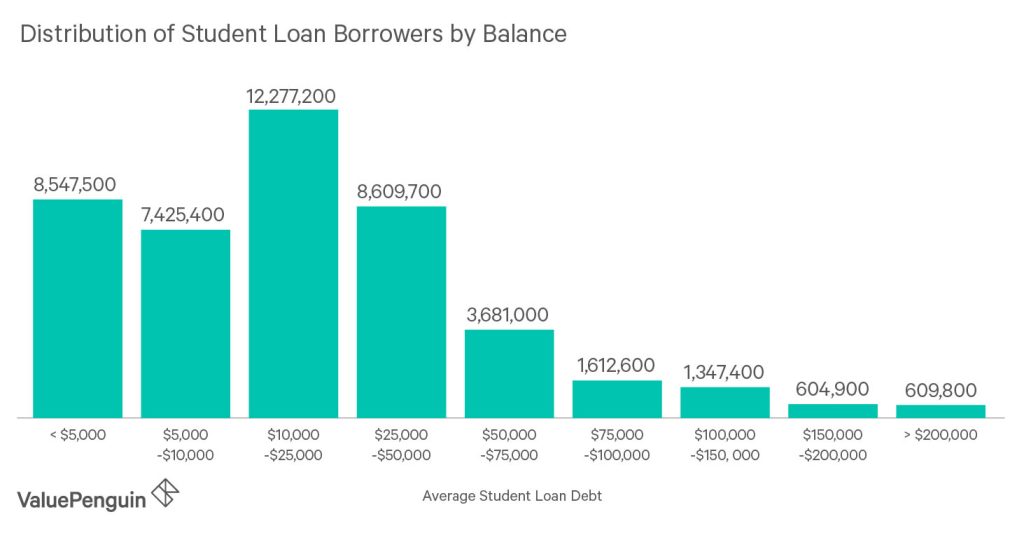

As a young individual, you will encounter various financial obstacles that may seem overwhelming when managing your finances. These challenges can include student loans and starting with a low income, making it difficult to attain financial stability. Nonetheless, being aware of these hurdles and implementing effective strategies can pave the way to success in money management. Let’s explore some common financial challenges young adults face and discover methods to navigate them.

The rising cost of education often leaves graduating students with substantial student loan debt. However, if you develop a repayment plan and understand the options, you can effectively manage your student loan debt. You can consolidate your loans, explore income-driven repayment options, or refinance your loans. Avoid default by consistently paying your loan and prioritizing repayment.

Another challenge faced by young adults is the constraint of low starting incomes. A modest income may not cover all your expenses for those just starting out in their careers. A realistic budget aligned with your payment is crucial in such circumstances. Spend less on discretionary items while prioritizing essential expenses. Consider side jobs or freelance work to boost your income. Making prudent financial decisions and increasing revenue can help you overcome low starting salaries and achieve financial stability.

Furthermore, young adults often encounter the allure of instant gratification and the influence of peers to spend on material possessions and experiences. It is vital to resist the urge to keep up with others and focus on your long-term financial objectives. Prioritize saving and investing for the future, even if it requires short-term sacrifices. Remember that financial independence and freedom hold more value than fleeting material possessions. By staying committed to your financial goals and resisting the urge to spend recklessly, you can conquer this challenge and establish a solid financial foundation.

