Are you exhausted from your daily routine and searching for methods to establish a more adaptable and economically stable future? This article examines various profitable ideas that can enhance your financial freedom through passive income.

Just envision earning money effortlessly while you rest, travel, or relish precious moments with your loved ones. With the right strategies and a modest amount of dedication, it can become a reality. We will explore ways to generate passive income, including properties, dividend stocks, and digital products.

In the foreseeable future, these ventures could generate income continuously. Regardless of your experience as an entrepreneur or where you are on your passive income journey, this article provides practical tips and valuable insights to assist you. Let’s look at how to make passive income a concrete and attainable goal.

What is Passive Income?

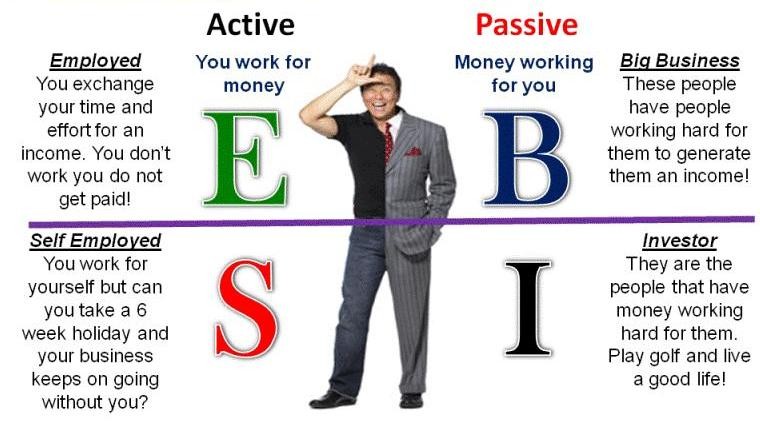

Passive income refers to a type of earnings that can be obtained without exerting significant ongoing effort. In contrast to active income, which involves exchanging your time for financial compensation, passive income enables you to generate money even when you are not actively engaged in work. This is accomplished by allocating your time, funds, or resources upfront and reaping the benefits in recurring revenue. Passive income is a valuable means to attain financial independence, allowing one to liberate oneself from traditional, rigid work schedules and cultivate a more adaptable lifestyle.

Passive income can stem from diverse origins, including investments, royalties, rental proceeds, and online enterprises. The crucial aspect lies in identifying passive income channels that harmonize with your personal interests, proficiencies, and financial objectives. While generating passive income necessitates an initial investment of effort and resources, it possesses the potential to generate a consistent stream of income that can complement or surpass your active earnings.

The Importance of Passive Income for Financial Freedom

Achieving financial independence refers to the ability to live according to one’s preferences without relying solely on a salary. It involves generating adequate passive earnings to cover expenses and enjoy the freedom to pursue personal interests, travel, spend quality time with loved ones, and lead a satisfying life. Passive income is pivotal in attaining financial independence as it offers a consistent and reliable source of earnings, detached from time or location constraints.

Diversifying passive income streams entails establishing multiple sources of earnings, mitigating the risks associated with depending solely on a single income stream. It also serves as a safety net in case one stream diminishes or performs poorly. By constructing a portfolio of passive income sources, individuals enhance their earning potential and cultivate a more stable and secure financial future.

Credit: linkedin.com

1. Exploring Passive Income Opportunities in the Real Estate Sector

Generating passive income and achieving financial freedom is a goal many aspire to, and real estate presents promising avenues for such pursuits. The realm of real estate offers various investment strategies that can help individuals establish a steady passive income stream. Here are a few options worth considering:

- Rental Properties: Renting out properties can earn passive income for owners. A consistent stream of rental income can be generated by strategically acquiring properties in high-demand areas and securing dependable tenants. Additionally, capital gains are possible as property values appreciate.

- Real Estate Investment Trusts (REITs): They own, operate, or finance real estate that generates income. Dividend distributions from REITs allow individuals to earn passive income. The advantage of REITs lies in their ability to provide exposure to real estate investments without requiring substantial upfront capital or the complexities of property management.

