Planning for retirement is pivotal in attaining financial security, and initiating the process early on significantly enhances your prospects during your post-career years. While setting aside cash is consistently smart, making astute investments to optimize your returns is equally crucial. Given the many investment alternatives available, discerning the most suitable options can be overwhelming.

Consequently, we have curated a compendium of the foremost five investment approaches to assist you in maximizing the potential of your retirement savings. Whether you are nearing retirement or just commencing deliberations on the matter, these recommendations will facilitate the growth of your financial reserves and ensure a stable economic future.

From diversifying your investment portfolio to capitalizing on tax-advantaged accounts, we are at your disposal to navigate you through this process and aid in realizing your retirement objectives. Let us now embark on an exploration of the top investment strategies for optimizing your retirement savings.

What are Investment Strategies?

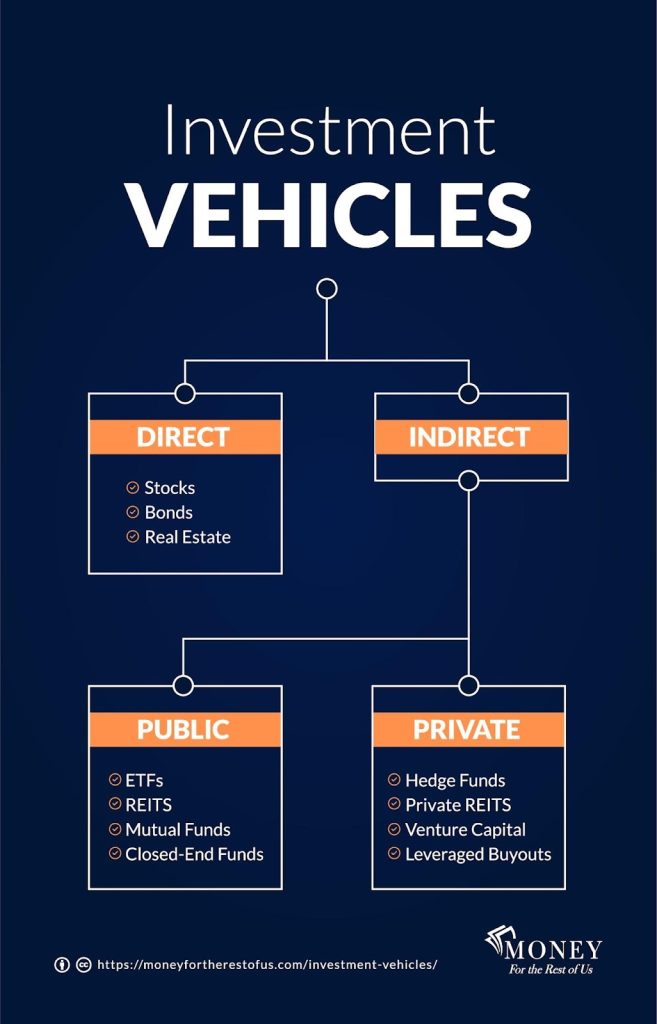

Investment strategies refer to well-thought-out approaches or methodologies to invest capital to attain favorable financial outcomes. Typically, an investment strategy entails allocating savings among various investment avenues, such as equities, fixed-income securities, pooled investment funds, or tangible assets like real estate. Investing’s primary goal is to optimize returns while mitigating potential risks.

Retirement Savings: The Importance of Diversification

Before delving into the top five investment strategies for optimizing your retirement savings, it is crucial to grasp the importance of diversification within your investment portfolio. Diversification involves carefully dispersing investments across different asset categories to diminish overall vulnerability. When you diversify your portfolio, the possibility of substantial losses due to poor performance in a single investment is significantly reduced.

Diversification holds great significance in the context of retirement savings since it pertains to long-term investment endeavors. The objective is to facilitate steady and incremental growth of investments over time while minimizing exposure to excessive risk. By diversifying your portfolio, you distribute risk across various investment types, thus enhancing your ability to navigate market fluctuations and achieve sustained financial prosperity in the long run.

