Are you prepared to elevate your investment game to unprecedented heights? The secret weapon might just be nestled in the overlooked realm of small-cap stocks. These hidden gems might lack the star-studded recognition that their bigger brethren boast, yet they possess a unique charm of untapped growth prospects, potentially leading you down a path of profitable rewards. This discussion will dive deep into the whirlwind world of small-cap stocks, highlighting their tantalizing rewards and risks and their noteworthy place in your investment game plan.

Think about the enticing possibility of exponential financial growth and the thrill of discovering underestimated market standouts – that’s the magic of small-cap stocks! They hold the potential to radically revolutionize your financial trajectory. However, as with any adventure, understanding the terrain is crucial. We’ll delve into the inherent risks and help you design a strategy that seamlessly syncs with your ambitions and risk appetite.

So, if you’re all set to embark on a thrilling journey into the vibrant universe of small-cap stocks, continue reading to unearth a treasure trove of strategies and insights. These will equip you to navigate small-cap investments’ fluctuating and potentially fruitful realm deftly. Let’s elevate your financial narrative together!

What are small-cap stocks?

Welcome to the exciting realm of small-cap stocks, a dynamic arena where businesses are valued between $300 million and $2 billion in market capitalization. In this vibrant sector, companies, often in the nascent stages of their expansion, are nurturing dreams to blossom into the next blockbuster success stories.

These aspiring heavyweights are typically found within rapidly evolving industries or those at the cusp of disruption. Technology, healthcare, and biotechnology are among their favorite playgrounds, offering fertile soil for growth and innovation.

The prospect of investing in small-cap stocks can be an exhilarating journey for those investors with an appetite for capitalizing on the growth potential these burgeoning companies offer. However, navigating these turbulent waters requires a well-articulated strategy and a comprehensive understanding of the potential windfalls and pitfalls.

Embarking on the adventure of small-cap investing is about more than just the thrill. It’s also about the diligence and precision it demands. These ventures can offer lucrative rewards, yet they also come with their own unique set of challenges. A blend of informed strategy, robust risk assessment, and a dash of daring can make small-cap investing a rewarding part of your financial portfolio. Dive in, but remember, wisdom and caution make for the best co-pilots.

Potential rewards of investing in small-cap stocks

Picture yourself as an intrepid explorer in the financial landscape, keen to discover new territories of growth and value. This is the thrilling expedition that awaits you when you invest in small-cap stocks. Their relatively diminutive size and market capitalization make them the dark horses of the stock market, brimming with the potential for stratospheric gains in a brief timeframe. When a small-cap stock gains momentum, it’s akin to catching a shooting star – the returns can be breathtakingly significant.

Think of small-cap stocks as the undiscovered masterpieces of the investment world. In contrast to their large-cap counterparts, which often bask in the limelight and the scrutinizing eyes of analysts, small-cap stocks maintain a lower profile, presenting a golden opportunity for discerning investors to uncover undervalued entities. Identifying these hidden treasures before they steal the limelight can set the stage for strikingly substantial profits.

