Welcome to the consummate beginner’s manual for venturing into equity investments! Are you prepared to commence a voyage toward fiscal prosperity and creating a flourishing asset collection?

Initially, equity investments might appear intimidating, but armed with the right insights and tactics, you can confidently traverse the market landscape.

This all-encompassing manual will elucidate vital pointers and stratagems to assist you in constructing a prosperous portfolio. This guide caters to both the novice investor and those who have had some prior encounters with investment, aiming to bestow upon you a fundamental grasp of equities and equip you with the necessary toolkit for well-informed investment choices.

From grasping the rudiments of the equity market to evaluating the performance of corporations, we’ll encompass it all. Brace yourself to assume control of your fiscal destiny and harness the untapped potential of the equity market. Without further ado, let’s plunge in!

Understanding the stock market

For a deeper awareness of the stock market, it is crucial to become familiar with its fundamental aspects without arousing suspicion. The stock market serves as a platform where buyers and sellers trade publicly listed companies shares. Knowledge about key concepts and terminologies associated with this domain is essential for making well-informed investment choices.

Stocks represent ownership in a company, and purchasing them makes you a shareholder. The stock market encompasses various exchanges, such as the NYSE and NASDAQ, facilitating stock trading. Stocks are further classified into distinct sectors like technology, healthcare, and finance, each harboring its unique characteristics and risks.

Effectively navigating the stock market necessitates comprehensively comprehending how stock prices are determined. These prices are influenced by the interplay of supply and demand, which, in turn, are impacted by factors like company performance, economic conditions, and investor sentiment. Grasping these factors empowers you to analyze stock prices judiciously and make prudent investment decisions.

It is also crucial for investors to acquaint themselves with different types of orders employed when buying or selling stocks. Market orders execute at the prevailing market price, while limit orders enable you to establish a specific price at which you desire to buy or sell a stock. A stop-loss order limits potential losses by automatically selling a stock if it reaches a certain price.

Having mastered these concepts, you will embark on a path toward comprehending the intricacies of the stock market. Investors should keep in mind that stocks carry inherent risks, so conducting thorough research and seeking professional advice, if necessary, becomes critical.

Benefits of investing in stocks

Stock investments offer a number of advantages that can benefit your financial future. Here are a few key benefits:

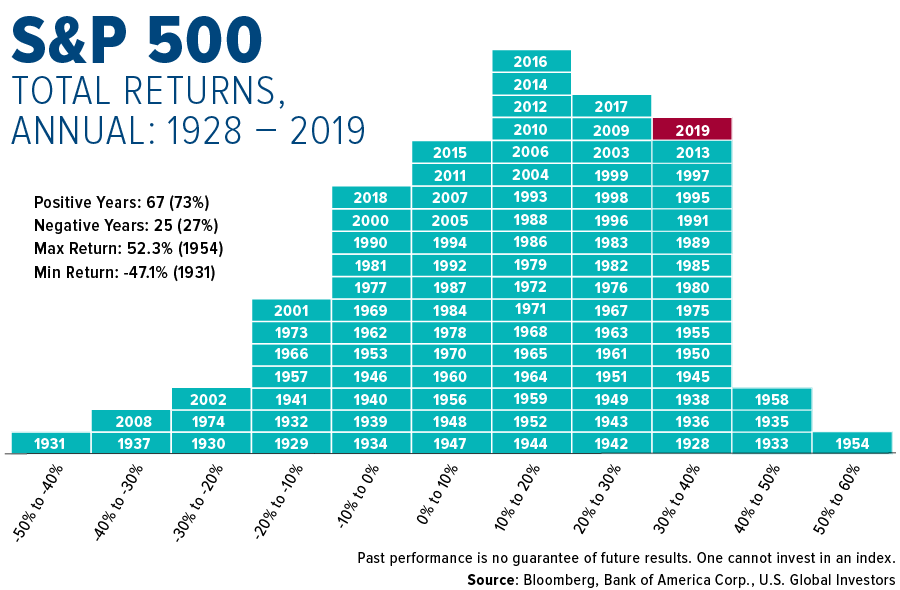

- Growth potential over time: Stocks historically outperform bonds and cash, providing long-term wealth accumulation opportunities. Investing in well-performing companies allows you to increase your financial resources over the years significantly.