- Real Estate Crowdfunding: Platforms specializing in real estate crowdfunding enable individuals to participate in real estate projects alongside other investors. By pooling resources with like-minded individuals, it becomes possible to access larger real estate opportunities and earn passive income through rental returns or profit-sharing arrangements.

Real estate investment requires thorough research, diligent analysis, and a comprehensive understanding of local markets. Evaluating factors such as location, rental demand, property management considerations, and potential risks is crucial before embarking on any investment decisions.

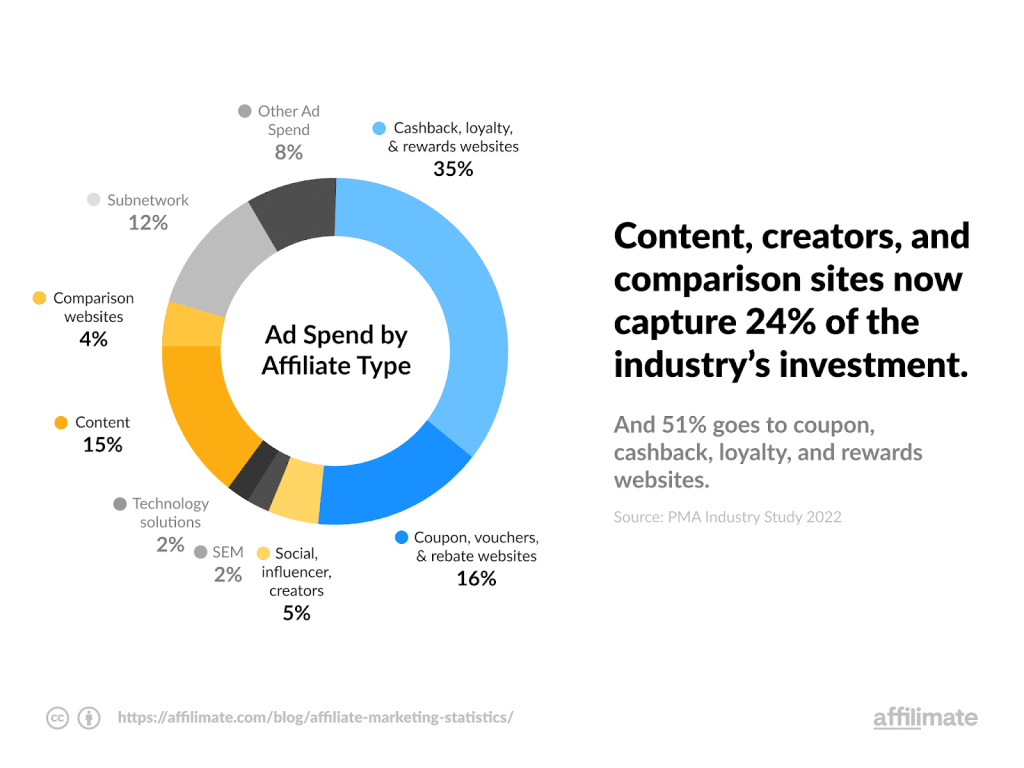

2. Generating Passive Income through Affiliate Marketing

Discover the lucrative world of online business and unlock the pathway to financial freedom through a widely embraced method known as affiliate marketing. By harnessing this approach, you can effortlessly generate passive income streams by effectively endorsing third-party offerings. Here’s a breakdown of the process:

- Identify Your Specialization: Select a niche or field that ignites your passion or leverages your expertise. This crucial step empowers you to craft compelling content that captivates and attracts a precisely targeted audience.

- Enroll in Affiliate Programs: Use reputable affiliate programs catering to products or services relevant to your chosen specialization. Renowned platforms like Amazon Associates, ClickBank, and ShareASale offer expansive networks to explore.

- Produce Compelling Content: Unleash your creativity and produce top-notch content across various mediums, including engaging blog posts, captivating videos, and influential social media posts. Embed strategic affiliate links within this content to seamlessly promote the products or services you endorse.

