Are you frequently faced with financial difficulties? Is meeting your expenses constantly challenging, leaving you with no savings as a safety net? If this resonates with your situation, you may possess inadequate abilities in handling finances.

In today’s modern and consumption-oriented society, succumbing to overspending and exceeding our financial capabilities is easy. However, the repercussions of lacking proficiency in money management can be extensive, impacting our financial stability and mental and emotional well-being.

Within this article, we will delve into nine unmistakable signs that suggest the presence of poor money management skills. These indicators range from neglecting to monitor your expenditures to consistently relying on credit cards, serving as cautionary signals to help you identify areas where you can enhance your financial habits.

So, if you’re determined to seize control over your finances and establish a promising future, continue reading to uncover the fundamental signs of inadequate money management skills.

Sign 1: Living Paycheck to Paycheck

One of the key indications of inadequate financial skills is the continual dependency on each paycheck to meet basic expenses, resulting in minimal or no savings for emergencies. This situation of living from one paycheck to another can induce significant stress and eliminate any scope for financial stability or future planning. Furthermore, it leaves you vulnerable to sudden unforeseen expenses that can swiftly disrupt your financial situation.

Sign 2: Constantly Relying on Credit Cards

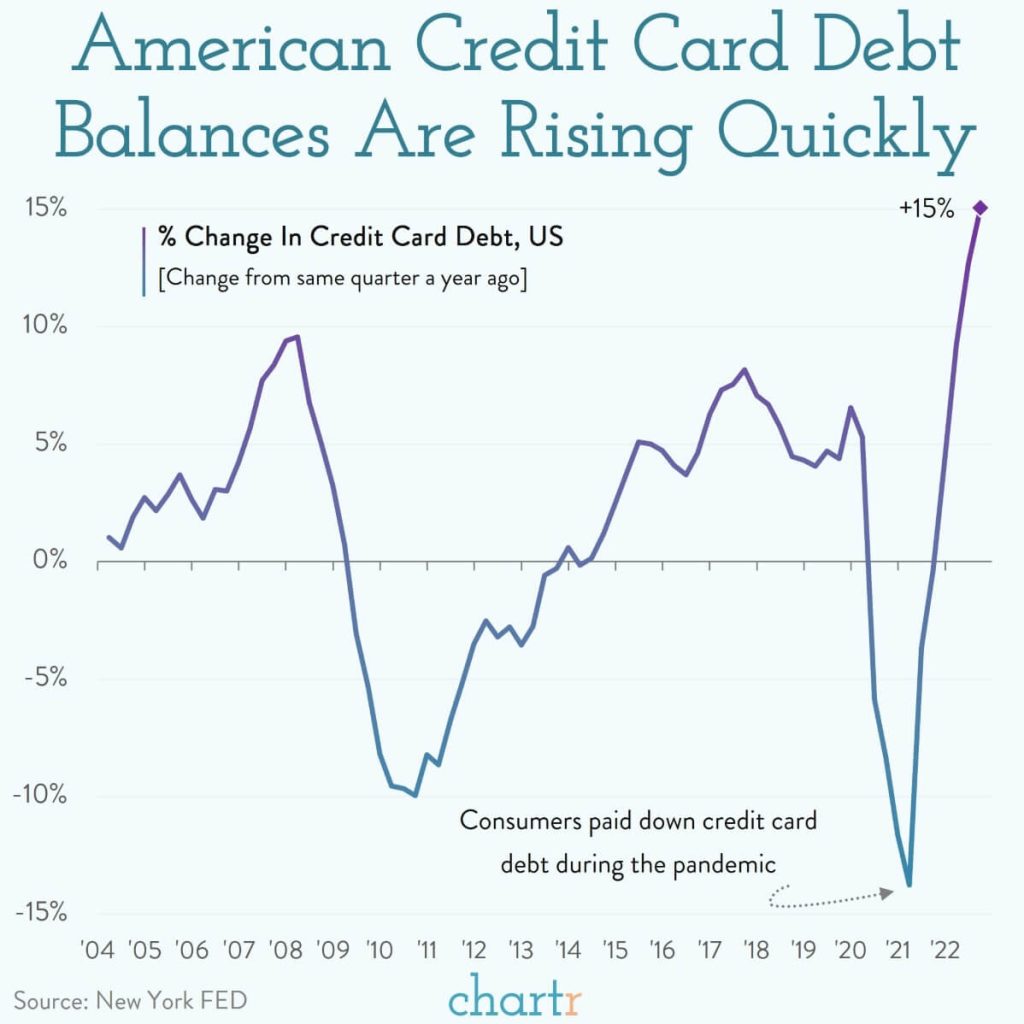

Another red flag pointing towards poor money management skills is an ongoing reliance on credit cards to bridge the financial gap. Leaning on credit cards as a temporary solution can initiate a hazardous cycle of debt, wherein accumulating high-interest rates and fees becomes commonplace. If you consistently resort to credit cards for day-to-day expenses or to acquire items beyond your means, it serves as a clear indication that enhancing your money management skills is necessary.

