Financial markets are fast-paced and unpredictable today, which makes value investing more relevant than ever. The long-term investment of value assets offers the potential to grow your wealth safely.

Why should you consider value investing?

As part of this article, we will examine the fundamentals of value investing and strategies to help you succeed financially. From analyzing intrinsic values to analyzing market trends, we’ll equip you with the tools and knowledge to succeed. No matter what level you are at in your financial journey, this article will help you uncover the secrets of value investing. Discover how value investing can exponentially grow your wealth.

The principles of value investing

Imagine you’re at a bustling market and spot a beautiful antique priced way below its worth. You know its true value, and you can’t believe your luck. That’s the thrill of value investing! It’s all about discovering those hidden gems – companies whose intrinsic value far outstrips their current market price. It’s like having a secret superpower that lets you see the diamond in the rough.

Value investing is like being a financial Sherlock Holmes. You’re delving into the heart of a company, examining its earnings, cash flow, and assets to uncover its real worth. It involves seeing beyond the surface and discovering the true value others may have overlooked. It’s also important to realize that investing in undervalued assets isn’t just about making quick gains; it’s about minimizing risk and maximizing returns over time.

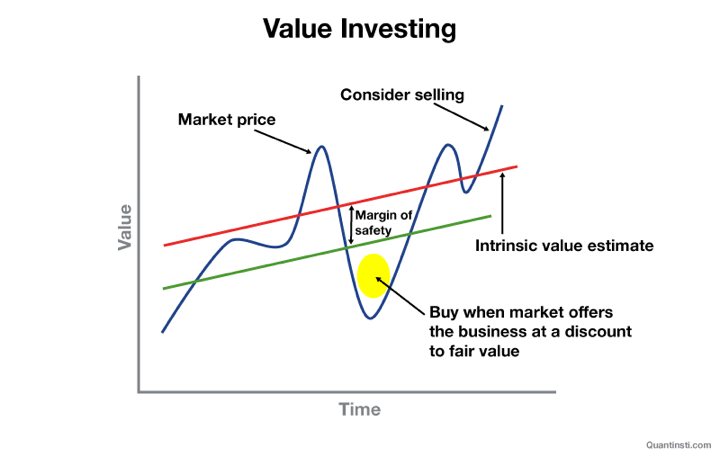

Now, let’s talk about the secret weapon of value investing – the margin of safety. Picture it as a safety net, protecting you from the high-wire act of the stock market. By buying assets well below their estimated intrinsic value, you’re cushioning yourself against potential losses. It’s like buying an umbrella before it rains – you’re prepared for market volatility, increasing your chances of positive returns. This principle is the heart and soul of value investing, underscoring the need for patience, discipline, and meticulous analysis.

Finally, value investing is all about having a long-term vision. It’s understanding that the market can sometimes be like a moody weather vane, swinging this way and that. Short-term price fluctuations? They’re just noise. Instead of trying to predict the market’s every move, value investors stay cool and collected, focusing on the long haul. By investing in undervalued assets and holding onto them, they harness the power of compounding, potentially achieving impressive growth in their wealth. It’s not about timing the market; it’s about time in the market.

The benefits of value investing

Dive into the world of value investing, and you’ll discover a treasure trove of benefits that can help you safely grow your wealth. Imagine yourself as a treasure hunter discovering hidden treasures others have overlooked. That’s what value investing feels like. You’re buying undervalued assets, waiting for the world to realize their true worth. As this happens, you stand to reap potentially higher returns. It’s like buying a masterpiece at a garage sale and later selling it for its true worth at an auction.

But the magic of value investing doesn’t stop there. It’s also your shield in a stormy market. You’re essentially putting on financial armor by focusing on companies with a safety margin. Even if the market takes a nosedive, your undervalued assets are less likely to be struck. They might even turn into golden opportunities for buying. It’s like having a sturdy umbrella that keeps you dry even when pouring, reducing your overall risk.

And then there’s the discipline that value investing instills. It’s like being a wise sage who doesn’t get swayed by the market’s mood swings or short-lived trends. Instead, you rely on fundamental analysis and intrinsic value, making decisions based on facts, not feelings. By taking this rational approach, your long-term goals will remain clear and you are less likely to make costly mistakes. Despite the noise and chaos in the market, it keeps you on track. It’s a mindset, not just a strategy, that encourages patience, discipline, and a focus on the big picture.

Credit: blog.quantinsti.com

How to identify undervalued stocks

The core element of value investing is finding undervalued stocks. Investing decisions must be evaluated in great detail based on a company’s financials and market conditions.