- Drive Organic Traffic: Implement an array of marketing strategies, encompassing search engine optimization (SEO), astute social media tactics, and effective email campaigns. These methods work synergistically to attract targeted traffic to your content, thereby enhancing the prospects of earning substantial passive income via affiliate commissions.

- Reap Lucrative Commissions: Each time a visitor clicks on your affiliate link and subsequently completes a purchase, you will reap a generous commission. The commission percentage varies depending on the affiliate program and the specific product or service being promoted.

Capitalizing on affiliate marketing can leverage your existing audience to create a sustainable passive income flow. This strategy enables you to endorse products or services that resonate with your audience’s needs and preferences. With careful consideration given to niche selection, content creation, and shrewd marketing methodologies, you can forge a successful affiliate marketing enterprise capable of generating passive income streams for years to come, ultimately granting you the coveted financial freedom you desire.

Credit: affilimate.com

3. Generating Passive Income through Online Course Creation and Sales

It is highly profitable to create and sell online courses if you possess expertise in a specific area. Online learning has driven the demand for valuable knowledge and skills. To start, follow these steps:

- Topic Selection: Identify a subject or skill you possess knowledge and passion for. This can encompass diverse areas ranging from photography and culinary arts to digital marketing and coding.

- Course Planning: Develop a comprehensive outline for your course, including its content and structure. Divide it into manageable modules or lessons and decide on the most effective format for delivering the material, such as video lectures, written resources, or interactive exercises.

- Course Creation: Utilize online platforms like Udemy, Teachable, or Coursera to design and host your course. These platforms offer tools to upload and organize your course content and manage payment processing and student enrollment.

- Course Promotion: Once your course is ready, employ various channels for promotion, including your website, social media platforms, email marketing, and online communities. Attract new students by offering discounts or limited-time promotions.

- Passive Income Generation: As students enroll in your course and make purchases, you begin to earn passive income. The potential for recurring income increases in direct proportion to the value and demand for your course.

Creating and selling online courses allows you to leverage your expertise and knowledge to assist others while simultaneously generating passive income. Although it demands initial effort in crafting the course content, once launched, you can continue earning income with minimal additional work.

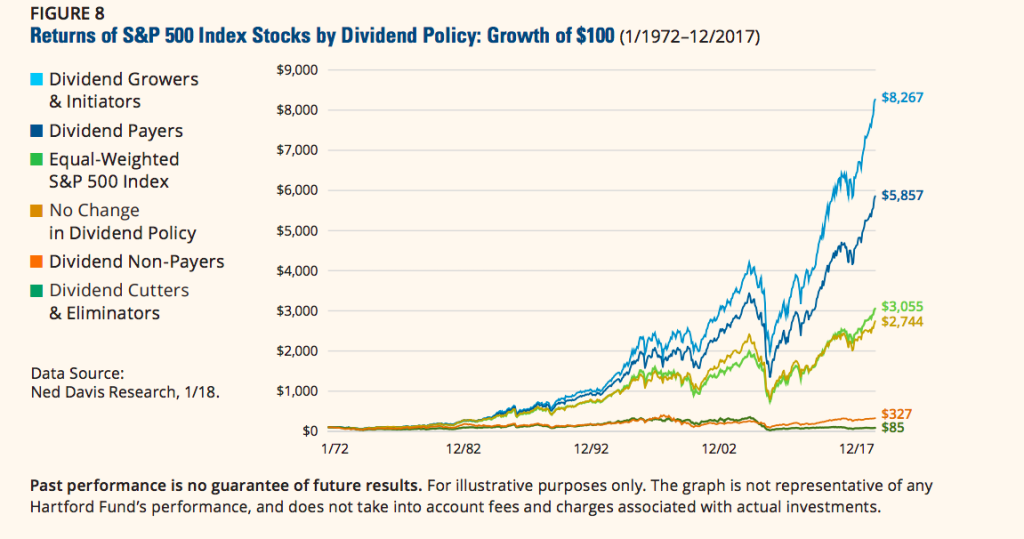

4. Earning Passive Income through Dividend Stocks

Investing in dividend stocks offers an effective means of generating passive income and achieving financial freedom. Below, you’ll find a breakdown of the process:

- Conduct Thorough Research and Select Dividend Stocks: Look for companies that regularly distribute and increase dividends. Identify businesses with solid financials, stable cash flow, and a competitive edge.