Credit: moneyfortherestofus.com

Top 5 Investment Strategies for Maximizing Retirement Savings

Strategy 1: Investing in Stocks and Bonds

An investment strategy widely adopted for long-term wealth accumulation involves allocating funds to stocks and bonds. Stocks represent partial company ownership, while bonds entail lending money to corporations or governments. Both stocks and bonds have the potential for favorable returns but are not without risks.

Stocks generally carry a higher risk than fixed income due to their susceptibility to market conditions. However, stocks also hold the potential for greater long-term returns. On the other hand, fixed-income instruments are generally considered less risky but offer lower returns.

Investments in equities and bonds can balance risk and return. During periods of favorable stock performance, your investment portfolio is likely to grow at a faster pace. However, during market downturns, bonds can help mitigate losses. As you approach retirement age, allocating a larger proportion of your investments to fixed-income assets may be prudent to reduce overall risk.

Strategy 2: Real Estate Investing

Investing in real estate is a widely favored approach for retirement savings. It encompasses diverse investment opportunities such as rental properties, vacation homes, and commercial properties. These investments can generate consistent income through rent payments and potential long-term growth in value.

Although real estate investing carries inherent risks, such as market volatility and property maintenance expenses, it can also yield a dependable income stream throughout retirement.

For those uninterested in direct property ownership, an alternative is investing in real estate investment trusts (REITs). REITs are companies responsible for owning and managing real estate properties, providing investment diversification opportunities.

Strategy 3: Annuities and Other Insurance Products

Investing in annuities and insurance products can be a valuable choice for individuals seeking secure income in their retirement years. An annuity serves as a contractual agreement with an insurance company, ensuring a reliable income stream for a specified duration or even for life. Two types of annuities exist fixed and variable. Fixed annuities guarantee an interest rate, while variable annuities have the potential for greater returns based on market performance.

Insurance products like life insurance policies with cash value components can also function as investment tools. These policies provide a death benefit to beneficiaries and accumulate cash value gradually.

Even so, you should be aware that fees and charges associated with annuities and insurance products can negatively affect your return. Prior to investing in these products, it is important to carefully evaluate their costs and advantages.

Strategy 4: Investing in Mutual Funds

Collective investment schemes are professionally overseen investment portfolios that combine funds from numerous investors to be allocated in stocks, bonds, or alternative holdings. These mutual funds present an opportunity for investment diversification without the need to individually select specific stocks or bonds. Moreover, they serve as an advantageous choice for novice investors or individuals with limited investment capital.

As a point of fact, mutual funds may involve certain expenses and levies such as management fees and sales charges. You should thoroughly review the prospectus of a particular scheme before making any investments, enabling a comprehensive comprehension of the associated costs and risks.

Strategy 5: Investing in Exchange-Traded Funds (ETFs)

Investment products known as exchange-traded funds (ETFs) function similarly to mutual funds by consolidating funds from multiple investors to create a varied portfolio of assets. The notable distinction lies in ETFs being tradable on exchanges akin to stocks, allowing for buying and selling opportunities during regular trading hours.

ETFs present the advantage of potentially lower fees when compared to mutual funds, providing an appealing alternative for investors seeking diversification without the need to handpick individual stocks or bonds. Nonetheless, it remains crucial to diligently peruse a fund’s prospectus prior to investment, ensuring comprehension of associated expenses and risks.

Choosing the Right Investment Strategy for Your Retirement Savings

Navigating the complex retirement savings landscape necessitates thoughtful consideration in selecting an investment approach. The decision-making process is affected by factors such as age, risk tolerance, and financial objectives. To reduce risk and boost long-term returns, diversification techniques must be used.

Stocks, bonds, real estate, annuities, mutual funds, and ETFs can all be used to safeguard retirement savings. It is imperative to recognize that each strategy entails distinct risks and rewards, thereby warranting a meticulous evaluation of available options before committing funds.

By adhering to these expert-endorsed retirement investment tactics, individuals can enhance financial stability and foster a secure future during their golden years. Initiating investments early, ensuring portfolio diversification, and seeking guidance from a financial professional can significantly contribute to attaining retirement goals.