Managing your finances is a life skill as crucial as any other, and mastering it can lead you toward financial stability and freedom. In today’s dynamic and fast-paced world, gaining proficiency in money management skills has never been more essential. From understanding the art of budgeting and building an emergency fund to managing debts efficiently, saving wisely, investing for growth, and leveraging insurance to safeguard against unforeseen circumstances — every aspect holds the key to a financially secure future. Whether you’re a seasoned financial planner or just starting this journey, these ten essential money management skills can help you navigate the complex financial landscape, making informed decisions that align with your goals and financial well-being. Stay tuned as we delve deeper into each skill, revealing the nuances and tactics that can help you master your financial universe.

1. Mastering Your Finances: The Critical Role of Budgeting

Budgeting is a vital skill that sets the foundation for your financial journey. It’s a roadmap that guides you toward your financial goals and helps you navigate potential pitfalls. Without a budget, you’re essentially driving blind in your financial life.

Creating a budget involves listing all your income sources and tracking expenses to the last penny. It is easy to see where each dollar goes, whether for rent, groceries, entertainment, or savings. This visibility lets you make informed decisions, prioritize spending, and save money.

For beginners, various financial planning and budgeting tools can simplify this process, offering intuitive interfaces and insightful analytics. They provide a clear snapshot of your financial health and guide you toward better money management.

A budget is not about restricting your spending. The key is to control, understand, and maximize your finances. The idea is to make money work for you rather than vice versa. This is why budgeting is so powerful.

2. The Essential Role of an Emergency Fund in Personal Finance Management

Coping with life’s unpredictable events—like a sudden job loss, unexpected medical bills, or urgent car repairs—can be financially straining. That’s where building an emergency fund comes into play. Considered a cornerstone of sound personal finance management, emergency funds are readily accessible cash reserves for unexpected expenses.

Creating an emergency fund isn’t just about securing financial stability and peace of mind. It means you’ll be prepared to handle financial emergencies without going into debt or tapping into long-term savings.

You should save 3-6 months’ worth of living expenses in your emergency fund. Start by setting realistic savings goals, then make regular contributions. Even small, consistent deposits can gradually build a robust financial safety net. Ensure these funds are kept in a liquid account, such as a savings account, so they are easily accessible.

An emergency fund should be a top priority in your personal finances strategy. Whether you’re creating a budget spreadsheet, exploring various finance management apps, or seeking professional financial planning advice, remember—the road to financial wellness often starts with the safety cushion of an emergency fund.

Credit: investopedia.com

3. Delving into Efficient Debt Management

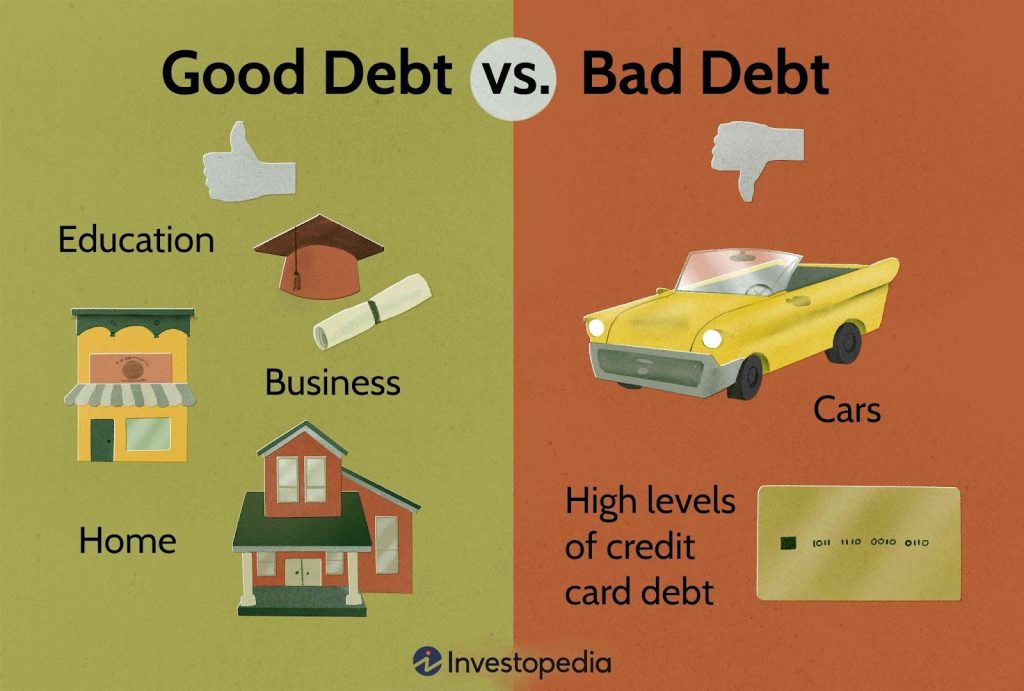

Mastering debt management is a critical financial skill. Debt management begins with understanding the different types of debt you owe. Interest rates and repayment terms vary by type of debt. Creating a debt repayment strategy is easier when you understand its intricacies.