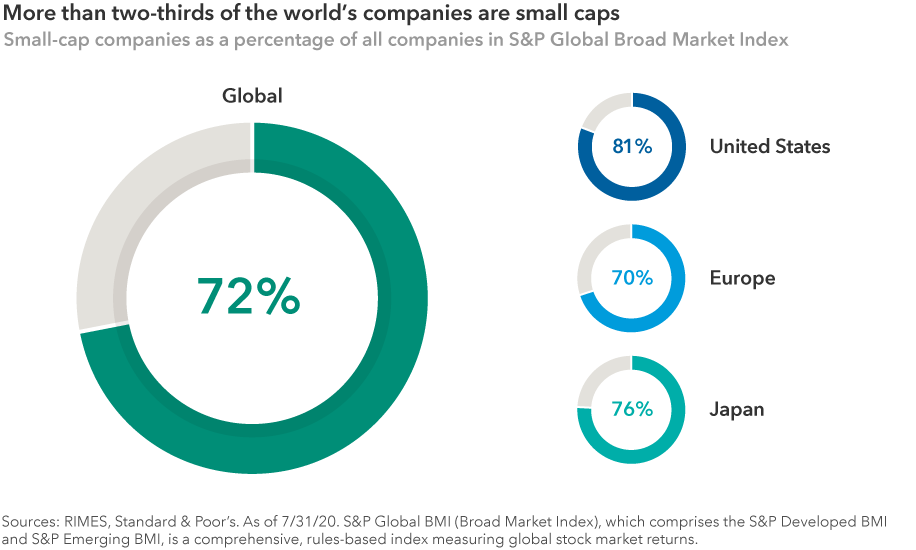

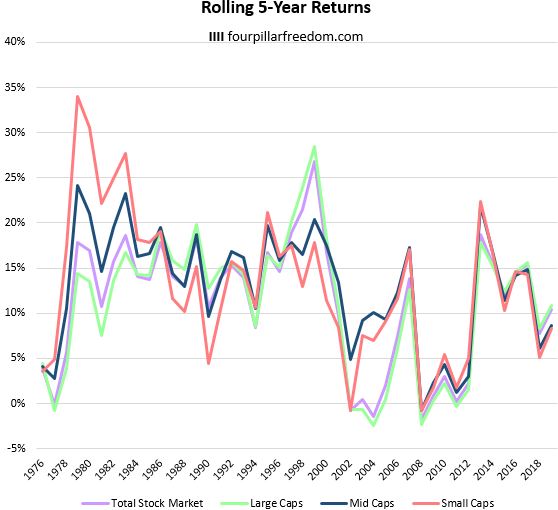

But that’s not all! Small-cap stocks come with an added benefit: they can serve as potent tools for diversification, contributing to the robustness of your investment portfolio. You can diffuse your risk and potentially bolster your overall returns by spicing up your investment mix with small-cap stocks alongside large-cap and mid-cap stocks. These under-the-radar assets often show lesser correlation with larger stocks, making them a compelling proposition for those who wish to diversify their portfolio and add an extra layer of resilience. Investing in small-cap stocks is akin to introducing a sprinkle of spice to a meal, enhancing the flavor while contributing to a balanced dietary mix.

Venture into the exhilarating world of small-cap stocks and prepare yourself for a thrilling exploration of growth, value, and diversification!

Credit: capitalgroup.com

Risks of investing in small-cap stocks

Small-cap stock investment can seem like diving into a treasure-filled grotto, shimmering with the promise of enormous returns. However, one must bear in mind that this venture is not without its perils. These pint-sized stocks inherently exhibit more erratic behavior than their blue-chip brethren, leading to drastic price oscillations in a blink. This capricious nature can trigger considerable setbacks for investors who haven’t braced themselves for the roller-coaster ride of market dynamics.

Furthermore, it’s important to recognize the elephant in the room – liquidity. Small-cap stocks often boast lower trade volumes, turning the act of buying or selling hefty share amounts into a high-stakes game of chess, fraught with the potential to upset the stock’s price stability. Compounding this issue is the deficiency of analyst coverage and information pertaining to small-cap stocks, which can make it feel like navigating a labyrinth in the dark for investors striving to make knowledge-driven decisions.

A crucial facet to remember is the increased vulnerability of small-cap stocks to economic whirlwinds and unexpected market jolts. These smaller players, often lacking in vast resources and financial maneuverability, can find themselves precariously perched on edge during economic turbulence. Therefore, investors should be geared up for greater volatility and the specter of heightened losses when the market takes a downward dive.

How to identify promising small-cap stocks

Identifying promising small-cap stocks requires careful research and analysis. Small-cap stocks should be evaluated based on these factors:

- Financial health: Review the company’s financial statements, including revenue growth, profitability, and debt levels. A strong balance sheet and strong financials are essential.

- Management team: Evaluate the experience and track record of the management team. Look for companies with competent and visionary leaders who have a proven ability to execute strategies and drive growth.

- Industry trends: Consider the industry in which the company operates. Invest in small-cap stocks in sectors experiencing growth or disruption.

- Competitive advantage: Check if the company offers a unique product or service. Look for companies with sustainable competitive advantages.

- Valuation: Compare the company’s value with its peers. Look for companies that are trading at an attractive valuation compared to their growth prospects.

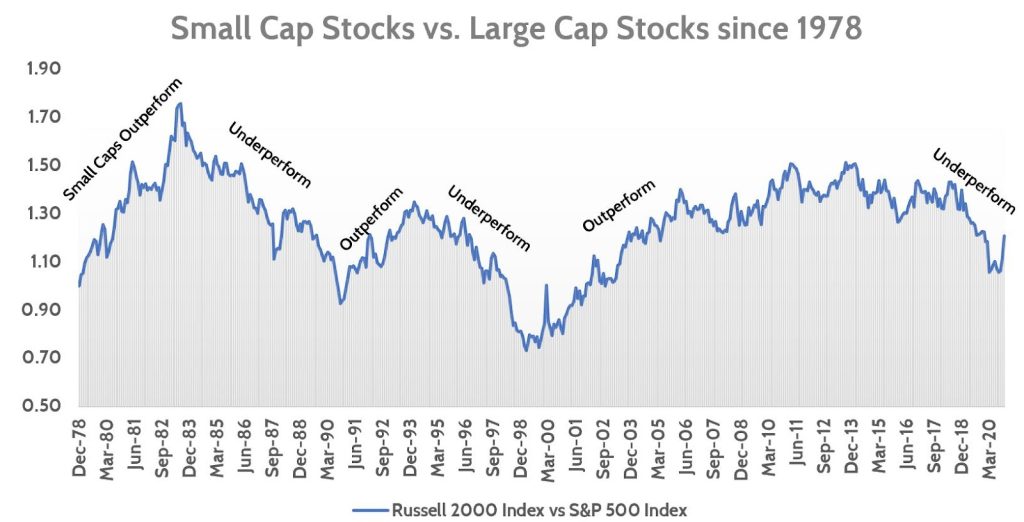

Credit: financialdesignstudio.com

Strategies for investing in small-cap stocks

Venturing into the dynamic world of small-cap stocks demands a robust strategy and a committed mindset. Embarking on this journey, here are some innovative yet essential strategies to enrich your small-cap stocks investment experience:

- Diversify: Instead of confining your investments to a single sector or industry, why not diversify? Spreading your assets across many sectors and industries could cushion the potential risk factors. Diversifying in your small-cap stocks can aid in insulating your overall portfolio against the turbulence caused by any stock’s performance.