- P/E Ratio: View the Price-to-Earnings (P/E) ratio as a magnifying glass, highlighting the relationship between earnings per share (EPS) and stock price. P/E ratios lower than industry norms or historical averages might suggest “undervalued stock.” Keep in mind that this is only one part of the puzzle. You should also consider growth prospects and industry trends.

- P/B Ratio: The Price-to-Book (P/B) ratio is your compass, pointing out the direction between a company’s stock price and net asset value per share. If the P/B ratio is less than 1, you might have stumbled upon an undervalued stock. Still, don’t jump in too soon. Make sure you scrutinize the company’s balance sheet and understand its assets’ quality before you move.

- Dividend Yield: The dividend yield is your beacon in the dark, showing the annual dividend payment as a percentage of the stock price. A high dividend yield could signal that the stock is undervalued, especially if the company consistently pays dividends. But don’t forget to check the company’s financial health and the sustainability of its dividends before you set sail toward it.

- The Earnings Growth Potential: The map to your treasure might be in a company’s earnings growth potential. Companies with solid growth prospects could be undervalued if the market hasn’t fully factored in their future earnings potential. You must examine industry trends, competitive advantages, and the management’s track record to find these hidden gems.

- The Balance Sheet: A company’s financial health is your shield in value investing. Assess a company’s long-term growth potential by looking at debt levels, liquidity, and asset quality. A company with a strong balance sheet and low debt levels might be undervalued if the market has not considered its financial strength.

Remember, finding undervalued stocks is like a treasure hunt. It requires patience, diligence, and a keen eye for detail.

Value investing strategies

Value investing encompasses various strategies investors can employ to identify undervalued assets and generate favorable returns. Here are a few popular value investing strategies:

- Deep Value Investing: This strategy identifies severely undervalued companies trading at a significant discount on their intrinsic value. Deep value investors often look for distressed companies or industries facing temporary challenges. By investing in these undervalued assets, they aim to benefit from a potential recovery and significant price appreciation.

- Contrarian Investing: Contrarian investors go against the market sentiment and invest in companies out of favor or face negative news. This strategy requires identifying opportunities where the market has overreacted, leading to undervaluation. Investors believe that short-term pessimism offers a discounted opportunity to buy quality assets.

- Dividend Investing: Dividend investing focuses on investing in companies that consistently pay dividends. This strategy seeks to generate income from dividend payments while benefiting from potential capital appreciation. Dividend investors often look for companies with a history of increasing dividends, strong cash flow generation, and sustainable payout ratios.

- Special Situations Investing: This strategy involves investing in companies undergoing significant corporate events or situations that may create value. An example of a particular situation is a merger or acquisition, a spin-off, a restructuring, or a bankruptcy. Investors can identify undervalued opportunities by analyzing these events and their potential impact on a company’s value.

- Focused Value Investing: Focused value investors concentrate their investments on a limited number of undervalued stocks. They aim to identify a handful of high-quality stocks trading below their intrinsic value by conducting in-depth research and analysis. This concentrated approach allows investors to capitalize on their best ideas and potentially achieve outsized returns.

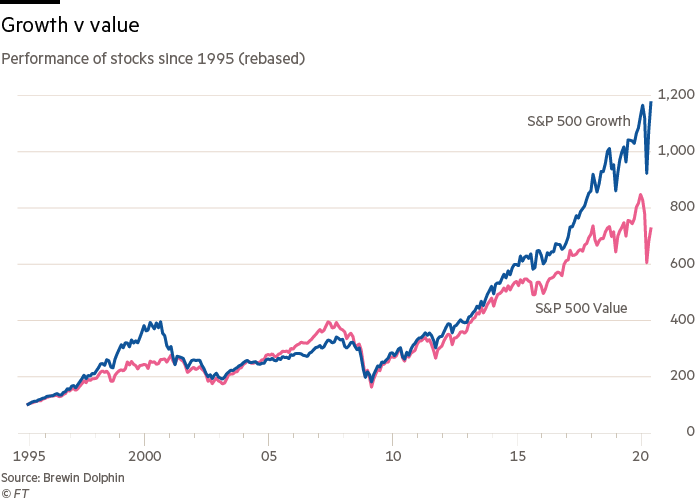

Credit: www.ft.com

Common mistakes to avoid in value investing

While value investing can be a rewarding strategy, it’s essential to avoid common pitfalls that can hinder investment success. Here are some mistakes to avoid in value investing:

- Ignoring Quality: Investing solely based on valuation metrics without considering the company’s quality can be costly. It’s crucial to assess factors such as the company’s competitive advantage, management team, and industry dynamics to ensure that poor quality does not justify the undervaluation.