Two popular strategies include the ‘Debt Avalanche’ and ‘Debt Snowball’ methods. In the avalanche method, debts with the highest interest rates are paid off first, while in the snowball method, smaller debts are paid off initially. Each method has its merits and can be utilized based on your financial situation and psychological preferences.

Maintaining discipline and adhering to your repayment plan is critical. Additionally, leveraging good debt for investments, such as a mortgage or a business loan, can lead to long-term financial success.

A debt management plan paves the way for improved credit scores, reduced financial stress, and a pathway to financial freedom. Implementing these strategies while leveraging fintech solutions and financial counseling can bolster your journey to becoming debt-free.

4. Delving Deeper into the Art of Saving

Understanding and practicing the art of saving is integral to achieving financial independence and stability. The beauty of saving lies in its simplicity; you can start small, and with consistency, you can accumulate a substantial amount over time.

Inculcating the habit of ‘paying yourself first’ by allocating a certain percentage of your income to savings before considering expenses is a popular approach. This shifts the perspective from saving what is left after spending to spending what is left after saving.

Technological advancements, such as automated savings apps, can make this process seamless. These digital tools can automatically transfer funds into your savings account, ensuring regular contributions and eliminating the possibility of forgetfulness or negligence.

Remember, saving isn’t about depriving yourself of joys today but about securing your financial future and preparing for your aspirations, whether that’s purchasing a home, starting a business, or embarking on a dream vacation. Embracing the art of saving is embracing a journey toward your financial goals.

5. Investing for a Brighter Financial Future

Investing is a critical component of wealth building, amplifying your earnings and paving the way to financial independence. While investing might seem like a complex venture, with the proper knowledge, it can transform your financial landscape.

Consider your money as a workforce. Investing is necessary for your money to stay active. Investing enables your money to generate more, akin to employees contributing to a company’s success. The ‘power of compounding’ is when your initial investment earns returns, and those returns are reinvested.

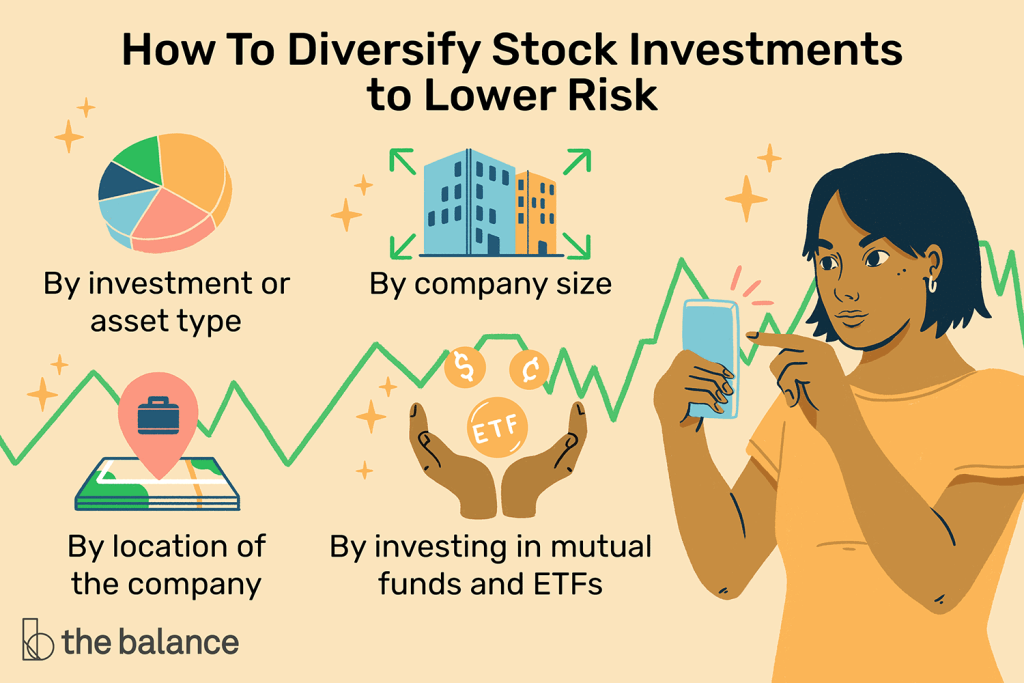

Many types of investments include stocks, bonds, mutual funds, ETFs, and real estate. Each carries its risk-return profile and serves different financial goals. Hence, understanding and aligning these options with your risk tolerance and long-term goals is pivotal.