Sign 3: Lack of Budgeting or Tracking Expenses

Insufficient financial planning and neglecting to monitor expenditures indicate inadequate financial resource management. When there is no structured budget in place, it becomes challenging to comprehend the destination of your funds and determine a reasonable spending limit. Consequently, this may result in excessive purchases, impulsive buying, and a lack of awareness regarding your overall financial standing. By disregarding the monitoring of your expenses, you may remain oblivious to wasteful spending patterns and fail to identify opportunities for cost reduction and savings.

Credit: chartr.co

Sign 4: Ignoring Financial Goals

If your money management skills are lacking, you likely disregard your financial objectives. Whether you aim to save for a home down payment, pay off debts, or establish an emergency fund, it is crucial to establish and actively pursue financial goals for long-term financial success. However, consistently delaying or neglecting these objectives indicates ineffective money management and a failure to prioritize your financial future.

Sign 5: Not Saving for Emergencies or Retirement

Lacking the habit of setting aside funds for unforeseen circumstances or retirement shows insufficient financial ability. Unexpected events and expenses will inevitably arise, and lacking an emergency fund may result in resorting to credit cards or loans to cover these expenses. Furthermore, overlooking the importance of retirement savings implies that one will likely face financial challenges later. Prioritizing the establishment of a robust emergency fund and contributing to a retirement account should be the primary focus for individuals seeking to enhance their aptitude in managing financial matters.

Sign 6: Poor Credit Score or Excessive Debt

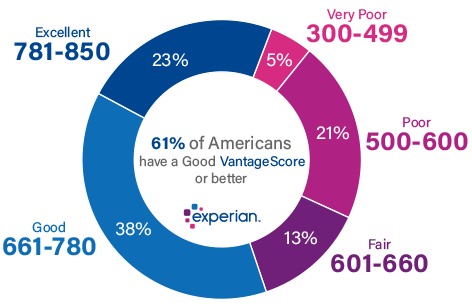

A subpar credit score or an overwhelming amount of debt serves as a clear indicator that there is room for improvement in terms of money management skills. Late payments, defaults, and high credit utilization all contribute to a diminished credit score, making it arduous to secure loans, rent accommodations, or even obtain employment. Excessive debt, regardless of its origin—be it credit cards, student loans, or personal loans—can significantly impede one’s financial freedom and limit available options. Taking proactive measures to enhance one’s credit score and reduce debt is crucial for cultivating improved financial management practices.

Credit: experian.com

Sign 7: Impulsive Spending Habits

Inadequate management of financial resources can have a detrimental impact on your economic stability. The tendency to make impulsive purchases or yield to the allure of sales and promotions can quickly deplete your bank account, hindering your progress toward financial objectives. Developing the ability to discern between wants and needs and practicing self-discipline in spending are crucial aspects of effective monetary management.

Sign 8: Difficulty Distinguishing Between Wants and Needs

The inability to differentiate between desires and necessities is strongly associated with impulsive spending patterns. Consistently engaging in unnecessary purchases or acquiring items that are not truly essential indicates a need for enhancement in one’s money management skills. By prioritizing needs over wants and making intentional choices when spending, one can regain control over one’s financial situation.

Sign 9: Not Seeking Professional Help or Financial Advice

Moreover, neglecting to seek professional assistance or financial guidance can indicate inadequate money management skills. If your financial well-being is at stake, there is no shame in seeking support. A financial advisor or financial education program can equip you with the knowledge and resources necessary to better manage your finances.

Improving Money Management Skills

If you notice any of these indicators in your own handling of financial matters, there’s no need to worry. There are effective measures you can implement to enhance your proficiency in managing money and regain command over your financial situation. Below are some recommended approaches to initiate this process:

- Create a budget: Monitor your income and expenditures to identify possible areas for saving and reducing spending. To ensure accountability, utilize budgeting tools, such as spreadsheets or applications.

- Establish financial objectives: You should set specific and attainable financial goals, such as eliminating debt, accumulating a down payment, or creating an emergency fund. Break them down into smaller milestones to make them more manageable and achievable.

- Give priority to saving: Elevate the importance of saving by arranging automated transfers to a designated savings account. Strive to save a portion of your monthly income to construct an emergency fund and contribute to your retirement savings.

- Enhance your financial knowledge: Learn about finances and money management with the information available online and in the literature. Acquiring knowledge will empower you to make well-informed decisions and establish a solid financial groundwork.

- Consider professional assistance: If you are overwhelmed or need guidance on where to begin, seeking advice from a financial advisor may be beneficial. They can offer personalized support and assist you in formulating a tailored plan to attain your financial objectives.

Key Takeaways

Identifying indicators of inadequate financial management is the initial stride in enhancing your monetary circumstances. Indications such as recurrently depleting your income, overreliance on credit cards, and neglecting to accumulate funds for unforeseen events or retirement all point towards areas where you can implement beneficial modifications. By establishing a comprehensive budget, establishing fiscal objectives, prioritizing savings, and seeking expert guidance, you can cultivate robust money management proficiencies to facilitate a more promising financial future. Remember, it is never too late to assume command over your finances and construct the life you desire. Commence your journey today!