- Income from dividends: Many companies distribute a portion of their profits to shareholders through dividends. Dividend-paying stocks can generate a steady income that can supplement your earnings or be reinvested to foster further growth.

- Market liquidity: Stocks are highly liquid assets, allowing for easy buying and selling on the stock market. This liquidity empowers you to swiftly respond to market fluctuations or seize investment prospects as they arise.

- Portfolio diversification: Stock investments enable you to diversify your portfolio by spreading your funds across various companies and sectors. Diversification mitigates the impact of poor performance by any single company on your overall investment portfolio.

- Ownership and voting privileges: When you invest in stocks, you obtain partial company ownership. As a shareholder, you may enjoy voting rights on matters like electing the board of directors or approving significant decisions.

It’s essential to acknowledge that stock investing carries certain risks, including potential capital losses. However, with thorough research, prudent risk management, and a long-term mindset, the benefits of investing in stocks can outweigh these risks. To enhance your understanding further, let’s debunk some prevalent myths about stock investing.

Credit: topforeignstocks.com

Common stock investing myths debunked

Numerous misconceptions exist surrounding the world of stock investing, which often dissuade newcomers from venturing into the market. Here are some widely held myths dispelled:

- Myth: Investing in stocks is akin to gambling: While short-term volatility is common, investing in stocks differs fundamentally from gambling. Unlike gambling, stock investing entails a comprehensive analysis of company performance, market trends, and economic indicators to make well-informed decisions. Through thorough research and diversification of investments, you can minimize the risks associated with stock investing.

- Myth: A substantial sum of money is necessary to invest in stocks: Many believe that stock investing is exclusive to the affluent or those with significant capital. However, this notion is unfounded. Thanks to the advent of online brokerage platforms and fractional share investing, you can commence your stock investment journey with as little as a few dollars. What truly matters is consistency and discipline in investing rather than the initial investment amount.

- Myth: Stock investing is only for seasoned experts: While it is true that investing demands knowledge and research, anyone can acquire the basics and engage in stock investing. With the abundant educational resources accessible online, you can attain the essential skills and knowledge required to make informed investment choices. It is important to start small, gradually gain experience, and continually educate yourself to enhance your investing prowess.

- Myth: Timing the market is the key to success: Attempting to time the market by predicting short-term price movements is exceedingly challenging, even for seasoned investors. Rather than fixating on market timing, adopting a long-term investment approach holds greater significance. Through consistent investing over time, you can benefit from the compounding effect and alleviate the impact of short-term market fluctuations.

By comprehending and debunking these prevailing myths, you can approach stock investing with a more realistic outlook. Now, let us evaluate your risk tolerance and establish financial objectives.

Evaluating your risk tolerance for stock investing

Before delving into stock investing, evaluating your risk tolerance is crucial. Risk tolerance pertains to your capacity and willingness to withstand potential losses or fluctuations in the value of your investments. Multiple factors influence it, including your financial circumstances, investment objectives, time frame, and personal comfort level regarding risk.

To assess your risk tolerance effectively, take into account the following aspects:

- Financial circumstances: Assess your financial stability, income, expenses, and debt commitments. Taking on more risk might be acceptable in a stable financial situation, while a precarious one might require caution.

- Investment objectives: Determine what you want to get out of your investments, such as saving for retirement, funding your child’s education, or buying a home. The risk tolerance of shorter-term goals may be higher than that of longer-term goals.

- Time frame: Determine the period you aim to accomplish your investment goals. Longer time frames generally enable a greater tolerance for risk, as they provide more opportunities to recover from potential losses.

- Comfort level with risk: Reflect on your stance toward risk. Are you at ease with the possibility of short-term fluctuations in your investment’s value? Understanding your emotional response to risk can facilitate better decision-making in assets.