- Falling for Value Traps: Some companies may appear undervalued but face structural challenges that make their recovery unlikely. Falling for value traps can result in significant losses, as the market may discount the company’s value. Thorough analysis and a deep understanding of the company’s fundamentals are essential to avoid value traps.

- Short-Term Focus: Value investing requires patience and discipline over the long haul. Be careful not to be swayed by short-term market movements or trying to time the market. Focusing on the long-term prospects of undervalued assets and staying committed to the investment thesis can help avoid costly mistakes.

- Lack of Diversification: Concentrating investments in a few undervalued stocks can increase the portfolio’s risk. Diversifying portfolios across industries and asset classes is crucial to mitigate risk. Diversification helps spread risk and ensures that the portfolio is not overly exposed to the performance of a single company or industry.

- Overlooking Catalysts: While the market may eventually recognize undervalued assets, it’s essential to consider the catalysts that can trigger the revaluation. Identifying potential catalysts, such as new product launches, management changes, or industry trends, can help determine the likelihood of the undervalued assets realizing their true value.

Tips for successful value investing

To succeed in value investing, consider the following tips:

- Thorough Research: Analyze and research the investment thoroughly. Investigate the financials, the competitive environment, the dynamics of the industry, and the potential risks involved. Don’t invest in companies you are unfamiliar with.

- Patience and Discipline: Value investing requires patience and discipline. Be prepared to hold investments for the long term and avoid being swayed by short-term market fluctuations. Stick to your investment thesis and avoid making impulsive decisions based on market noise.

- The margin of Safety: Always invest with a margin of safety. Buy assets at a significant discount to their intrinsic value to protect against potential losses. Higher margins of safety mean lower risks and higher returns.

- Diversification: Spread your assets across various sectors. By diversifying, the portfolio is less affected by the performance of individual companies or industries. To achieve a balanced portfolio, invest in undervalued stocks, bonds, and other assets.

- Continuous Learning: Value investing is a lifelong learning process. Stay updated on market trends, industry developments, and new investment opportunities. Read books, attend seminars, and follow successful value investors to enhance your knowledge and refine your investment approach.

Credit: edgeinvestments.org

Value investing vs. growth investing

Imagine yourself at a crossroads with the opportunity to find a treasure chest full of undervalued gems or a garden full of fast-growing, promising seeds. You must choose between value investing and growth investing in this exciting world of investing. Based on your personal goals and your willingness to take risks, each path has its own allure and potential pot of gold.

Value investing is like being a savvy bargain hunter. The goal is to find undervalued companies with strong foundations – think of stable cash flows, strong balance sheets, and profitable track records. Similar to buying a vintage car at a discount and later realizing its true value.

On the flip side, growth investing is like being a venture capitalist in Silicon Valley. You’re scouting for companies that are growing at a breakneck speed. Yes, their valuations might seem sky-high, but you’re willing to pay that premium because you believe in their potential to skyrocket even further. Think of it as betting on the next big startup.

The investing world is divided into camps that swear by either value or growth investing. But remember, it’s your journey. The two strategies can be combined to create a diversified portfolio that benefits from varying market conditions. After all, who says you can’t have the best of both worlds?

Historical examples of successful value investors

Let’s take a stroll down memory lane and meet some of the rockstars of the investing world who’ve made a fortune through value investing.

First up, we have Benjamin Graham, the grandmaster of value investing. As the “father of value investing,” Graham’s wisdom has guided countless investors for decades. Those seeking to master value investing should read his book, “The Intelligent Investor.” He had many disciples, but Warren Buffett stands out.

It is hard to argue with the success of value investing as exemplified by Warren Buffett, the Oracle of Omaha. The strategy he follows is simple and powerful – he finds undervalued companies with strong fundamentals and holds onto them for the long haul. What are the results? A track record of returns would make Midas green with envy. His investment firm, Berkshire Hathaway, is a powerhouse of successful businesses, and his annual letters to shareholders are like a masterclass in investing.

Last but not least, we have Seth Klarman, the wizard behind the Baupost Group. Known for his painstaking research and patience, Klarman has a knack for finding deep value opportunities and managing risk. He emphasizes independent thinking, taking a long-term view, and going against the crowd in his investment philosophy. The success story of his investments demonstrates the importance of patience and diligence in investing.