Are you ready to embark on a journey toward financial success? Discover the world of growth stocks—a profitable investment opportunity for those seeking wealth. However, starting can be overwhelming. In this comprehensive beginner’s guide to investing in growth stocks, I will provide you with essential knowledge, strategies, and expert advice to help you achieve your financial goals without attracting unnecessary attention. Explore the concept of growth stocks and their distinguishing features compared to other investment types. Learn how to identify promising companies and assess their growth potential effectively. This guide will give you insights and tools to make prudent investment decisions. No matter what level of investor you are or whether you’re brand new to investing, this guide is your trusted companion.

Understanding Growth Stocks

Growth stocks refer to shares of companies anticipated to experience an above-average expansion rate relative to the overall market. These companies typically reinvest their profits into business development rather than distributing dividends to shareholders. Consequently, growth stocks often exhibit elevated price-to-earnings (P/E) ratios, which signify the market’s optimism regarding future growth prospects.

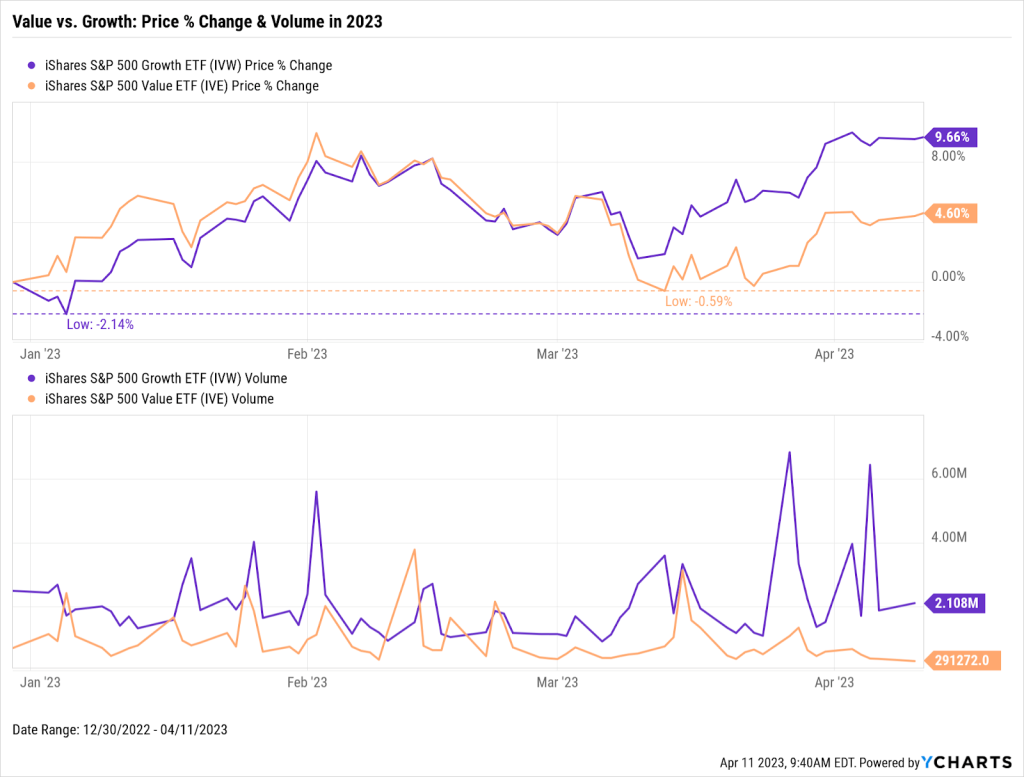

Engaging in growth stock investments can prove advantageous for long-term wealth accumulation. Historically, growth stocks have consistently outperformed value stocks and the broader market during extended timeframes. However, past performance cannot guarantee future results. Compared to other investment categories, growth stocks can deliver significant profits but entail greater risk.

Benefits of Investing in Growth Stocks

Investing in growth stocks presents numerous advantages for investors. Primarily, growth stocks have the capacity for substantial appreciation in capital. If you can identify companies that exhibit potential for rapid expansion, you have the opportunity to multiply your initial investment manifold. This makes growth stocks appealing to investors seeking returns above the norm.

Additionally, growth stocks contribute to diversification within your investment portfolio. Incorporating growth stocks into your holdings can offset the risks associated with other investments, such as bonds or value stocks. This diversification is a safeguard for your portfolio during market downturns and ensures stability during periods of volatility.

Moreover, growth stocks often provide captivating investment prospects within groundbreaking industries and technologies. By investing in companies at the forefront of technological advancements or disruptive business models, you have the potential for financial gains and the satisfaction of supporting entities shaping the future.