By carefully considering these factors, you can comprehensively understand your risk tolerance. It is vital to balance assuming sufficient risk to achieve your financial objectives and avoiding excessive risk that could endanger your financial well-being. Once you have assessed your risk tolerance, you can establish clear financial goals.

Establishing Financial Objectives for Investing in Stocks

Defining well-defined financial objectives is pivotal in constructing a prosperous stock portfolio. Your objectives will serve as a roadmap for your investment choices and assist you in remaining focused amidst market fluctuations. Here’s a comprehensive approach to setting effective financial objectives:

- Specify your objectives: Begin by identifying your immediate and long-term financial aspirations. Immediate objectives involve saving for a getaway or purchasing a vehicle, while long-term objectives could encompass retirement planning or building a college fund. Be precise about the monetary amount required and the desired timeframe for accomplishing each goal.

- Prioritize your objectives: Determine the relative importance of each objective and prioritize them accordingly. Some targets may necessitate immediate attention, while others can be pursued over an extended period. By establishing priorities, you can allocate your resources efficiently and make the necessary investment choices to attain your primary objectives.

- Quantify your objectives: Assign a specific monetary value to each objective. This will aid in determining the amount you need to save or invest to reach your goals. Take into account factors such as inflation and any supplementary sources of income, such as dividends or rental earnings, to ensure the feasibility of your objectives.

- Establish a timeframe:

Set a timeline for each objective to create a sense of urgency and accountability.

Divide long-term objectives into smaller milestones to track your progress.

Regularly review and adjust your timeline as required to stay on course. - Monitor and evaluate: Once you have established your financial objectives, monitoring and evaluating your progress is vital. Assess your portfolio, track your savings, and make adjustments if necessary. Celebrate milestones along the way to stay motivated and maintain your concentration.

By setting precise and attainable financial objectives, you can align your investment strategy with your aspirations and enhance your likelihood of success. Now that you possess a solid foundation in comprehending the stock market, evaluating your risk tolerance, and establishing financial objectives, let’s explore the practical aspects of investing in stocks.