Credit: cpf.gov.sg

Enhancing Money Management Skills through Goal Setting and Budgeting

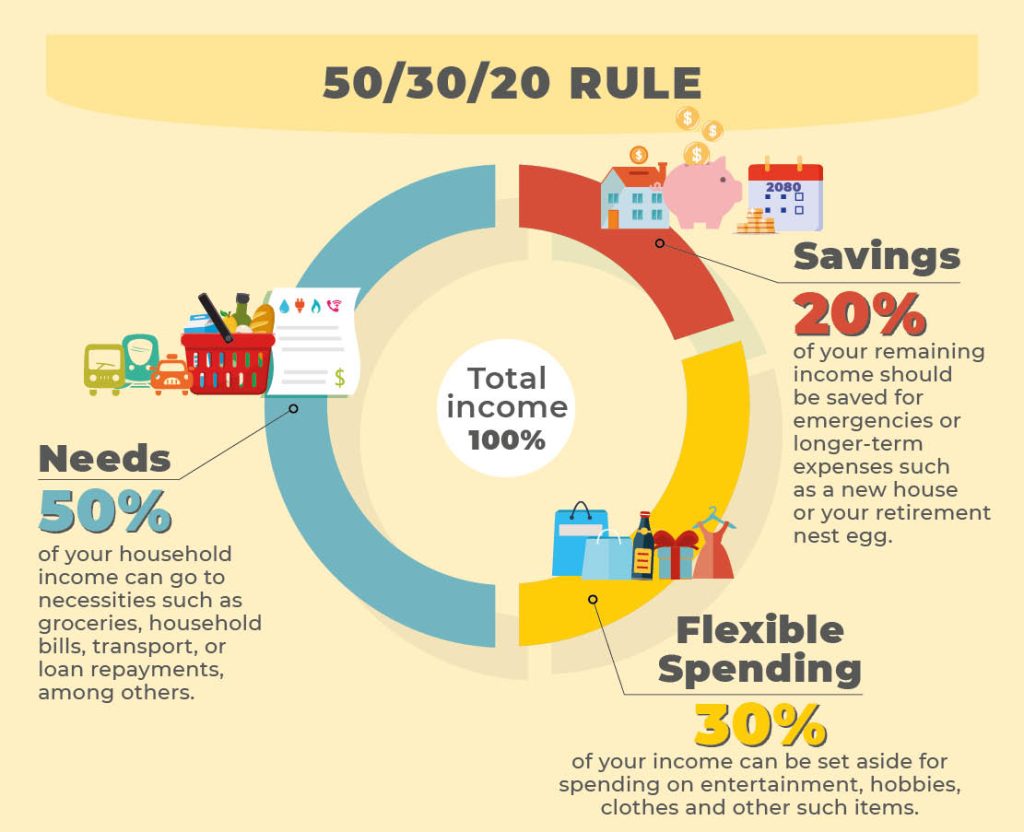

Budgeting and setting concrete financial goals are crucial to improving money management skills. Setting financial goals fosters motivation and focus on your financial journey. You will remain on track if you have specific financial goals, whether saving for a down payment, eliminating student loan debt, or establishing a retirement fund. You can create an adequate budget by following these steps:

- Set short- and long-term financial goals. A short-term goal is building an emergency fund, eliminating credit card debt, or saving for a trip. A long term goal may be buying a house, beginning a business, or retiring early. Each objective should have a realistic timeframe.

- Analyze your income and expenses. Analyze your sources of income, including salary, investments, and supplemental income. To determine where your money is being spent, track your monthly expenses. Divide your expenses into fixed costs (rent, utilities, and insurance) and variable costs (groceries, dining out, and entertainment).

- Calculate your net income. Deduct your total expenses from your income to ascertain your net income. This calculation will provide you with an approximation of how much money remains after covering your expenditures.

- Allocate your income toward your goals. Set a portion of your net income aside for your financial goals. Begin with your most significant goals and evaluate how much you can realistically save or invest monthly. Consider streamlining your savings by arranging automated transfers to a separate savings or investment account.

- Regularly monitor and adjust your budget. Remember that your budget is flexible and necessitates adjustments as your financial circumstances evolve. Review your budget every month and make modifications as necessary. If you notice consistent overspending in specific categories, explore opportunities to reduce expenses and redirect those funds toward your goals.

Crafting and adhering to a budget may demand discipline and sacrifices, but it represents a pivotal stride toward achieving your financial objectives. By tracking your income and expenses, you will understand where your money is being allocated, empowering you to make informed decisions regarding resource allocation.

