Navigating the landscape of personal finance can often feel like embarking on a complex journey. One common dilemma faced by many is choosing between saving and investing. Though they may seem similar, saving and investing are as different as a calm harbor and a bustling marketplace. Having a solid understanding of these differences is crucial to managing your finances effectively. This informative guide will delve into the key distinctions between the safe haven of saving and the volatile dance of investing, discuss the time horizons, financial goals, control levels, inflation impact, and the required financial knowledge for each. Prepare to enhance your financial literacy and embark on your journey toward financial prosperity.

1. Delving Deeper into Risk: The Stable Shelter of Saving vs. The Adventurous Ride of Investing

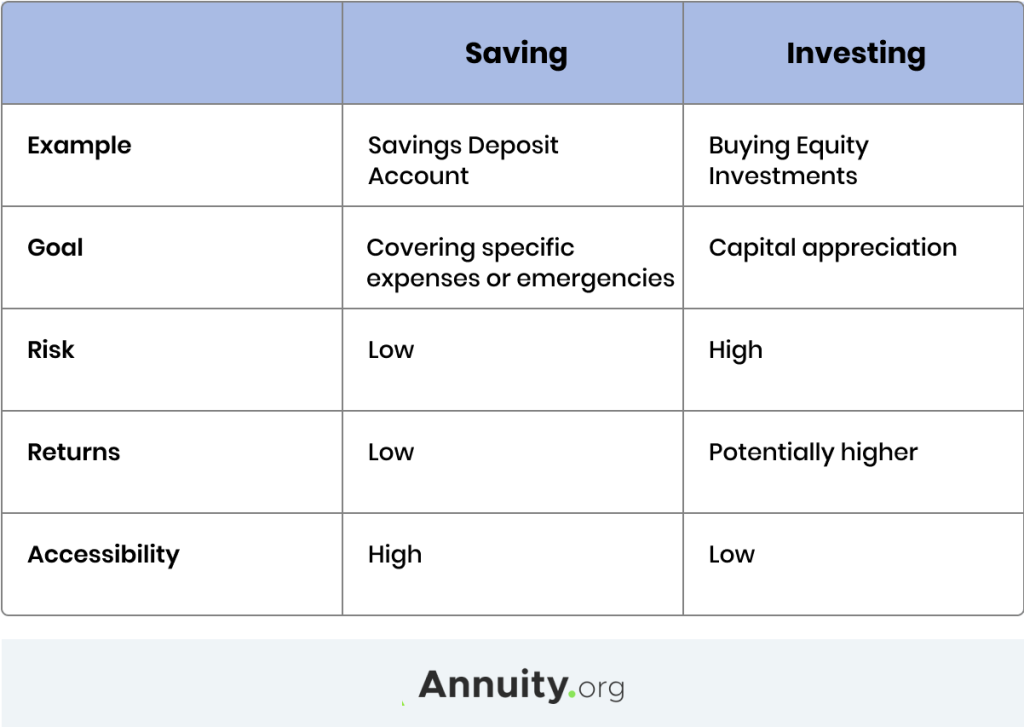

In the realm of personal finance, the understanding of ‘risk’ serves as a vital dividing line between saving and investing. When you embark on the journey of ‘saving,’ it often implies parking your money in a safe environment, such as a savings account. This method is like building a stable shelter for your money, where it remains shielded and grows modestly over time. The key advantage of this fortress-like approach is the security of your capital. The likelihood of losing your savings is minimal, making it a reliable, albeit slow, wealth accumulation method. However, it’s important to remember that the pace of growth in a savings account often lags behind inflation. This situation is like a castle slowly losing its strength due to erosion, signifying a gradual decrease in the actual value of your savings.

Conversely, ‘investing’ is akin to embarking on an adventurous ride, where your money is allocated to assets like stocks, bonds, or real estate with anticipation of higher returns. This venture into the financial wilderness offers the potential for substantial returns, but it comes bundled with a higher degree of risk. If your investments hit the bullseye, you can significantly grow your wealth. However, if they miss the mark, you can lose a portion or potentially all of your investment. Unlike the tranquil fortress of savings, investing is more like a roller coaster ride. It has exhilarating highs when markets perform well and nerve-wracking drops when they don’t.

To truly master the art of personal finance, it’s crucial to balance between the secure fortress of saving and the adventurous roller coaster of investing, understanding the inherent risks involved in each approach. This balance is critical in navigating the complex terrain of personal finance toward a prosperous financial future.

2. Time Horizons: Quick Access in Saving vs. Long-term Growth in Investing

“Time” is a significant factor when discussing saving versus investing. Savings typically cater to short-term financial needs and goals. For example, if you’re saving for a vacation, emergency fund, or a new car, you’ll want quick and easy access to your money. Savings accounts offer liquidity, meaning you can withdraw your money anytime without penalties.