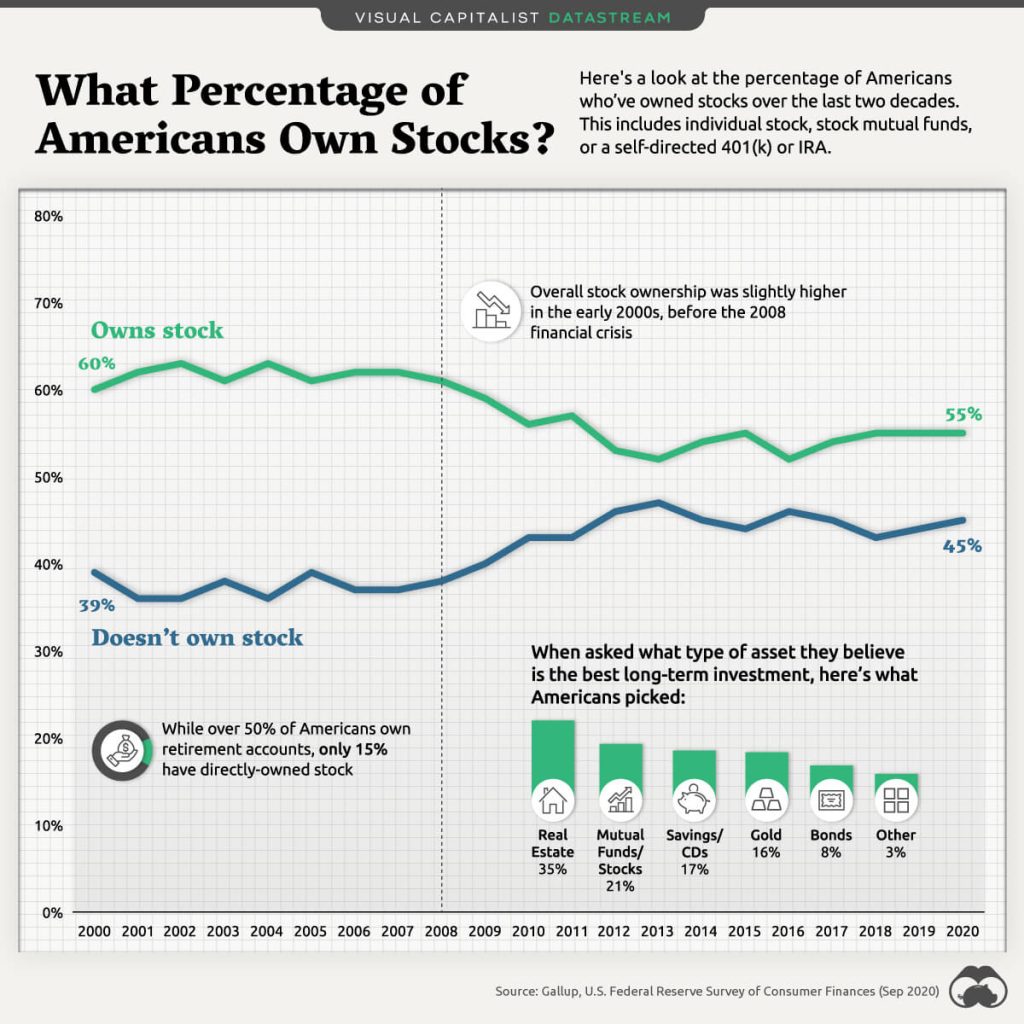

Credit: visualcapitalist.com

Selecting the Optimal Brokerage Account for Stock Investment

When engaging in stock investment, choosing the most suitable brokerage account is crucial. A brokerage account functions as a financial vehicle enabling the buying and selling stocks, bonds, mutual funds, and other investment assets. Here are several key factors to bear in mind when making your brokerage account selection:

- Transaction Costs and Charges: Different brokerage firms impose varying fees and commissions for executing trades. It is essential to compare fee structures and evaluate their potential impact on your investment returns. Seek brokerage accounts that offer competitive pricing and minimize transaction fees.

- Minimum Account Requirements: Certain brokerage accounts necessitate a minimum deposit to initiate an account. If you are a novice investor with limited funds, look for brokerage firms that impose low or no minimum deposit requirements.

- Diverse Investment Options: Assess the breadth of investment choices available through the brokerage account. Confirm that the account grants access to the specific stocks, bonds, or funds that pique your investment interest. Additionally, ascertain whether the brokerage provides research tools and educational resources to bolster investment decisions.

- Intuitive Platform: An intuitive trading platform can significantly enhance your investment experience, particularly if you are a beginner. Seek brokerage accounts that provide user-friendly trading platforms, mobile applications, and educational materials to help you navigate the stock market with ease and efficiency.

- Customer Support: Evaluate the quality of customer support rendered by the brokerage firm. Prompt and dependable customer service proves vital when encountering issues or requiring clarification regarding your account or trades.

- Robust Security Measures: Ensure that your chosen brokerage account incorporates robust security measures to safeguard your personal and financial information. Look for accounts offering two-factor authentication and encryption protocols to protect your assets.

By thoughtfully considering these factors, you can identify a brokerage account that aligns with your investment requirements and preferences. Once you have chosen a suitable brokerage account, you are primed to commence the process of selecting stocks for your portfolio.

Strategies for Selecting Stocks

Choosing the right stocks is vital for achieving success in your investment portfolio. Several effective stock selection strategies exist, and it’s crucial to opt for an approach that harmonizes with your investment objectives, risk tolerance, and investment timeframe. Below are a few popular strategies to consider:

- Value investing: Value investing concentrates on identifying currently undervalued stocks and trading below their intrinsic worth. Investors utilizing this strategy search for stocks with solid fundamentals, such as low price-to-earnings (P/E) ratios and robust balance sheets. The objective is to purchase shares at discounted prices and awaits the market’s acknowledgment of their true value.