Credit: get.ycharts.com

Risks Associated with Growth Stocks

Investing in growth stocks can potentially yield substantial returns, but investors must be aware of the associated risks. One notable risk pertains to the volatility often linked to growth stocks. Due to their elevated growth expectations, these stocks tend to undergo significant price swings due to investor sentiment and market conditions. Such volatility might unsettle investors, particularly those who prefer low-risk investments.

Another risk involves the possibility of overvaluation. When growth stocks experience rapid price appreciation can surpass their intrinsic value, resulting in overvaluation. Consequently, the stock price might undergo a considerable correction, leading to losses for investors who purchased the stocks at inflated prices.

Furthermore, growth stocks are more vulnerable to economic downturns and market fluctuations. Growth stocks may be disproportionately affected during a broader market downturn due to their higher valuations. Investors must maintain a long-term perspective while investing in growth stocks and be prepared for short-term fluctuations.

How to Identify Growth Stocks

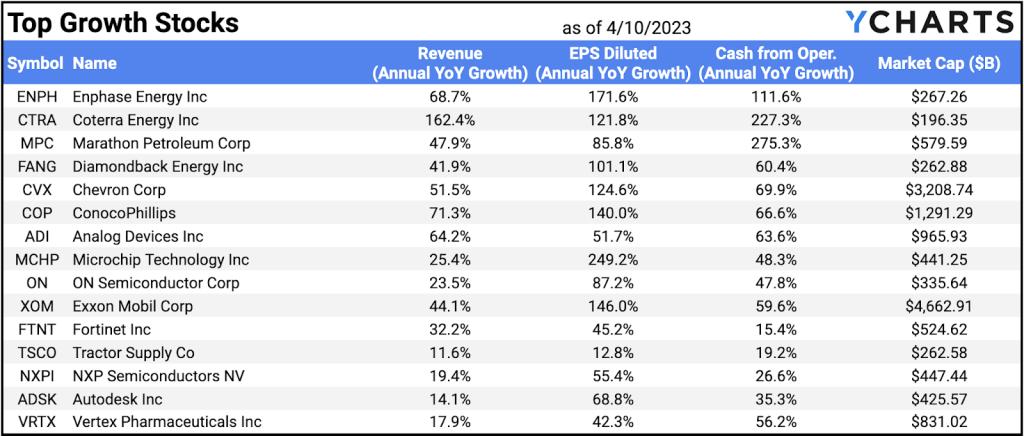

Discovering promising growth stocks necessitates thorough research, meticulous analysis, and a comprehensive grasp of market patterns. Below are essential factors to consider when evaluating growth stocks:

- Revenue and Earnings Expansion: Seek out companies that have consistently exhibited robust revenue and earnings growth over an extended timeframe. This demonstrates a proven history of achievement and indicates a likelihood of sustained growth in the future.

- Market Potential: Assess the size and prospects of the market in which the company operates. Companies operating in sizable and expanding markets have a higher probability of maintaining long-term growth.

- Distinct Competitive Edge: Evaluate whether the company possesses a unique competitive advantage that distinguishes it from its peers. This advantage may manifest as exclusive technology, intellectual property, or a strong brand presence.

- Management Team: Evaluate the competence and experience of the company’s management team. Look for evidence of successful execution in the past and a clearly defined vision for the future.

- Industry Insights: Stay well-informed about the latest trends and advancements in the industry relevant to the company. A comprehensive understanding of the broader market dynamics enables the identification of companies well-positioned for future growth.

Researching Growth Stocks

Once you have identified potential growth stocks, it is crucial to conduct comprehensive research to gain profound insights into the companies and their future prospects. When researching growth stocks, consider these steps:

- Review Financial Disclosures: Study the balance sheet, income statement, and cash flow statement. Pay careful attention to vital financial indicators like revenue growth, profit margins, and cash flow generation.

- Examine Analyst Reports: Familiarize yourself with research reports from credible analysts who cover the company. It sheds valuable perspective on the company’s competitive position, growth potential, and risks.

- Stay Abreast of Current News and Developments: Stay up-to-date on company news. This encompasses aspects like product introductions, partnerships, regulatory adjustments, and industry trends. By remaining informed, you can make well-informed investment decisions.

- Evaluate Valuation: Assess the company’s valuation in relation to its growth prospects. While a company may exhibit considerable growth potential, if its valuation is excessively high, it may not present a favorable investment opportunity.

- Seek Expert Advice: Talk to a financial advisor or investment professional if you are unsure about your research. They can provide valuable insight and guide you through the stock market.

Credit: fool.com

Creating Your Investment Strategy

Once you have completed your thorough analysis and identified promising growth stocks, it’s time to formulate your investment strategy. Here are some essential considerations to guide you:

- Establish Attainable Objectives: Clearly define your financial goals and aspirations. Are you seeking immediate returns or long-term wealth accumulation? Understanding your objectives will enable you to align your investment strategy accordingly.