- Establish a Diversified Portfolio: Spread your holdings across different industries and sectors to mitigate risk. Try to blend high-yield stocks with dividend-growth stocks, allowing for income generation and capital appreciation.

- Consider Dividend Reinvestment: You should consider reinvesting dividends through a dividend reinvestment plan (DRIP). With this strategy, you can acquire additional shares without incurring transaction costs, thereby boosting your dividend income.

- Keep a Close Eye on Your Investments: Keep up with changes in the company’s financial situation and dividend policies. Review your portfolio regularly and make adjustments to maintain a healthy balance.

For investors with long-term goals, dividend stocks provide dependable passive income. The key to building a portfolio that consistently generates income in the years to come is to carefully select dividend-paying companies and adopt a disciplined investment approach.

Credit : seekingalpha.com

5. Building a Passive Income Stream through Rental Properties

Generating passive income and achieving financial freedom can be made possible through the ownership of rental properties. If you’re interested in building a passive income stream using this method, consider the following steps:

- Thoroughly Research and Select Suitable Properties: Conduct extensive research on various locations and property types with a strong demand for rentals. Look for properties that can offer a favorable rental yield and show potential for long-term value appreciation.

- Acquire the Property: Once you have identified a suitable property, take the necessary steps to secure financing and complete the purchase. Before deciding, you should carefully consider the property’s condition, location, and potential rental income.

- Locate Reliable Tenants: Prioritize the thorough screening of potential tenants to ensure they possess a positive rental history and the financial means to afford monthly rental payments. This involves conducting background checks, verifying employment and income information, and checking references.

- Efficient Property Management: Maintain the property well and address any issues promptly, whether you manage the property yourself or hire a company. Regularly reviewing rental rates to remain competitive in the market is also essential.

- Enjoy Passive Income: As tenants make their monthly rental payments, you will begin to accumulate passive income. Ensure that a portion of rental income goes towards maintenance and repairs.

Passive income can be created from rental properties, especially in high-demand areas. Although finding and managing tenants may require some effort, the long-term income potential and property appreciation make it a worthwhile investment.