- Growth investing: Growth investing involves selecting stocks of companies that are projected to experience above-average growth compared to the overall market. Growth investors focus on companies with robust earnings growth, innovative products or services, and a competitive edge in their industry. This strategy often involves investing in rapidly expanding sectors like technology or healthcare.

- Dividend investing: Dividend investing entails choosing stocks of companies that consistently distribute a portion of their profits as dividends. Dividend investors seek stocks with a history of reliable dividend payments, high dividend yields, and the potential for future dividend growth. This strategy is favored by income-focused investors who prioritize generating passive income.

- Index fund investing: Index fund investing involves purchasing a diversified portfolio of stocks replicating a specific stock index, such as the S&P 500. Index funds offer broad market exposure, low fees, and simplicity. Passive investors often prefer this strategy, aiming to match the overall market performance rather than outperform it.

Many investors combine elements of different strategies in their portfolios, so these strategies are not mutually exclusive. The key is discovering a system that suits your investment style and aligns with your financial objectives. Additionally, conducting thorough research, analyzing company financials, and staying informed about market trends are essential for successful stock selection.

Credit: economictimes.indiatimes.com

Enhancing Portfolio Diversification

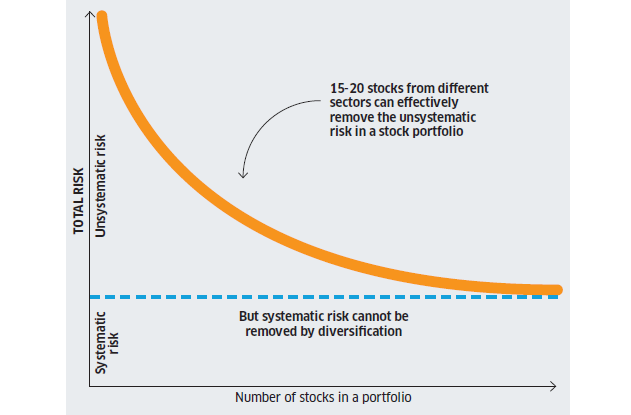

Portfolio diversification is a crucial strategy for managing risks effectively by distributing investments across various asset classes, sectors, and geographic locations. This approach helps mitigate the impact of poor performance in any individual investment on the overall portfolio. The following factors should be taken into account when diversifying your stocks:

- Optimal asset allocation: Spread your investments among stocks, bonds, cash equivalents, and real estate. The suitable asset allocation depends on factors such as risk tolerance, investment objectives, and time horizon. A well-diversified portfolio typically incorporates a mix of assets that exhibit diverse performance patterns under different market conditions.

- Sector distribution: Distribute your stock investments across different sectors within the economy. This strategy reduces the risk of heavy exposure to the performance of a single industry. Consider investing in sectors like technology, healthcare, finance, consumer goods, and energy to achieve sector diversification.

- Company variety: Within each sector, diversify your investments by selecting stocks from various companies. It is crucial to avoid overconcentration in any single stock, as this exposes your portfolio to unnecessary risks. Aim to maintain a diversified stock portfolio encompassing various industries and market capitalizations.

- Geographical dispersion: Explore investment opportunities in stocks from diverse geographic regions and countries. Geographic diversification provides a broader scope for potential returns and helps reduce the impact of regional economic fluctuations.

To sum up

In conclusion, venturing into the realm of stock investing as a beginner necessitates a comprehensive understanding of market dynamics, the ability to manage risks, and financial literacy. It is crucial to distribute your investments across various assets, comprehend economic patterns, and regularly assess your investment approach. Exercising patience is highly valuable in the stock market, as immediate gains should not be anticipated. Instead, prioritize consistent and long-term growth. It is important to acknowledge that investing in stocks carries inherent risks, and it is advisable to seek professional guidance to make well-informed decisions. Continuous learning, adaptation, and enhancement of your financial expertise will facilitate effective navigation through the intricate world of stock investing. Are you prepared to immerse yourself in the realm of stock investment and construct a prosperous portfolio? Best of luck with your investment endeavors!