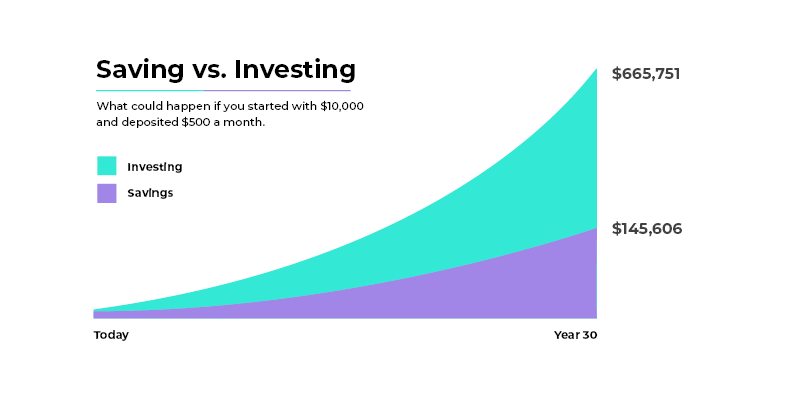

Conversely, investing is more suitable for long-term goals like retirement or your child’s college education. Investments usually take time to mature and offer substantial returns. In essence, investing is about nurturing a seed into a full-grown tree. It’s a process of building wealth over time, letting the power of compounding work its magic. However, unlike savings, investments can be less liquid depending on the type of asset, and withdrawing early could lead to penalties or losses.

Credit: annuity.org

3. Financial Goals: Preserving Capital with Saving vs. Building Wealth with Investing

The choice between saving and investing also depends on your financial goals. Saving might be the best option if you aim to preserve capital and maintain a safety net. It’s like building a financial dam, holding back the tide of unexpected expenses that could sweep you off your feet. This strategy may work for you if you have a low-risk tolerance or need to spend money within the next few months.

Conversely, if you want to create wealth and beat inflation, you should invest. Investing lets you participate in the economic growth of companies and markets. Think of it as buying a boat that enables you to ride the waves of the market and potentially reach the shore of financial freedom. However, it requires understanding market trends, asset classes, and risk management. It’s important to have a diversified portfolio to spread the risk and potentially maximize returns.

4. Level of Control: Passive Saving vs. Active Investing

Consider the degree of control and engagement required when discussing saving versus investing. With saving, you take a passive approach. Once you’ve set up an automatic transfer to your savings account, there’s not much more you need to do. It’s like letting your money rest in a cozy bed, growing slowly and steadily while you sleep.

On the other hand, investing requires a more active engagement. You must research, make decisions, monitor performance, and adjust your portfolio. It’s like driving a car on the highway of financial markets, where you need to keep your hands on the wheel and eyes on the road, adjusting your direction based on traffic (market trends) and road conditions (economic factors).

5. The Impact of Inflation: Slow Erosion of Saving vs. Potential Outpacing with Investing

Inflation is another crucial factor to take into account. Saving money often results in a lower interest rate than inflation. This mismatch can slowly erode the real value of your savings over time. It’s like trying to fill a bucket with a small hole at the bottom, where water (money) trickles out slowly (loses value due to inflation).

On the contrary, the returns from investments can potentially outpace inflation. By investing, you aim to grow your money faster, preserving or even enhancing its purchasing power. It’s like planting a tree that grows faster than the surrounding grass (inflation), ensuring your money tree stands tall and robust over time.

Credit: hatchinvest.nz

6. Financial Knowledge and Skills: Simple Saving vs. Complex Investing

Lastly, saving and investing differ in the level of financial knowledge and skills required. Saving is a relatively straightforward process with few complexities. It’s as simple as keeping your money in a piggy bank, although the bank is a secure financial institution in this case.

Financial markets and investment products often require an in-depth understanding of investing. Investing is like playing a game of strategy, where you must understand the rules, study the game board (market), and make calculated moves (investment decisions). Although investing can be more complex, taking time to learn about investing could lead to greater financial prosperity in the long run.

To sum up

In conclusion, understanding the difference between saving and investing is a crucial step in the journey toward financial literacy. Saving provides a secure haven for your money, acting like a fortress guarding against financial storms, while investing is a thrilling roller coaster ride that can potentially lead to substantial wealth. Remember, the impact of inflation, the level of control, time horizons, financial goals, and the knowledge required, all play vital roles in shaping your financial strategies. By mastering these nuances, you can build a balanced approach, fostering financial growth and security in your personal economy. Remember, the choice between saving and investing is not an ‘either-or’ decision, but a careful mix of both, tailored to your unique financial goals and risk tolerance.

Add Comment