- Long-term perspective: Small-cap stocks might present a rollercoaster ride in the short term. But remember, it’s a marathon, not a sprint. These stocks could unlock substantial growth over the long run. So, lace up your long-term investor shoes and get ready to embrace your small-cap stock investments for an extended period.

- Stay informed: Knowledge is power, especially when it comes to investments. Keep your knowledge engine running by consistently staying tuned to industry trends, company updates, and market shifts. Dive into financial statements, review analyst reports, and keep an eye on company announcements to keep a pulse on the health of your portfolio components.

- Consider professional guidance: If the uncharted waters of small-cap stocks seem daunting, or if you are pressed for time and expertise, bringing a seasoned navigator on board might be worthwhile. Engaging professional help from a financial advisor or investment manager who breathes and lives small-cap stocks. They can guide you around the potential pitfalls and toward rewarding opportunities.

Common mistakes to avoid when investing in small-cap stocks

You can make money by investing in small-cap stocks, but beware of common mistakes. Avoid these mistakes:

- Chasing performance: Avoid investing in small-cap stocks solely based on recent performance or hype. Conduct thorough research and analysis before making investment decisions.

- Lack of diversification: Investing all your funds into a single small-cap stock can be risky. Diversify your investments across multiple small-cap stocks to spread your risk.

- Ignoring fundamentals: Don’t make investment decisions solely based on stock price movements or market sentiment. Assess the company’s long-term prospects, financials, and fundamentals.

- Neglecting risk management: Establish stop-loss limits for significant losses and assess your risk tolerance. Regularly review your portfolio and make adjustments as needed.

Credit: fourpillarfreedom.com

Tips for managing risk when investing in small-cap stocks

Small-cap stock investment requires risk management. Here are a few tips for managing risk effectively:

- Set realistic expectations: Understand that investing in small-cap stocks involves higher risk and volatility. Set realistic expectations for returns and be prepared for market fluctuations.

- Do your due diligence: Conduct thorough research and analysis before investing in a small-cap stock. Research the company’s financial health, management team, and growth prospects.

- Invest only what you can afford to lose: Stocks in small companies can be volatile, and there is always a risk of losing your investment. Don’t invest funds that you can’t afford to lose.

- Keep track of your investments: Review your small-cap stock holdings regularly and stay updated on industry developments. Portfolio adjustments may be necessary.

Example case studies of successful small-cap stock investments

To illustrate the potential rewards of investing in small-cap stocks, let’s explore a few case studies of successful investments:

- Company A: A small-cap technology company experienced significant growth after launching a groundbreaking product. Investors who identified the company potential early on and invested in its stock saw their investment multiply several times within a few years.

- Company B: A small-cap healthcare company developed a breakthrough drug approved by the FDA. Before the drug’s approval, investors who recognized the company’s potential gained substantial returns from its stock.

Case studies demonstrate the potential for significant returns when investing in small-cap stocks. There is, however, no guarantee that all small-cap stocks will succeed, and past performance is no guarantee of future success.

Final Thought

Venturing into small-cap stocks can be an exhilarating expedition, teeming with growth opportunities and diversification prospects for the savvy investor. These under-the-radar equities hold the potential for staggering returns, akin to discovering buried treasure in untouched terrain. Alongside this, they also present unique avenues for diversification, thereby enriching the texture of your portfolio. However, one must tread this path with prudence, acutely aware of the inherent risks, and armed with a strategy tailored to their investment aspirations and risk appetite.

The secret to unlocking the tantalizing promise of small-cap stocks lies in meticulous research, identifying the burgeoning stars in this investment class, and robust risk management tactics. The ever-changing, potentially lucrative small-cap terrain can be conquered by investors who can turn uncertainty into an advantage. Whether you’re an experienced market maverick or a novice embarking on your maiden investment voyage, small-cap stocks merit serious attention as a cornerstone of a robust, diverse investment strategy.

So, if you feel the call of small-cap stocks’ vibrant and thrilling domain, remember to step into it with discernment, conduct comprehensive due diligence, and don’t hesitate to enlist professional advice when necessary. With the right mix of strategy, attitude, and perseverance, investing in small-cap stocks can become a rewarding adventure that has the power to reshape your financial destiny.