- Achieve Portfolio Diversification: Mitigate risk by avoiding overexposure to a single growth stock. Opt for a well-balanced portfolio encompassing various industries and companies, thereby distributing your investment risk.

- Embrace Long-Term Investing: Growth stocks necessitate a long-term perspective. Despite short-term price fluctuations that may induce anxiety, remain focused on the long-term growth potential of your chosen companies.

- Monitor Investments Regularly: Stay informed about the performance of your investments and conduct periodic assessments. This practice empowers you to make well-informed decisions and adjust your strategy when necessary.

- Exercise Discipline: Steer clear of impulsive investment choices fueled by short-term market shifts or emotional reactions. Adhere to your investment strategy and exhibit discipline, even during phases of market volatility.

Diversifying Your Growth Stock Portfolio

Diversification plays a pivotal role in optimizing investments in growth stocks. By employing a diversified approach, investors can mitigate risks and potentially enhance the likelihood of consistent returns. Here are valuable insights to consider when diversifying your growth stock portfolio:

- Industry Allocation: Employ a strategic allocation strategy that encompasses diverse industries. This method aims to minimize concentration risk, shielding your portfolio from significant impacts caused by adverse developments within a single industry.

- Market Capitalization Variation: Broaden the spectrum of your growth stock investments by including companies with varying market capitalizations. This encompasses large-cap, small-cap, and mid-cap stocks, each offering distinct growth prospects and risk profiles.

- Balancing Risk and Reward: Conduct a comprehensive assessment of the risk-reward dynamics associated with each growth stock you incorporate into your portfolio. This evaluation ensures that your portfolio maintains a well-balanced composition by considering growth potential alongside associated risks.

- Periodic Portfolio Evaluation and Adjustment: Regularly review the performance of your growth stock portfolio and make necessary adjustments when required. Over time, individual stocks may exhibit fluctuations in performance, potentially leading to an imbalance in your portfolio. You can maintain your desired asset allocation and optimize portfolio performance by rebalancing.

Credit: get.ycharts.com

Investing in Growth Stocks for Long-Term Growth

Long-term growth stocks can accumulate significant wealth over time. When aiming for long-term growth, consider these factors:

- Exercise Patience: Investing in growth stocks demands patience, as their progress may vary. Some assets experience rapid price appreciation, while others take longer. Investing should be based on your long-term vision rather than impulsive decisions based on short-term fluctuations.

- Leverage Dividend Reinvestment: If your growth stocks pay dividends, it makes sense to reinvest those dividends into the respective companies. This approach allows for the compounding of returns over time, maximizing the potential for long-term growth.

- Employ Dollar-Cost Averaging: Dollar-cost averaging entails making regular investments, regardless of the stock price. This strategy smoothens the impact of market volatility and is an effective method for gradually accumulating growth stocks.

- Stay Knowledgeable: Continuously educate yourself about the companies you invest in and inform you about broader market trends. This practice enables you to make informed decisions and stay ahead of any developments affecting your investments.

- Regularly Evaluate and Adjust: Conduct periodic evaluations of your growth stock holdings and adjust your portfolio accordingly. As companies and industries evolve, staying abreast of any changes that could impact your investments is essential.

Common Mistakes to Avoid When Investing in Growth Stocks

Investing in growth stocks can yield significant returns, but avoiding common mistakes is crucial. Here are key factors to consider:

- Resisting Hype: Avoid basing your investment solely on market trends or hype. Instead, conduct comprehensive research and analysis to ensure the growth stock has substantial potential.

- Assessing Risks: Evaluate the risks associated with growth stock investments and incorporate them into your decision-making process. Neglecting potential risks may result in substantial losses.

- Embracing Diversification: Minimize risk by not investing all your capital in a single growth stock or industry. Diversifying your portfolio helps spread risk and enhances the likelihood of consistent returns.

- Exercising Patience: Successful growth stock investments require a long-term perspective. Resist the urge to sell prematurely or panic during short-term market downturns. Stay focused on your long-term objectives.

- Applying Fundamental Analysis: Avoid relying solely on market trends or stock price fluctuations. Perform fundamental analysis to evaluate the company’s financial health, growth prospects, and competitive position.

In conclusion, growth stocks offer promising opportunities for wealth creation, particularly for novice investors. By grasping the fundamentals, conducting thorough research, and developing a robust investment strategy, you can unlock the potential for exponential returns and secure your financial future. Remain disciplined, diversify your portfolio, and maintain a long-term outlook. With the right knowledge and approach, growth stock investments can pave the path to financial success. Enjoy your investment journey!