However, investing isn’t about quick riches. It’s a long-term financial growth journey requiring patience, discipline, and continuous learning. Making informed decisions and growing wealth over time requires staying current with market trends and economic indicators. Investment isn’t a gamble; it’s a calculated risk.

Credit: thebalancemoney.com

6. Harnessing the Power of Credit Wisely

Using credit wisely can contribute to wealth creation and enhance financial flexibility. Good credit (such as a mortgage or student loans) and bad credit (such as high-interest credit card debt) are two different things.

Using credit cards responsibly is a major component of intelligent credit use. Keep a low credit utilization rate and pay your balance in full each month to avoid interest charges. A good credit score can lead to lower loan interest rates, better insurance rates, and better job prospects.

Avoiding late payments is also important. Consistent, on-time payments demonstrate to lenders that you are reliable and can manage your debts effectively.

Beyond these points, understanding the terms and conditions of your credit agreements can save you from unexpected fees or interest rate hikes. By mastering these aspects of credit usage, you can navigate the world of credit confidently and to your advantage.

7. Strategic Retirement Planning: Securing Your Golden Years

Planning for retirement is akin to planting a seed today for a tree that will provide shade in the future. Retirement planning isn’t just about setting money aside. It’s about ensuring that you can maintain a comfortable lifestyle when your steady income ceases.

To effectively plan for retirement, you must first understand the power of compound interest. This concept, often called’ interest on interest’, grows your savings exponentially. Starting early gives your money more time to compound, meaning that even modest contributions can grow into a substantial retirement fund.

The next step is to familiarize yourself with retirement savings accounts such as 401(k)s and IRAs. Besides providing a structured way to save for retirement, these vehicles also have tax advantages. Regular, disciplined contributions are crucial to reaping the full benefits of these accounts.

Lastly, consider your retirement lifestyle and the associated costs. Do you plan to travel? Pursue expensive hobbies? Understanding these future needs will allow you to set a realistic savings goal.

In the end, retirement planning is all about foresight, discipline, and patience. By mastering these skills, you can ensure a secure and comfortable retirement.

8. Boosting Your Financial Health with Tax Efficiency

Tax efficiency is one aspect of money management that is often overlooked but can significantly impact your financial health. Becoming tax-efficient means strategically planning your financial affairs to minimize tax liability. This isn’t about evading taxes but rather utilizing legal strategies to reduce your tax burden.

Several methods can help you achieve tax efficiency. You can use tax-advantaged accounts like 401(k)s and IRAs. Saving for retirement is easier with these accounts, offering tax-free growth or withdrawals.

Understanding how different types of income—like earned income, investment income, and passive income—are taxed is also crucial. This knowledge can guide your investment strategies, enabling you to retain more earnings.

Finally, knowing your eligible tax deductions and credits can lower your tax bill. This might include deductions for mortgage interest, education expenses, or charitable contributions.

Becoming tax-efficient can be complex, but various tax planning tools, software, and professional financial advisors can guide you through it. Remember, every dollar saved on taxes is another dollar for your savings, investments, or spending. It’s all part of becoming a savvy money manager.

9. Unraveling the Complex World of Insurance

Insurance can be seen as a protective shield against life’s unexpected financial blows. Each type of insurance serves a specific purpose, and understanding them is crucial to financial security. Let’s delve deeper:

- Life Insurance: It financially supports your loved ones during your death. Whole life insurance and term life insurance both have advantages and disadvantages.

- Health Insurance: Medical emergencies can be financially draining. A comprehensive health insurance plan can cover hospital bills, medication costs, and preventive care.

- Homeowners/Renters Insurance: This protects your home and belongings from damage from fire, theft, or natural disasters.

- Auto Insurance: Required by law in most places, it covers damages from accidents, theft, and other mishaps.

- Disability Insurance: Provides a portion of your income if you are unable to work due to illness or injury.

While it’s an expense, insurance is an investment in financial safety. Remember, not having insurance can cost more in the long run. Staying informed about insurance trends, policies, and optimization strategies is vital for effective financial management.