Saving Strategies for Young Adults

Practical money management skills are essential for financial stability and long-term success. It can be particularly challenging for individuals starting their careers and facing various financial obligations. Luckily, there are several strategies that young adults can employ to optimize their savings. Let’s explore some of these strategies:

- Prioritize saving: Treat your savings as an indispensable expense by allocating funds first. Establish automatic transfers from your checking account to a separate savings or investment account. This approach reduces the likelihood of spending that money on discretionary purchases.

- Build an emergency fund: An emergency fund is a crucial safety net during unexpected financial hardships. Aim to save at least three to six months of living expenses. Begin with smaller savings goals and progressively increase the amount over time.

- Reduce discretionary spending: Carefully assess your expenses and identify areas where you can curtail costs. For instance, consider brewing your coffee at home instead of purchasing it daily, bringing packed lunches instead of eating out, or canceling unused subscriptions. These minor adjustments accumulate and create more room for savings.

- Automate savings: Establish automatic transfers to your savings or investment account. This automation eliminates the temptation to spend that money and guarantees consistent progress toward your saving goals.

- Leverage employer-sponsored retirement plans: If your employer sponsors retirement plans like a 401(k) or a Roth IRA, take full advantage of them. Contribute at least enough to receive the complete employer match, if available. Employer matches represent free money that significantly bolsters your retirement savings.

Remember, saving money is a habit that develops over time. Start with modest amounts and gradually increase your savings rate as your income rises. You will effectively progress towards your financial goals by prioritizing saving and adopting intelligent saving strategies.

Credit: valuepenguin.com

Tips for Managing Student Loans and Other Types of Debt

For many young individuals, educational loans and other debts can negatively impact their financial security. A strategic approach and effective money management will help you navigate debt and achieve financial independence. Here’s how to manage student loans and other types of debt:

- Gain comprehensive knowledge about your loans. Take the time to understand the terms and conditions of your student loans, including the interest rate, repayment options, and potential forgiveness programs. Making sound decisions about your repayment strategy requires knowledge about the specifics of your loans.

- Devise a structured repayment plan. Decide how much you can feasibly allocate toward monthly payments based on your financial situation. Evaluate alternatives such as income-driven repayment plans or refinancing to secure a reduced interest rate. Develop a repayment plan that aligns with your financial objectives and consistently make timely payments.

- Give priority to debt with high-interest rates. The highest interest rate credit cards and personal loans should be paid off first. Addressing the debt with the most substantial interest rate will save money in the long run by minimizing interest payments.

- Explore options for consolidating debt. If you are confronted with multiple loans or balances on credit cards, consider consolidating them into a single loan offering a lower interest rate. A debt consolidation program can reduce interest payments and simplify repayment processes.

- Consider seeking expert assistance when necessary. It is worthwhile to seek professional aid if you encounter difficulties in managing your debt or feel overwhelmed by your financial situation. Financial advisors or credit counseling agencies possess the expertise to provide valuable guidance and assist in developing a customized plan to address your debt concerns.

Effectively managing debt necessitates discipline, commitment, and the implementation of a clearly defined course of action. By comprehending the details of your loans, creating a repayment plan, and seeking professional assistance, you can successfully manage your debt and progress toward a future free of financial obligations.

To sum up

In conclusion, acquiring effective money management skills is paramount for young individuals as they embark on achieving financial autonomy. Well-informed decisions and a strategic approach can help efficiently handle educational loans and other financial obligations. By understanding loan terms and conditions, devising a repayment plan, prioritizing high-interest debt, exploring consolidation options, and seeking professional assistance, young adults can lay the foundation for a debt-free future.

By developing money management skills, young adults not only overcome immediate financial obstacles but also establish a solid foundation for success in the future. To achieve their financial goals, people must be able to budget, save, and make informed financial choices.