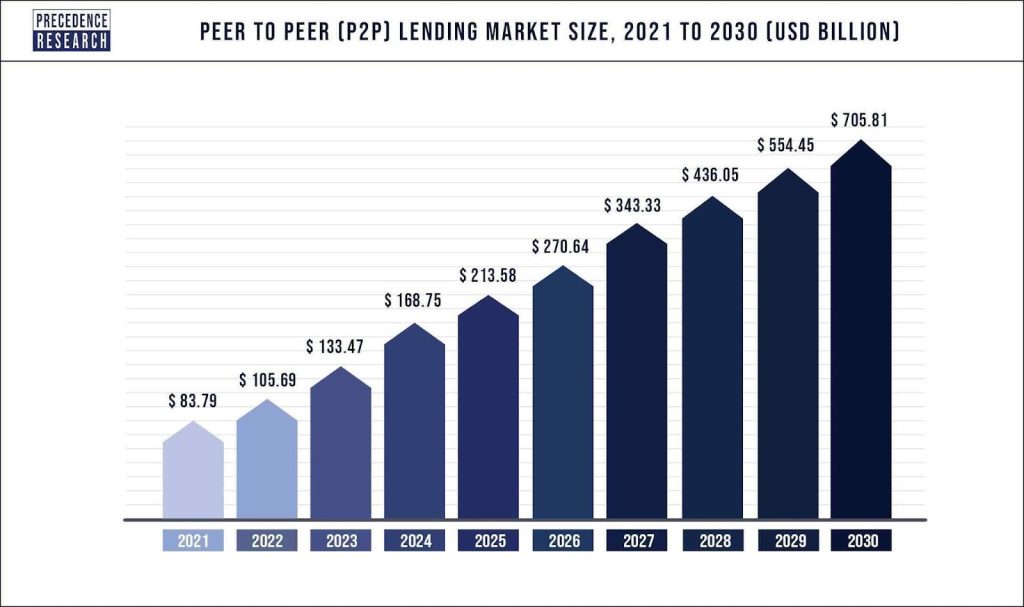

6. Generating Passive Income through Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers and individual lenders, presenting a lucrative opportunity for you to generate passive income. By lending money to others, you can gradually achieve financial freedom.

- Select a Reliable P2P Lending Platform: Conduct thorough research to identify a trustworthy P2P lending platform that suits your risk tolerance and investment objectives. Several well-regarded platforms include LendingClub, Prosper, and Funding Circle.

- Establish Your Investment Criteria: Define the types of loans and borrowers that align with your comfort level. Your investment criteria should consider credit score, loan purpose, and loan term.

- Diversify Your Investments: Minimize the risk of default by diversifying your investments across multiple loans. You can create a well-balanced portfolio by allocating small amounts to a diverse range of loans.

- Regularly Monitor Your Investments: Stay vigilant by consistently evaluating your loans’ performance and tracking borrowers’ repayment progress. Many platforms offer valuable tools and analytics to assist you in assessing the risk and return of your investments.

- Reap the Rewards of Passive Income: As borrowers repay their loans, you will earn passive income through interest payments. You can reinvest these repayments or withdraw them according to your cash flow management needs.

P2P lending presents a compelling alternative for earning passive income by providing loans to individuals or businesses. You should carefully assess the risk associated with each loan and diversify your investments effectively to minimize default risks.

Credit: precedenceresearch.com

7. Creating and Monetizing a Blog or YouTube Channel

If you are passionate about writing or producing videos, embarking on a blog or YouTube channel can effectively generate passive income. Below are the steps to commence your journey:

- Select a Specific Area of Interest: Pick a niche that reflects your passion and has a large audience. Differentiate yourself from your competitors with a unique perspective.

- Generate Valuable Content: Create top-notch content that offers substantial value to your audience. Develop engaging videos and blog posts that provide solutions, address queries, or engage viewers.

- Foster an Audience: Optimize your blog or YouTube channel for search engines, promote social media, and build networks. Interact with your audience through comments, emails, and social media.

- Monetize Your Platform: After you have built a dedicated audience, explore monetization strategies like display ads, sponsored content, and affiliate marketing.

- Enhance Passive Income Potential: Optimize your content quality, SEO implementation, and marketing tactics for more traffic and passive income. Experiment with various monetization approaches to identify the most effective methods for your audience and niche.

Establishing a successful blog or YouTube channel requires time and effort, but it can be gratifying to attain financial freedom while sharing your passion and expertise with others. Focus on delivering value, cultivating a loyal audience, and diversifying your income streams to optimize your earning potential.

Conclusion: Choosing the Right Passive Income Strategy for You

In summary, generating revenue passively offers a valuable avenue towards achieving financial independence and attaining a more adaptable way of life. There are various approaches to consider, such as investing in tangible assets like properties, exploring the realm of partner marketing, crafting digital educational courses, investing in stocks with dividend payouts, or pursuing other prospects for passive income. The crucial aspect is identifying a strategy that harmoniously aligns with your personal interests, proficiencies, and financial aspirations.

An initial investment of time and resources is necessary to construct a passive income source. Nevertheless, the potential rewards far outweigh the costs. Initiate the process by conducting thorough research into diverse ideas for generating passive income, evaluating their associated risks and potential returns, and then taking decisive action. It is wise to diversify your income streams, vigilantly monitor your investments, and consistently enhance your strategies to maximize your potential for passive income.

By embracing determination, perseverance, and a willingness to acquire knowledge, you can transform your aspirations of generating passive income into tangible achievements. Therefore, seize the opportunity today and embark on the journey to achieve financial freedom.